Score

CPT Markets

Belize|10-15 years| Benchmark B|

Belize|10-15 years| Benchmark B|https://cptmarkets.com

Website

Rating Index

Benchmark

Benchmark

B

Average transaction speed (ms)

MT4/5

Full License

CPTMarketsUKLimited-Trading-Live

Benchmark

Speed:AA

Slippage:AA

Cost:D

Disconnected:AA

Rollover:A

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomContact

100% Mediation in the complaints

Response of EMC during7working days

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

Basic Information

Belize

BelizeAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Benchmark

Total Margin Trend

| VPS Region | User | Products | Closing time |

|---|---|---|---|

| 693*** | XAUUSD | 02-13 08:05:00 | |

Hongkong Hongkong | 215*** | XAUUSD | 02-13 03:04:19 |

Hongkong Hongkong | 142*** | XAUUSD | 02-13 03:04:19 |

Stop Out

0.70%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

Website

cptbrokerage.com

Server Location

Hong Kong

Website Domain Name

cptbrokerage.com

Server IP

154.23.181.82

cptinternational.pro

Server Location

United States

Website Domain Name

cptinternational.pro

Server IP

3.33.130.190

cptinternational.co

Server Location

United States

Website Domain Name

cptinternational.co

Server IP

3.33.130.190

Genealogy

VIP is not activated.

VIP is not activated.CityPoint China

Mary And Thomas Green Limited

XGT

Relevant Enterprises

MICHAEL DAVID CECIL GREENHALGH

United Kingdom

Director

Start date

2022-06-16

Status

Employed

CPT MARKETS UK LIMITED(United Kingdom)

JULIAN MORGAN COURTNEY

United Kingdom

Director

Start date

2022-02-01

Status

Employed

CPT MARKETS UK LIMITED(United Kingdom)

ST JAMES'S CORPORATE SERVICES LIMITED

United Kingdom

Secretary

Start date

2018-02-01

Status

Employed

CPT MARKETS UK LIMITED(United Kingdom)

Company Summary

Company Summary

Company profile

| CPT Markets | Basic Information |

| Registered Country/Region | Belize |

| Founded in | 2016 |

| Regulation | FCA (UK), FSC (Belize) |

| Minimum Deposit | $500 |

| Demo Account | Yes |

| Tradable Assets | Forex, Metals, Energy, Indices, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, WebTrader, Mobile App |

| Spreads | From 0.0 pips |

| Commission | $3 per lot |

| Leverage | Up to 1:1000 |

| Deposit Methods | Bank Wire Transfer, Credit/Debit Cards, E-wallets |

| Withdrawal Methods | Bank Wire Transfer, Credit/Debit Cards, E-wallets |

| Education | Trading Academy, Webinars, Trading Tools |

| Customer Support | Phone, Email, Live Chat |

Overview of CPT Markets

CPT Markets is a global financial brokerage firm that offers a variety of financial instruments for trading. Founded in 2016, the broker is headquartered in London, UK, and is regulated by the Financial Conduct Authority (FCA) and the International Financial Services Commission (IFSC). CPT Markets provides its clients with access to a range of trading platforms, including the popular MetaTrader 4 (MT4) platform, as well as a variety of educational resources and trading tools. The broker also offers competitive spreads and leverage, with the ability to trade on a range of asset classes, including forex, commodities, indices, and cryptocurrencies. However, CPT Markets does not offer its services to residents of the United States, Canada, and some other jurisdictions.

Is CPT Markets legit or a scam?

CPT Markets is a legit broker and it has two entities regulated in their own jurisdictions:

CPT Markets is the trading name used by CPT Markets Limited, registered in Belize, regulated by the Belize International Financial Services Commission, license number: No. IFSC000314/351.

CPT Markets UK is the trading name used by CPT Markets UK Limited. The company's registered office is located in Wales, England, with registration number 6707165, authorized and managed by the UK Financial Conduct Authority (FCA), number 606110. CPT Markets UK Limited is an associated company of CPT Markets Limited.

Pros & Cons

When evaluating a potential broker to trade with, it's important to consider both the advantages and disadvantages. This can help you make an informed decision on whether a broker like CPT Markets is suitable for your trading needs. In this section, we will provide an overview of the pros and cons of trading with CPT Markets, including aspects such as trading conditions, account types, customer support, and more. By the end of this section, you should have a better understanding of what CPT Markets has to offer and whether it aligns with your trading goals and preferences.

| Pros | Cons |

| Wide selection of trading instruments | Limited range of tradable instruments |

| Multiple account types to suit various traders | No proprietary trading platform |

| Competitive spreads and commissions | Limited educational resources |

| Multiple deposit and withdrawal options | Limited research and analysis tools |

| Negative balance protection and client fund safety | Limited customer support options outside of Asia |

| Access to popular trading platforms such as MT4 | Limited social trading options |

Market Instruments

CPT Markets offers a range of financial instruments across different markets, including forex, indices, commodities, and cryptocurrencies. The broker's asset selection is designed to provide traders with diversified trading opportunities and a chance to profit from market volatility. With over 60 currency pairs, major indices such as the S&P 500 and Nasdaq 100, popular commodities like gold, silver, and crude oil, as well as cryptocurrencies like Bitcoin and Ethereum, CPT Markets has a range of assets to suit different trading styles and strategies. In this way, traders have access to a broad range of markets to trade, making it easier to find potential opportunities in various markets.

| Pros | Cons |

| Diverse range of assets including forex, commodities, indices, and cryptocurrencies | Limited selection of stocks compared to some other brokers |

| Competitive spreads and low commissions | No option to trade futures |

| No option to trade options | |

| Limited information about some of the available assets | |

| No access to bonds or other fixed-income assets |

Account Types

CPT Markets (Belize) offers three types of trading accounts: Standard, Platinum, and ECN. Each account comes with a minimum deposit requirement of $500.

The Standard account is designed for beginner traders who want to start trading with a small investment. This account offers fixed spreads and allows trading in all available instruments. It also comes with the option to use a swap-free account for those who want to trade according to Shariah law.

The Platinum account is aimed at more experienced traders who require access to a wider range of trading tools and services. This account offers variable spreads and allows trading in all available instruments. It also comes with a personal account manager, free VPS hosting, and priority withdrawal processing.

The ECN account is designed for advanced traders who require faster execution speeds and the ability to trade with no dealing desk intervention. This account offers raw spreads, which means that traders can access the tightest spreads available in the market. It also allows trading in all available instruments and comes with the option to use a swap-free account for those who want to trade according to Shariah law. Additionally, the ECN account offers free VPS hosting and priority withdrawal processing.

| Pros | Cons |

| Multiple account types to choose from | High minimum deposit requirement of $500 |

| Competitive spreads on all account types | No 24/7 customer support |

| Access to various trading instruments | No bonuses or promotions offered |

| Advanced trading platforms offered | |

| Negative balance protection | |

| Demo Accounts Available |

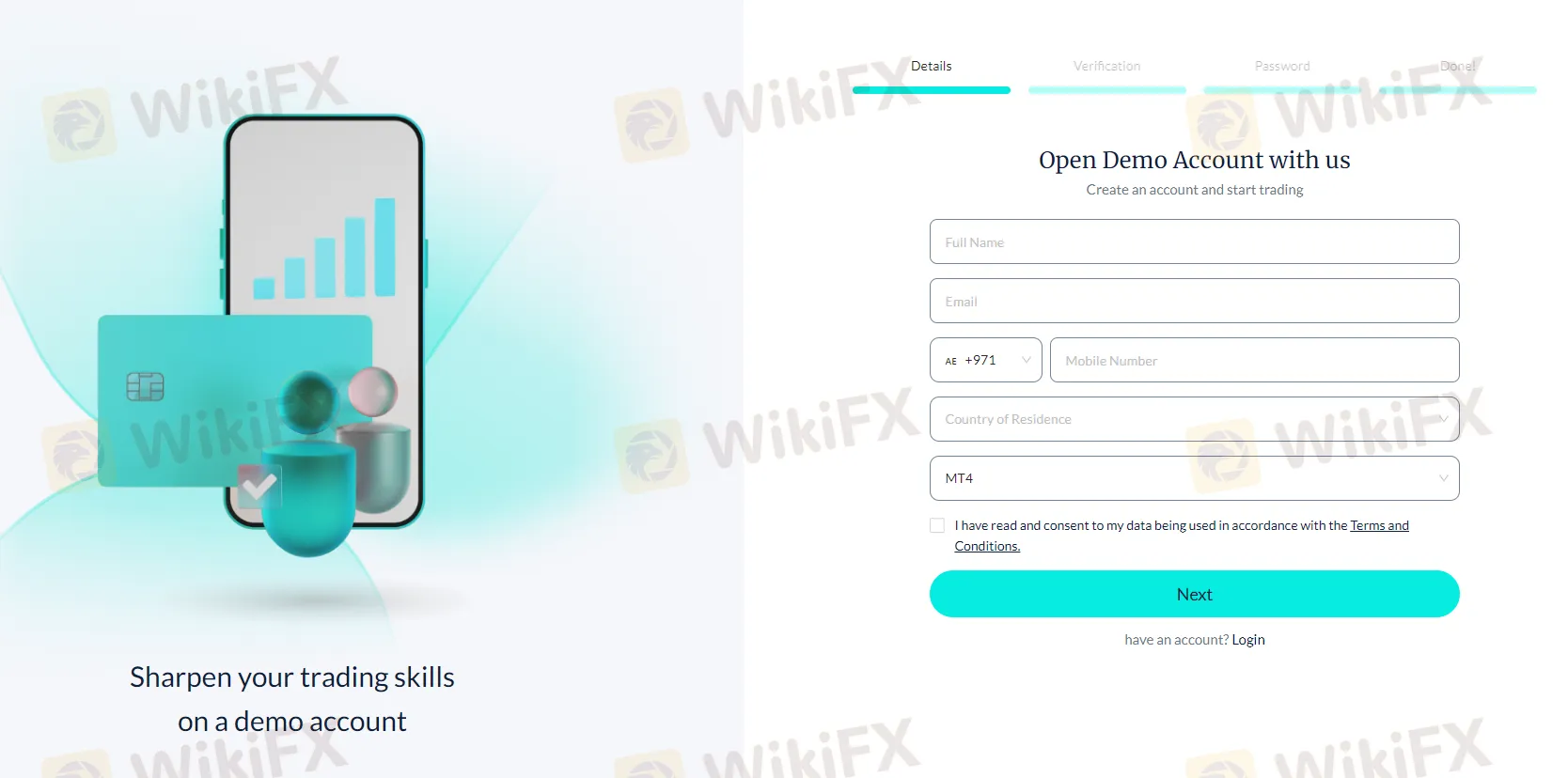

Demo Accounts

CPT Markets offers demo accounts to its clients, which can be used to practice trading without risking real money. The validity period of the CPT Markets demo account is 30 days, after which the account will expire. It's not possible to extend the demo account's validity period, but clients can open a new demo account once the previous one expires. Each client is allowed to have multiple demo accounts to test different trading strategies or to use them for educational purposes.

How to open an account with CPT Markets?

To initiate the account opening process with CPT Markets, interested individuals may visit the broker's official website and click on the “Open Account” button.

This will redirect them to the account registration page where they will be required to fill out the necessary personal and contact information, as well as financial details and other relevant documents.

After completing the online registration form, the account will then be subject to review and approval by CPT Markets. Once the account has been verified and activated, clients may then proceed to fund their trading account with the required minimum deposit and start trading various financial instruments offered by the broker.

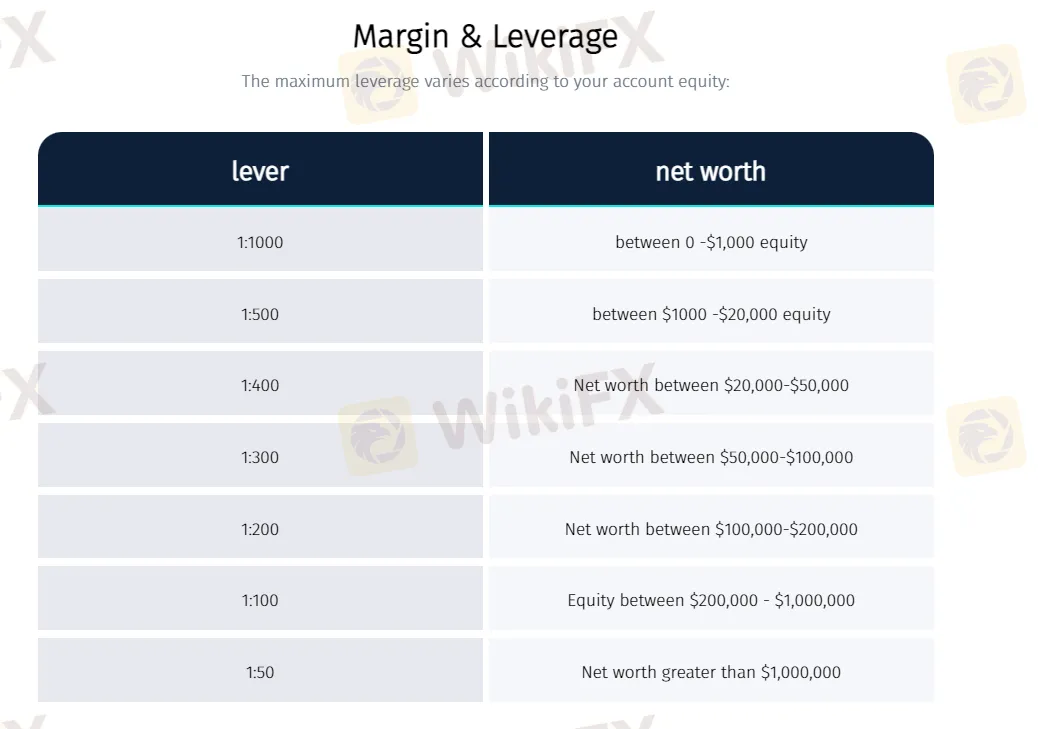

Leverage

CPT Markets (Belize) offers a maximum leverage of up to 1:1000, which is considered to be high. However, it's worth noting that the actual leverage offered to traders may vary depending on their account equity.

For example, traders with a lower account balance may have a lower leverage ratio, while those with a higher account balance may be able to access higher leverage ratios. This is because higher leverage ratios can increase the risk of losses, and brokers must take steps to ensure that traders have enough margin to cover potential losses.

You can request a change to the leverage of your trading account by logging into the CPT Markets Client Portal, clicking on “Accounts” section, selecting the relevant account number, and clicking on the “double arrow - leverage change” icon, selecting the suitable leverage from the options.

While CPT Markets (UK) offers trading leverage up to 1:30 in accordance with the regulations set by the Financial Conduct Authority (FCA). One of the regulations set by the FCA is the maximum allowable leverage that can be offered to retail clients, which is currently set at 1:30 for forex trading. This is intended to protect retail clients from incurring large losses due to excessive leverage.

Spreads & Commissions (Trading Fees)

CPT Markets offers variable spreads, which means that the spread can widen or narrow based on market conditions. The broker also charges commissions on some of its account types.

The spreads on CPT Markets' forex pairs start from 0.0 pips, with an average spread of 0.2 pips on the EUR/USD pair. The broker also offers competitive spreads on other major currency pairs, such as GBP/USD, USD/JPY, and AUD/USD.

For indices, the spread on the UK 100 index starts from 0.8 points, while the spread on the US 500 index starts from 0.5 points. For commodities, the spread on gold starts from 0.3 pips, while the spread on silver starts from 0.02 pips.

In terms of commissions, CPT Markets charges $4 per lot for its ECN account, while the Standard and Platinum accounts have no commission charges.

Below is a table comparing the spreads of CPT Markets on EUR/USD, Crude Oil, and Gold with those of FP Markets and AvaTrade:

| Broker | EUR/USD Spread | Crude Oil Spread | Gold Spread |

| CPT Markets | 0.3 pips | 3.5 cents | 20 cents |

| FP Markets | 0.1 pips | 3 cents | 25 cents |

| AvaTrade | 0.9 pips | 3 cents | 35 cents |

Non-Trading Fees

In addition to trading costs, CPT Markets also charges non-trading fees that clients should be aware of. These fees include fees for deposits, withdrawals, account inactivity, and other administrative fees that may apply.

CPT Markets does not charge fees for deposits and withdrawals, and clients can make unlimited free-of-charge withdrawals per month. However, it should be noted that some payment providers may charge their own fees for transactions, which is beyond the control of the broker.

Inactivity fees may be charged to clients who have not made any trades or account activity for a period of 90 days or more. The fee for this inactivity is $50 per month, which will be deducted from the client's account balance. However, if there is no available balance in the account, no fee will be charged.

Other administrative fees that may apply include fees for account closure, wire transfers, and chargebacks. These fees vary depending on the specific circumstances and are listed in the broker's terms and conditions

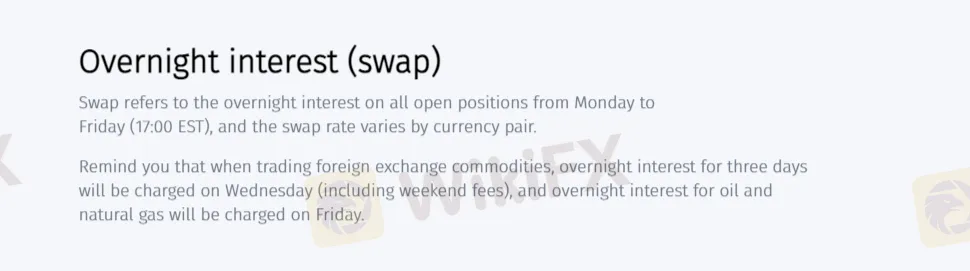

Besides, CPT Markets also charge swap fees. Swap fees are charges incurred for holding a position overnight, also known as an overnight financing fee. The amount of the swap fee depends on the instrument being traded and the direction of the position (long or short).

Trading Platform

CPT Markets gives its clients access to two excellent choices of trading platforms, the advanced MT4 and MT5. CPT Markets offers the popular MetaTrader 4 (MT4) trading platform, which is available for download on desktop and mobile devices. MT4 is a well-established platform in the industry, offering advanced charting tools, technical analysis indicators, and the ability to execute trades directly from the platform. Additionally, CPT Markets also provides a web-based platform, which can be accessed through a web browser without the need for any downloads. The web platform offers similar features to the desktop platform, including charting tools and order execution.

Besides, CPT Markets also offers the MetaTrader 5 (MT5) trading platform to its clients. With MT5, traders can access a range of order types, including market orders, limit orders, stop orders, and trailing stops. The platform also supports hedging, allowing traders to open multiple positions in the same market in different directions. In addition to the desktop version, CPT Markets also offers a mobile version of the MT5 platform, allowing traders to access the markets from anywhere with an internet connection. The mobile app is available for both iOS and Android devices and offers many of the same features as the desktop version.

| Broker | Platform | Desktop | Web | Mobile | Automated Trading |

| CPT Markets | MetaTrader 4 | ✔ | ✔ | ✔ | ✔ |

| MetaTrader 5 | ✔ | ✔ | ✔ | ✔ | |

| cTrader | ❌ | ❌ | ❌ | ❌ | |

| FXCM | Trading Station | ✔ | ✔ | ✔ | ✔ |

| MetaTrader 4 | ✔ | ✔ | ✔ | ✔ | |

| NinjaTrader | ✔ | ❌ | ✔ | ✔ | |

| FP Markets | MetaTrader 4 | ✔ | ✔ | ✔ | ✔ |

| MetaTrader 5 | ✔ | ✔ | ✔ | ✔ | |

| WebTrader | ❌ | ✔ | ✔ | ✔ | |

| IRESS | ✔ | ❌ | ✔ | ✔ |

Deposit & Withdrawal

CPT Markets offers a variety of deposit and withdrawal methods for its clients, including bank wire transfer, credit/debit card, and online payment systems. The broker does not charge any fees for deposits, but third-party fees may apply depending on the payment method used. Withdrawals are generally processed within one business day, but it may take up to five business days for funds to appear in the client's account, depending on the withdrawal method.

Clients can make deposits and withdrawals in multiple currencies, including USD, EUR, GBP, AUD, and CAD. However, it's worth noting that there may be some currency conversion fees charged by the payment provider. In terms of minimum deposit requirements, CPT Markets requires a minimum deposit of $500 for all account types, which is higher than the industry standard.

| Pros | Cons |

| Multiple deposit and withdrawal options | Some methods may incur fees or minimum transaction amounts |

| No deposit or withdrawal fees for most methods | Withdrawals can take up to 3 business days to process |

| Option to use local bank transfer in some regions | Limited availability of some methods in certain regions |

| Withdrawal options are more limited than deposit options | |

| Currency conversion fees may apply for some methods |

Minimum Deposit

CPT Markets has set the minimum deposit amount at $500, which is relatively higher than the industry average. This may be a consideration for some traders who are just starting out or have limited funds available for trading.

Below is a table comparing the minimum deposit requirements of CPT Markets, IC Markets, and FP Markets:

| Broker | Minimum Deposit |

| CPT Markets | $500 |

| IC Markets | $200 |

| FP Markets | $100 |

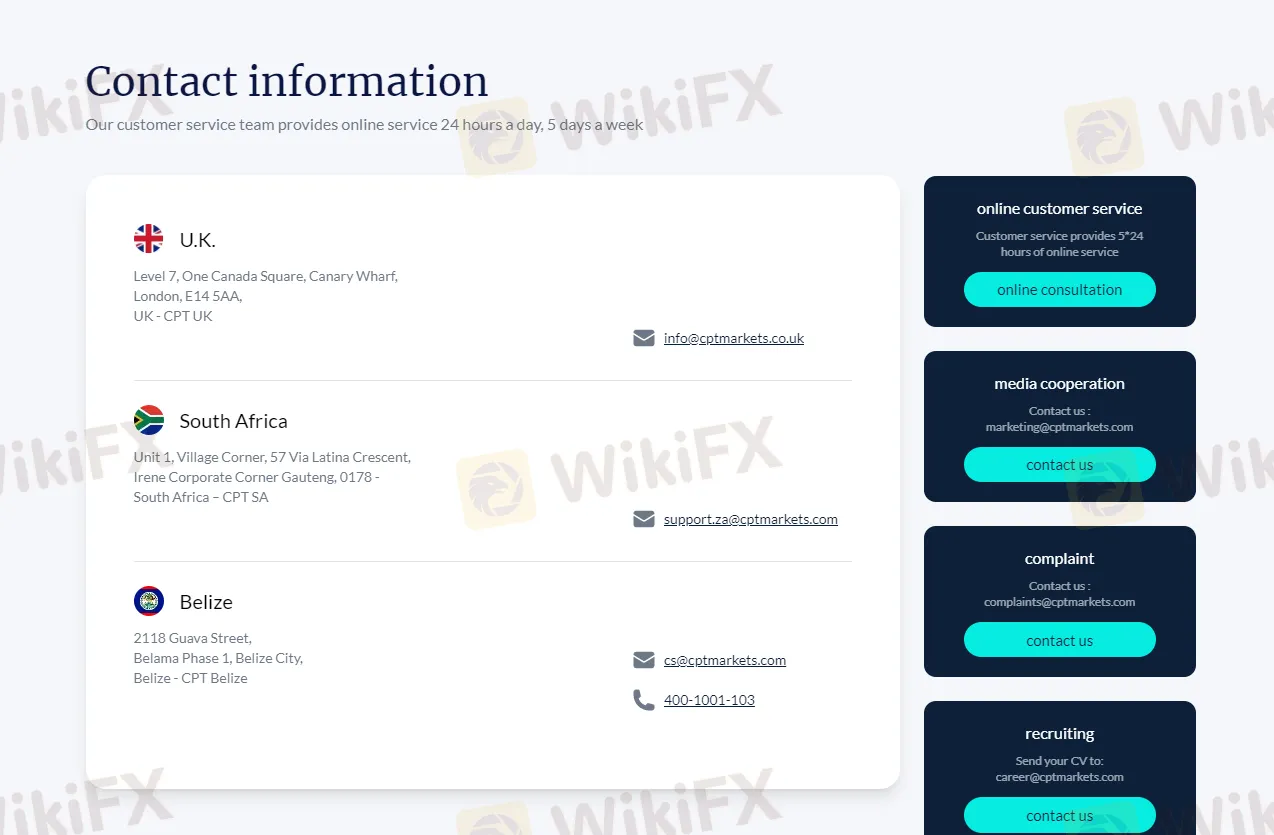

Customer Support

CPT Markets offers customer support to clients via various channels. Clients can reach out to the broker's customer service team through phone, email, live chat, and social media platforms such as Facebook and Twitter. The broker also provides a comprehensive FAQ section on its website that covers a wide range of topics related to trading and account management.

CPT Markets' customer service team is available 24/5 to assist clients with any questions or issues they may have. The broker has a multilingual support team that can assist clients in different languages, including English, Chinese, Spanish, and Arabic.

Educational Resources

CPT Markets offers a variety of educational resources to help traders improve their skills and knowledge of the financial markets. These resources include:

Webinars: CPT Markets offers regular webinars covering a range of topics, from trading strategies and market analysis to risk management and trading psychology.

Video Tutorials: CPT Markets provides a range of video tutorials covering different aspects of trading, including technical analysis, fundamental analysis, and trading psychology.

eBooks: CPT Markets offers a range of eBooks covering various topics related to trading, including forex trading, stock trading, and commodity trading.

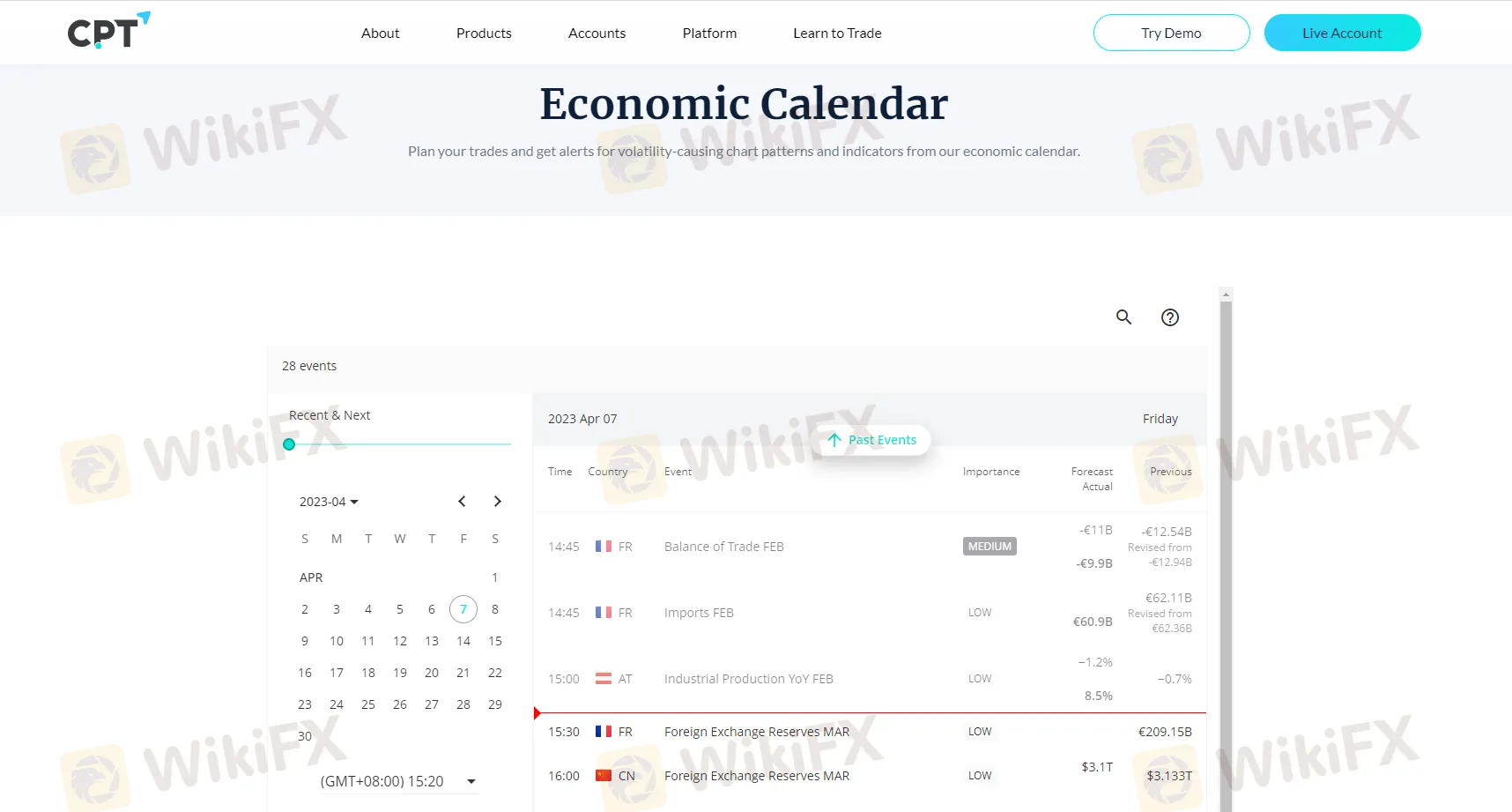

Economic Calendar: CPT Markets provides an economic calendar that displays upcoming economic events and their potential impact on the financial markets.

Market Analysis: CPT Markets provides daily market analysis, including technical analysis, fundamental analysis, and market news.

Trading Tools: CPT Markets offers a range of trading tools, including trading calculators, economic indicators, and a margin calculator.

Conclusion

CPT Markets is a regulated broker that offers a range of trading instruments on multiple trading platforms. The broker's competitive spreads and flexible leverage options make it an attractive option for traders. Additionally, CPT Markets provides a wide range of educational resources, including webinars, trading courses, and market analysis, to help traders improve their skills and make informed trading decisions.

However, CPT Markets does have some drawbacks. The minimum deposit requirement of $500 is higher than industry standards, and the broker charges higher than average non-trading fees. Customer support options are limited, with no phone support available. Finally, while the broker offers a variety of deposit and withdrawal options, some users have reported slow processing times for withdrawals.

Overall, CPT Markets may be a suitable choice for experienced traders who value competitive pricing and a variety of educational resources. However, potential users should weigh the pros and cons carefully and conduct their own research before opening an account with the broker.

FAQs

Q: Is CPT Markets regulated?

A: Yes, CPT Markets is regulated by the Financial Conduct Authority (FCA) in the UK and the International Financial Services Commission (IFSC) in Belize.

Q: What is the minimum deposit requirement for CPT Markets?

A: The minimum deposit requirement for CPT Markets is $500.

Q: What trading platforms are available with CPT Markets?

A: CPT Markets offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, as well as the CPT Markets Mobile App.

Q: Does CPT Markets offer a demo account?

A: Yes, CPT Markets offers a demo account that is valid for 90 days. Multiple demo accounts can be opened.

Q: What is the maximum leverage offered by CPT Markets?

A: CPT Markets offers leverage up to 1:1000, but the actual leverage offered varies depending on the account equity.

Keywords

- 10-15 years

- Regulated in United Kingdom

- Regulated in South Africa

- Market Maker (MM)

- Financial Service

- MT4 Full License

- MT5 Full License

| CPT Markets | Basic Information |

| Founded | 2016 |

| Registered Country | Belize |

| Regulation | FCA (UK), Offshore FSC (Belize), FSCA (South Africa) |

| Minimum Deposit | $20 |

| Demo Account | ✅ |

| Tradable Assets | Forex, Indices, Commodities, Stocks, Cryptocurrencies |

| Trading Platform | MetaTrader 4, MetaTrader 5, cTrader |

| Spread | From 1.4 pips (Classic account) |

| Leverage | Up to 1:1000 |

| Customer Support | Online Chat: 5/24 |

| Email: support.za@cptmarkets.com, info@cptmarkets.co.uk, cs@cinda.com.hk | |

| Region Restrictions | The United States, United Kingdom, Canada, Israel, Iran, Cyprus, and North Korea... |

CPT Markets Basic Information

Founded in 2016, CPT Markets is a global financial brokerage firm that offers trading on Forex, Metals, Energy, Indices, Cryptocurrencies through MT4, MT5 or cTrader. However, CPT Markets does not offer its services to residents of the United States, Canada, and some other jurisdictions.

Is CPT Markets legit?

CPT Markets is a legit broker and it has three entities regulated in their own jurisdictions:

CPT Markets UK is the trading name used by CPT Markets UK Limited. The company's registered office is located in Wales, England, with registration number 6707165, authorized and managed by the UK Financial Conduct Authority (FCA), number 606110. CPT Markets UK Limited is an associated company of CPT Markets Limited.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Status |

| Financial Conduct Authority (FCA) | CPT Markets UK Limited | Market Making (MM) | 606110 | Regulated |

CPT Markets is the trading name used by CPT Markets Limited, registered in Belize, offshore regulated by the Belize International Financial Services Commission (FSC), license number: No. IFSC000314/351.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Status |

| Financial Services Commission (FSC) | CPT Markets Limited | Retail Forex | 000314/126 | Offshore Regulated |

Another entity, CPT MARKETS (PTY) LTD, is regulated in South Africa, authorized by the Financial Sector Conduct Authority (FSCA) under license no. 45954.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Status |

| Financial Sector Conduct Authority (FSCA) | CPT MARKETS (PTY) LTD | Financial Service | 45954 | Regulated |

Pros & Cons

| Pros | Cons |

|

|

|

|

| |

| |

| |

| |

|

Market Instruments

CPT Markets offers access to five classes of tradable instruments across different markets, including forex, indices, commodities, stocks, and cryptocurrencies. With over 60 currency pairs, major indices such as the S&P 500 and Nasdaq 100, popular commodities like gold, silver, and crude oil, as well as cryptocurrencies like Bitcoin and Ethereum, traders can choose their preferred investment options based on their trading style.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Types

Three account options are on offer with CPT Markets, namely Classic, ECN and Prime, classified by account-opening deposits.

For those looking for a more accessible entry point, the Classic account is the most popular choice. It requires a minimal deposit of just $20, making it ideal for beginners or those preferring to start with smaller capital. While it maintains the high leverage of 1:1000, it offers slightly wider spreads of 1.4 pips but without any commission charges.

The ECN account, with a minimum deposit of $1,000, is tailored for experienced traders seeking tight spreads and direct market access. It offers spreads as low as 0.1 pips and operates on a commission-based model. This account type provides maximum leverage of 1:1000, with a 50% margin call and a 30% stop out level.

The Prime account strikes a balance between the ECN and Classic offerings. It requires the same $1,000 minimum deposit as the ECN account but provides a commission-free trading environment with spreads from 0.7 pips. This account maintains the same leverage, margin call, and stop out levels as the other account types.

| Account Type | Min Deposit | Max Leverage | Spread | Commission |

| ECN | $1,000 | 1:1000 | From 0.1 pips | ✔ |

| Classic | $20 | From 1.4 pips | ❌ | |

| Prime | $1,000 | From 0.7 pips | ❌ |

Aside from the three types of trading accounts above, CPT Markets also offers MAM accounts and Corporate accounts.

Demo Accounts

CPT Markets offers demo accounts to its clients, which can be used to practice trading without risking real money. The validity period of the CPT Markets demo account is 30 days, after which the account will expire. It's not possible to extend the demo account's validity period, but clients can open a new demo account once the previous one expires. Each client is allowed to have multiple demo accounts to test different trading strategies or to use them for educational purposes.

Leverage

CPT Markets (Belize) offers a maximum leverage of up to 1:1000, which is considered to be high.

While CPT Markets (UK) offers trading leverage up to 1:30 in accordance with the regulations set by the Financial Conduct Authority (FCA). One of the regulations set by the FCA is the maximum allowable leverage that can be offered to retail clients, which is currently set at 1:30 for forex trading. This is intended to protect retail clients from incurring large losses due to excessive leverage.

Spreads & Commissions

CPT Markets offers variable spreads, which means that the spread can widen or narrow based on market conditions. The broker also charges commissions on some of its account types.

The spreads on CPT Markets' forex pairs start from 0.0 pips, with an average spread of 0.2 pips on the EUR/USD pair. The broker also offers competitive spreads on other major currency pairs, such as GBP/USD, USD/JPY, and AUD/USD.

For indices, the spread on the UK 100 index starts from 0.8 points, while the spread on the US 500 index starts from 0.5 points. For commodities, the spread on gold starts from 0.3 pips, while the spread on silver starts from 0.02 pips.

In terms of commissions, CPT Markets charges $4 per lot for its ECN account, while the Standard and Platinum accounts have no commission charges.

Non-Trading Fees

In addition to trading costs, CPT Markets also charges non-trading fees that clients should be aware of. These fees include fees for deposits, withdrawals, account inactivity, and other administrative fees that may apply.

CPT Markets does not charge fees for deposits and withdrawals, and clients can make unlimited free-of-charge withdrawals per month. However, it should be noted that some payment providers may charge their own fees for transactions, which is beyond the control of the broker.

Inactivity fees may be charged to clients who have not made any trades or account activity for a period of 90 days or more. The fee for this inactivity is $50 per month, which will be deducted from the client's account balance. However, if there is no available balance in the account, no fee will be charged.

Other administrative fees that may apply include fees for account closure, wire transfers, and chargebacks. These fees vary depending on the specific circumstances and are listed in the broker's terms and conditions

Besides, CPT Markets also charge swap fees. Swap fees are charges incurred for holding a position overnight, also known as an overnight financing fee. The amount of the swap fee depends on the instrument being traded and the direction of the position (long or short).

Trading Platforms

CPT Markets gives its clients access to three excellent choices of trading platforms, the advanced MT4 and MT5 as well as cTrader.

MetaTrader 4 (MT4)

CPT Markets offers the popular MetaTrader 4 (MT4) trading platform, which is available for download on desktop and mobile devices. MT4 is a well-established platform in the industry, offering advanced charting tools, technical analysis indicators, and the ability to execute trades directly from the platform. Additionally, CPT Markets also provides a web-based platform, which can be accessed through a web browser without the need for any downloads. The web platform offers similar features to the desktop platform, including charting tools and order execution.

MetaTrader 5 (MT5)

Besides, CPT Markets also offers the MetaTrader 5 (MT5) trading platform to its clients. With MT5, traders can access a range of order types, including market orders, limit orders, stop orders, and trailing stops. The platform also supports hedging, allowing traders to open multiple positions in the same market in different directions. In addition to the desktop version, CPT Markets also offers a mobile version of the MT5 platform, allowing traders to access the markets from anywhere with an internet connection. The mobile app is available for both iOS and Android devices and offers many of the same features as the desktop version.

cTrader

CPT Markets also offers cTrader, an intuitive and easy-to-use trading platform for new and advanced traders. With cTrader, you can customize your on-the-go trading experience with a variety of order types, technical analysis tools, price alerts, and trade statistics. CPT Markets cTrader is available on PC, desktop and mobile devices.

Copy Trading

CPT Markets offers a copy trading feature that allows less experienced traders to replicate the strategies of successful investors. You can choose to be a social trading provider or follower by filling out the following form.

Deposit & Withdrawal

CPT Markets offers 14 payment methods for its clients, including bank transfer, credit/debit card, and Skrill, Neteller, and other online payment systems. The broker does not charge any fees for deposits, but third-party fees may apply depending on the payment method used. Withdrawals are generally processed within one business day, but it may take up to five business days for funds to appear in the client's account, depending on the withdrawal method.

Clients can make deposits and withdrawals in multiple currencies, including USD, EUR, GBP, AUD, and CAD. However, it's worth noting that there may be some currency conversion fees charged by the payment provider. In terms of minimum deposit requirements, CPT Markets requires a minimum deposit of $500 for all account types, which is higher than the industry standard.

Customer Support

Clients can reach out to the broker's customer service team through phone, email, live chat, and social media platforms such as Facebook and Twitter. CPT Markets' customer service team is available 24/5 to assist clients with any questions or issues they may have.

The broker has a multilingual support team that can assist clients in different languages, including English, Chinese, Spanish, and Arabic.

| Region | Office Address | Additional Info | |

|---|---|---|---|

| United Kingdom | Level 7, One Canada Square, Canary Wharf, London, E14 5AA, UK - CPT UK | info@cptmarkets.co.uk | Support available 24/5 |

| South Africa | 6 Kikuyu Road, Sunninghill, Johannesburg Gauteng, 2191, South Africa | support.za@cptmarkets.com | Support available 24/5 |

| Media Collaboration | N/A | marketing.za@cptmarkets.com | For media-related inquiries |

| Complaints | N/A | complaints@cptmarkets.com | For complaints |

| Career | N/A | career@cptmarkets.com | For job applications (send CV) |

Educational Resources

In comparison to industry peers such as FP Markets and XM, CPT Markets offers a more limited range of educational resources. The broker's educational offerings are focused primarily on essential tools, including the CPT Academy, an Economic Calendar, and occasional webinars. While these resources provide basic support for traders, the scope and depth of educational content are not as extensive as those offered by some of its competitors in the forex and CFD trading space.

FAQs

Is CPT Markets legit?

CPT Markets operates legally, and it is regulated by FCA in the UK, FSC in Belize, and FSCA in South Africa.

What account types are available at CPT Markets?

CPT Markets offers several account types, including Classic, ECN, Prime, MAM and Corporate accounts.

Is CPT Markets a good broker for beginners?

Yes, CPT Markets is a good broker for beginners. CPT Markets offers robust platforms for traders, operating under stringent regulatory oversight and providing solid educational resources along with demo accounts. More importantly, it allows small-budget trading from $20 only.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital.

News

News CPT Markets Secures UAE SCA License for FX and CFDs Services

CPT Markets’ UAE subsidiary, CPT MENA, secures an SCA Category Five license, expanding its FX and CFDs services in the region. Learn more about its UAE growth.

2025-03-10 14:50

News Avoid Fake Websites of CPT Markets

You may have heard the proverb "All that glitters is not gold.". It's high time to take this proverb seriously if you are involved in the forex market; otherwise, you will lose your hard-earned money.

2024-12-18 17:06

News WikiFX Broker Assessment Series | CPT Markets: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of CPT Markets, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

2024-07-16 18:02

News CPT Markets Expands with New Cyprus Office

CPT Markets strengthens its European presence with a new office in Cyprus. The UK unit shows financial improvement despite increased expenses.

2024-06-24 17:13

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now