简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD: July Fed Meeting to Spark US Dollar Currency Volatility

الملخص:A major move in USD following the Federal Reserves updated monetary policy stance on Wednesday risks sparking volatility across the currency market.

USD PRICE ACTION TURNS TO JULY FED MEETING

The US Dollar is primed for volatility and will likely be sparked by Wednesdays July Fed meeting

EURUSD and USDJPY 1-week implied volatility readings, although muted, suggest a looming breakout from technical confluence

Register for live webinar coverage of the July Fed Rate Decision hosted by DailyFX Chief Currency Strategist John Kicklighter

The US Dollar looks to take the spotlight as currency traders anxiously await the outcome of the July Fed meeting slated for release Wednesday at 18:00 GMT. A reduction in the federal funds rate has been long priced in, but the size of the expected Fed rate cut remains ambiguous. As such, the July Fed meeting poses a major threat to the US Dollar and stands to spark currency volatility.

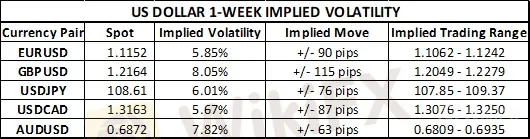

US DOLLAR 1-WEEK IMPLIED VOLATILITY & TRADING RANGE CHART

Interestingly, USD implied volatility measures appear relatively suppressed given the high-impact event risk surrounding the FOMC rate decision. Looking at tenors further out, however, we see that the implied volatility curve is inverted for the major USD pairs and indicates that currency option traders are placing greater emphasizing on the near-term. That said, a major move in USD tomorrow following the Federal Reserves updated monetary policy stance risks sparking volatility across the currency market.

US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (OCTOBER 29, 2018 TO JULY 30, 2019)

A violent repricing in lofty Fed rate cut bets (which currently stand at around 75 basis points of easing by year-end) could serve as the catalyst – particularly if Chair Powell communicates a firm outlook and conveys that the move to lower rates at the July Fed meeting was a ‘one-and-done insurance cut.’ This scenario, if confirmed, will likely see the US Dollar extend its stretch of gains and push onward to test year-to-date highs measured via the DXY Index. The potential for a breakout – or breakdown – in the US Dollar is also suggested by the 1-week implied volatility measures for major pairs like EURUSD and USDJPY.

EURUSD PRICE CHART: DAILY TIME FRAME (DECEMBER 21, 2018 TO JULY 30, 2019)

EURUSD 1-week implied volatility of 5.85% results in a 1-standard deviation trading range between 1.1062 and 1.1242. These option-implied upper and lower bounds are outside of the major technical confluence at the 1.11 and 1.12 handles. As such, a major move in spot EURUSD that smashes through these key technical levels could provide evidence of the US Dollars resurgence or a looming reversal in the greenback. In turn, currency volatility stands to rise off the currently subdued readings.

Read more on EURUSD implied volatility here.

USDJPY PRICE CHART: DAILY TIME FRAME (APRIL 22, 2019 TO JULY 30, 2019)

According to USDJPY 1-week implied volatility of 6.01%, the currency pair is calculated to trade between 107.85 and 109.37 with a 68% statistical probability. Similar to the setup in EURUSD, the options-implied trading range in spot USDJPY aligns outside the key levels of technical support and resistance at the 108.00 and 109.00 handles respectively. If spot USDJPY makes a move outside these closely watched levels, currency price action could be exacerbated and stoke additional forex volatility.

عدم اعطاء رأي:

الآراء الواردة في هذه المقالة تمثل فقط الآراء الشخصية للمؤلف ولا تشكل نصيحة استثمارية لهذه المنصة. لا تضمن هذه المنصة دقة معلومات المقالة واكتمالها وتوقيتها ، كما أنها ليست مسؤولة عن أي خسارة ناتجة عن استخدام معلومات المقالة أو الاعتماد عليها.

وسيط WikiFX

أحدث الأخبار

شركة AVFX المراجعة الكاملة 2024: موثوقة أم احتيال؟

توقعات زوج الجنيه الإسترليني/الدولار الأمريكي | ارتفاع الدولار وسط سياسة الفيدرالي المتشددة - تحليل

شركة Z Market المراجعة الكاملة 2024: موثوقة أم احتيال ؟

تقرير المستخدم السنوي لـWikiFX 2024 جاهز! اكتشف هويتك الحصرية الآن!

إحذر من منصة إكسنوفا (Exnova) | عمليات احتيال والخطر يهدد أموالك

شركة AFC المراجعة الكاملة 2024: موثوقة أم احتيال؟

حساب النسبة