Score

M4Markets

Cyprus|2-5 years|

Cyprus|2-5 years| https://www.m4markets.com/

Website

Rating Index

Contact

100% Mediation in the complaints

Response of EMC during7working days

Licenses

Licenses

+40%

+40% 1*CPU

1*CPU 1G*RAM

1G*RAM 60G*HDD

60G*HDD 2M*ADSL

2M*ADSLBasic Information

Cyprus

CyprusAccount Information

Website

m4markets.site

Server Location

United States

Website Domain Name

m4markets.site

Server IP

104.21.88.201

m4markets.com

Server Location

United States

Website Domain Name

m4markets.com

Server IP

66.220.147.11

m4markets.eu

Server Location

United States

Website Domain Name

m4markets.eu

Server IP

172.67.136.81

Genealogy

VIP is not activated.

VIP is not activated.INFLYX

Axiance

Ever Pro Trader

Company Summary

| Company Name | M4Markets |

| Headquarters | Limassol, Cyprus |

| Regulations | Regulated by CySEC |

| Market Instruments | Forex, Indices, Commodities, Shares CFDs, Cryptocurrencies |

| Account Types | Standard, Premium, VIP |

| Leverage | Retail: 1:30, Professional: 1:500 |

| Spread | Competitive spreads from 0.1 pips |

| Commission Fee | Indices, Cryptos: $0 each side; Forex, Energies, Metals: €0 each side (VIP account has €4 per round lot commissions) |

| Minimum Deposit | Standard: €100, Premium: €5,000, VIP: €10,000 |

| Deposit/Withdraw Methods | Wire Transfers, Online Payment Solutions |

| Bonuses | N/A |

| Trading Platforms | OpTrade trading platform |

| Customer Support | Support Center, Live Agent, Email |

| Educational Resources | Forex calculators, AI-powered Economic Calendar |

Overview of M4Markets

M4Markets is a brokerage firm operating within the financial markets, with its headquarters situated in Limassol, Cyprus. The broker offers a diverse range of market instruments, encompassing Forex, Indices, Commodities, Shares CFDs, and Cryptocurrencies. These instruments provide traders with opportunities to engage in various segments of the global financial landscape.

At the heart of M4Markets' trading experience lies the OpTrade platform, designed to facilitate seamless and efficient trading. The platform is equipped with an array of tools and features tailored to enhance the trading journey. Through its user-friendly interface and comprehensive functionalities, traders can access real-time market data, execute orders, and manage their trading activities effectively.

Is M4Markets regulated?

M4Markets operates as a regulated entity under the supervision of the Cyprus Securities and Exchange Commission (CySEC). The company is licensed as a Market Making (MM) institution under the license number 301/16. This regulatory framework ensures that M4Markets adheres to established industry standards and guidelines, providing a level of oversight that promotes transparency and security for its clients.

Harindale Ltd serves as the licensed institution for M4Markets, with its license having been effective since April 27, 2016. The company is headquartered at Spyrou Kyprianou78, Magnum Business Center, 3076, Limassol, Cyprus. Clients can reach out to M4Markets via the provided email address, support@m4markets.eu, or by phone at +357 25 885 00. The company's commitment to regulation and its affiliation with the Cyprus Securities and Exchange Commission underscores its dedication to maintaining a regulated trading environment for its clients.

Pros and Cons

M4Markets offers a regulated trading environment under the oversight of the Cyprus Securities and Exchange Commission (CySEC), ensuring a level of accountability and transparency. The diverse range of market instruments, including Forex, Indices, Commodities, Shares CFDs, and Cryptocurrencies, caters to various trading preferences. The OpTrade trading platform enhances the trading experience with its intuitive design and cutting-edge tools. Clients benefit from a variety of educational resources, including forex calculators and an AI-powered Economic Calendar. Moreover, the availability of competitive spreads, starting from 0.1 pips, can contribute to potentially favorable trading conditions.

While M4Markets provides an array of advantages, it's essential to consider potential limitations. The absence of detailed information regarding trading fees and commissions on certain categories may require clients to seek additional clarification. Additionally, the offered leverage options of 1:30 for retail traders and 1:500 for professional traders can amplify both gains and losses, necessitating careful risk management. Traders looking for a more extensive range of account types beyond the three offered tiers might find limited options. Lastly, while M4Markets emphasizes an intuitive trading platform, some traders may prefer additional third-party platforms for advanced trading features.

| Pros | Cons |

| Regulated by CySEC for accountability | Lack of detailed fee information |

| Diverse market instruments cater to varied preferences | Leverage options require careful risk management |

| Intuitive OpTrade platform enhances trading experience | Limited account type variety |

| Educational resources like forex calculators available | Potential preference for additional third-party platforms |

| Competitive spreads contribute to potentially favorable conditions |

Market Instruments

M4Markets offers a wide range of market instruments to suit varying trading strategies. In the Forex category, traders can engage in currency trading, with pairs like EUR/USD and GBP/USD allowing speculation on global economic trends. Indices trading provides exposure to baskets of stocks, including US100 and GER30. Commodities trading covers major resources like Gold, Oil, and Silver. Shares CFDs offer the chance to trade with popular global companies such as Apple and Microsoft.

Cryptocurrencies, including BTCUSD and DOGEUSD, enable participation in the dynamic world of digital assets. These diverse options showcase M4Markets' commitment to accommodating a broad spectrum of trading interests, providing traders with a comprehensive set of tools to pursue their investment goals.

Account Types

M4Markets offers three distinct account types to cater to traders with varying preferences and needs.

The Standard account, with a €100 minimum deposit, suits beginners. Spreads from 1.2 pips offer competitive pricing. Leverage options: 1:30 for retail, 1:500 for pros. Trades from 0.1 minimum volume. Risk management: 100% margin call, 50% stop-out. Swap-free, VPS is available. No commissions for indices, cryptos, forex, energies, and metals.

The Premium account, €5,000 minimum deposit, suits intermediates. Spreads from 0.8 pips for tighter pricing. Leverage same as Standard. Trades from 0.01 minimum volume. Risk management: 100% margin call, 50% stop-out. Swap-free, VPS is available. No commissions for indices, cryptos, forex, energies, and metals.

The VIP account, €10,000 minimum deposit, suits experienced traders. The tightest spreads from 0.1 pips enhance precision. Leverage like other accounts. Trades from 0.01 minimum volume. Consistent risk management. VIP offers free VPS and introduces €4 commissions per round lot for indices, cryptos, forex, energies, and metals. Account currency: USD or EUR. M4Markets tailors account for varied preferences, ensuring compliance and risk management.

How to open an account in M4Markets?

Opening an account with M4Markets is a simple process that can be completed in just a few steps:

Complete the Registration Form and submit KYC documents.

Fill out your Economic Profile and complete the Appropriateness Test for profile verification.

Choose “Open Live Account” under the Accounts tab to initiate the account opening.

Select your preferred account type.

Fund your account by clicking “Deposit funds” under the Funds tab and selecting your funding method.

Navigate to the “Downloads” tab under the Traders Menu and download your preferred trading platform.

Launch the downloaded platform and begin trading, entering the dynamic world of financial markets with M4Markets.

Spread and Commission Fees

M4Markets offers traders the opportunity to engage in CFD trading with competitive spreads starting from as low as 0.1 pips. The platform's commitment to providing institutional-grade liquidity ensures that these spreads remain tight even in periods of market volatility, allowing traders to potentially optimize their trading outcomes.

M4Markets takes a transparent approach by not charging commissions on various trading categories. For instance, Indices, Cryptocurrencies, Forex, Energies, and Metals trading do not entail any commission fees for trades. This transparency in fee structures serves to provide traders with clarity and predictability in their trading costs, contributing to a more informed decision-making process. Traders can therefore focus on their trading strategies and market analysis with a clear understanding of the associated spread and commission dynamics within the M4Markets trading environment.

Leverage

M4Markets provides a range of leverage options for traders, accommodating different risk appetites and trading strategies. Retail traders can access maximum leverage of 1:30, aligning with regulatory standards to promote responsible trading practices. This level of leverage allows traders to amplify their positions while also emphasizing the importance of risk management.

For more experienced and professional traders, M4Markets offers a higher leverage option of 1:500. This provides the opportunity for potentially larger positions and greater market exposure. However, it's important for traders to approach high leverage with caution, as while it can amplify potential profits, it also increases the potential for losses.

Trading Platform

OpTrade, introduced by M4Markets, offers a trading platform aimed at enhancing the trading experience. This solution provides an interface accessible via desktop-class web portals, allowing users to navigate the trading landscape with relative ease and make informed decisions.

OpTrade provides traders with an array of tools and features. The platform includes intuitive trading panels, real-time economic data, and customizable charting tools, facilitating market analysis. Advanced order types are available for tailoring trading strategies, and market updates and notifications are timely. OpTrade's versatility covers trading assets such as CFDs on various categories, addressing the needs of contemporary traders.

Deposit & Withdrawal

M4Markets offers a variety of secure and efficient payment methods for deposits and withdrawals, ensuring a convenient financial experience for its users. For deposits, users can opt for wire transfers or utilize online payment solutions such as Skrill, Neteller, and Perfect Money, among others. These methods offer a minimum deposit amount of €5, with no deposit fees and instant processing. Moreover, clients can select from different base currencies like EUR, USD, GBP, and AUD. Notably, the platform emphasizes that the availability of payment methods might vary depending on the country, and clients are advised to refer to their Client Portal for detailed options.

Similarly, when it comes to withdrawals, M4Markets provides seamless solutions. Clients can conveniently withdraw funds through the same methods used for deposits, ensuring a streamlined process. While the platform strives to ensure efficient withdrawal processing times, potential delays attributed to payment providers should be noted.

Customer Support

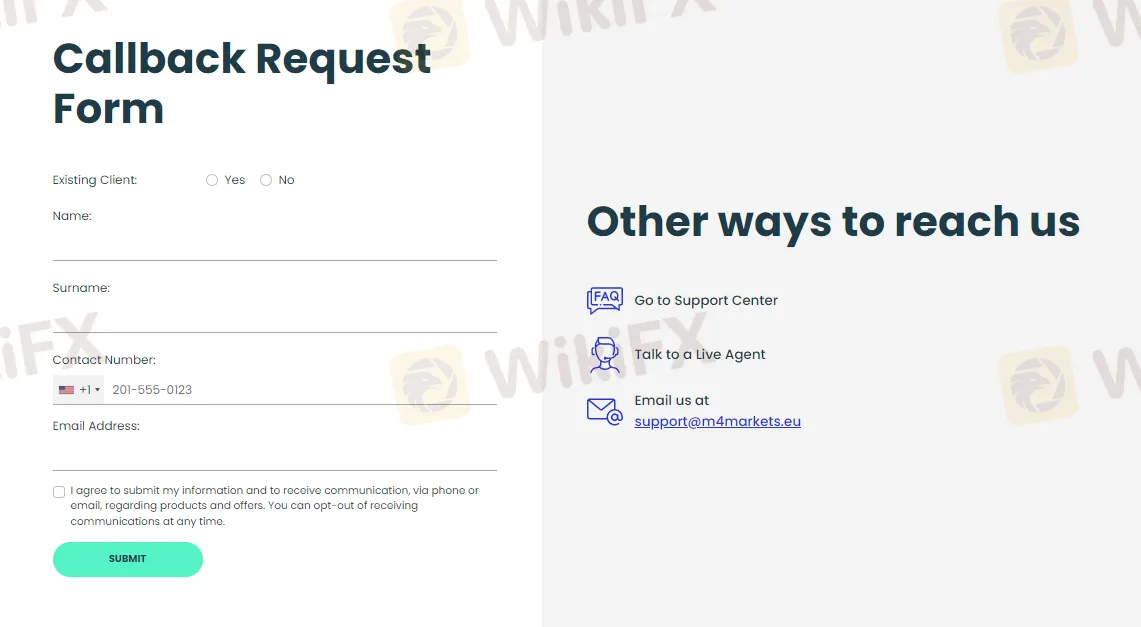

Clients have the option to engage with the platform's efficient and responsive customer service through various channels, catering to their preferences and convenience. One avenue for seeking assistance is the Callback Request Form, where clients can indicate their status as existing clients and provide their contact information, including name, surname, contact number, and email address. This form allows for personalized support and the option to receive communications about products and offers.

For those who prefer alternative means of communication, M4Markets offers a Support Center where clients can access a wealth of resources and information to address their queries. Additionally, clients can opt to engage in real-time conversations with live agents or send inquiries via email to support@m4markets.eu.

Educational Resources

M4Markets offers traders valuable educational tools, including forex calculators and an AI-powered Economic Calendar. These resources are designed to enhance traders' understanding and decision-making capabilities. The forex calculators provide practical functionalities, enabling traders to calculate pip values, margin requirements, and more. These tools assist in refining risk management strategies for informed trading. Comprising calculators like the Currency Converter, Margin Calculator, Pip Calculator, Swaps Calculator, and Profit & Loss Calculator, M4Markets equips traders with precision-focused insights.

Additionally, M4Markets' AI-driven Economic Calendar delivers essential economic indicators and data releases from around the world. Employing advanced sentiment analysis and machine learning algorithms, this tool aids traders in staying updated with crucial market events and shifts in sentiment. With these educational resources, M4Markets empowers traders to make informed decisions and navigate the complex landscape of the financial markets.

Conclusion

M4Markets introduces a trading platform with a range of appealing features while also raising certain considerations. Regulated by CySEC, the broker emphasizes a regulated environment for accountability and transparency. Traders can engage with various market instruments including Forex, Indices, Commodities, Shares CFDs, and Cryptocurrencies, catering to diverse preferences.

The OpTrade platform offers an intuitive interface and advanced tools, enhancing the trading experience. Educational resources like forex calculators and an AI-powered Economic Calendar are also available. However, concerns arise from limited fee information and the offered leverage options of 1:30 for retail traders and 1:500 for professional traders, emphasizing the need for careful risk management. Traders should weigh these aspects to determine how well M4Markets aligns with their trading goals.

FAQs

Q: What is the regulatory status of M4Markets?

A: M4Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC) under the license number 301/16.

Q: What market instruments can I trade with M4Markets?

A: M4Markets offers a diverse range of instruments including Forex, Indices, Commodities, Shares CFDs, and Cryptocurrencies.

Q: How can I reach customer support?

A: You can contact customer support through the Support Center, talk to a live agent, or email at support@m4markets.eu.

Q: What trading platform does M4Markets offer?

A: M4Markets provides the OpTrade trading platform, offering intuitive tools and features for comprehensive trading.

Q: Are educational resources available?

A: Yes, M4Markets provides forex calculators and an AI-powered Economic Calendar to assist traders in making informed decisions.

Q: What leverage options are available?

A: Leverage options include 1:30 for retail traders and 1:500 for professional traders, enabling flexibility in trade sizing.

Keywords

- 2-5 years

- Regulated in Cyprus

- Regulated in Seychelles

- Market Maker (MM)

- Retail Forex License

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now