简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading Scenario: Margin Call Level at 100% and No Separate Stop Out Level

Abstract:Series of forex brokers handle a Margin Call in different ways. Some brokers consider a Margin Call and Stop Out as just one and the same, meaning they will not send you a warning message, they will only just start closing your trades along with a message notifying you of the action just.

Now let us use all the margin jargon we discussed from the past lessons by looking at trading scenarios with different Margin Call and Stop Out Levels.

Series of forex brokers handle a Margin Call in different ways. Some brokers consider a Margin Call and Stop Out as just one and the same, meaning they will not send you a warning message, they will only just start closing your trades along with a message notifying you of the action just.

In this lesson, we will go through a real-life trading scenario where you are using a broker that only operates with a Margin Call. Meaning that the broker defines its Margin Call Level at 100% and does not have a separate Stop Out Level.

Here is A question, What do you think will happen when you involved in trade that goes terribly wrong?

Let's see!

Step 1: Deposit Funds Into Trading Account

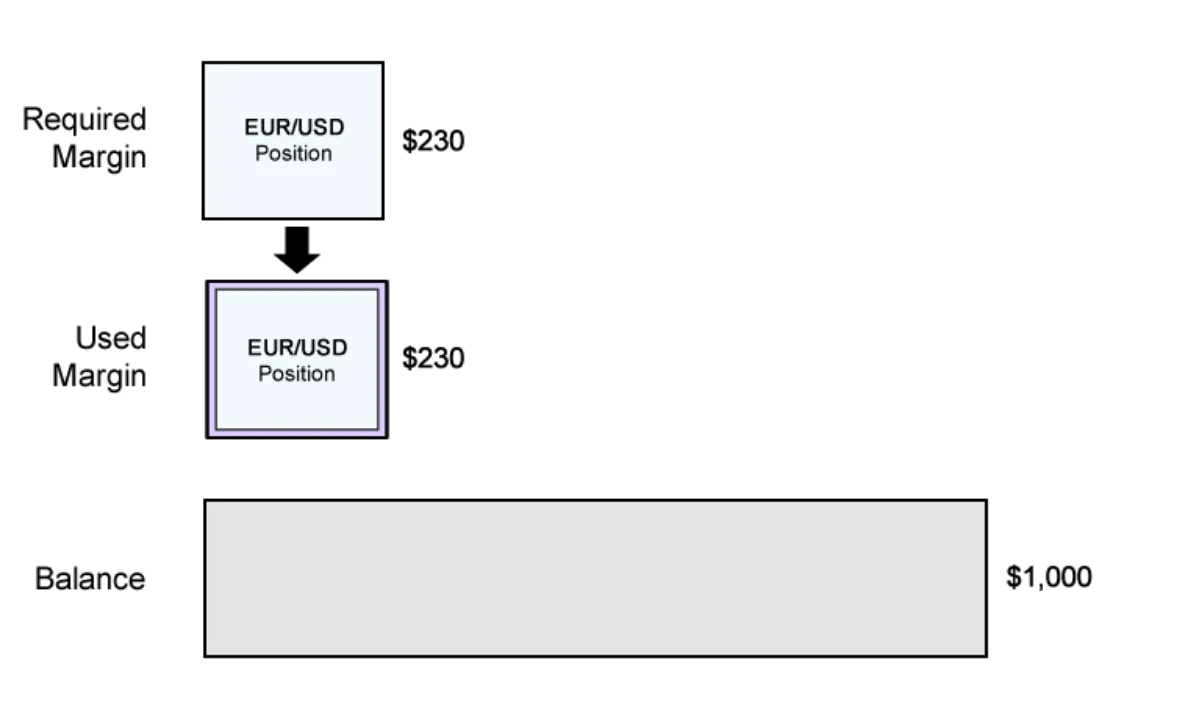

Assuming you have a trading balance of $1,000, which will looks like this in your account

Below is how is will looks in your trading account

Step 2: Calculate Required Margin

You want to go long EUR/USD at 1.15000 and want to open a 1 mini lot (10,000 units) position. The Margin Requirement is 2%.

How much margin (Required Margin) will you need to open the position?

Since EUR is the base currency. this mini lot is 10,000 euros, which means the positions Notional Value is €10,000. Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the Notional Value of the trade.

$1.15 = €1

$11,500 = €10,000

The Notional Value is $11,500.

Now we can calculate the Required Margin:

Required Margin = Notional Value x Margin Requirement

$230 = $11,500 x .02

Assuming your trading account is denominated in USD, since the Margin Requirement is 2%, the Required Margin will be $230.

Step 3: Calculate Used Margin

Apart from the trade we just entered, there are no other trades open. As we have a single position open, the Required Margin will be same as used Margin.

Step 4: Calculate Equity

Lets assume that the price has moved slightly in your favor and your position is now trading at breakeven.

This means that your Floating P/L is $0.

Lets calculate your Equity:

Equity = Balance + Floating Profits (or Losses)

$1,000 = $1,000 + $0

The Equity in your account is now $1,000.

Step 5: Calculate Free Margin

Now that we know the Equity, we can now calculate the Free Margin:

Free Margin = Equity - Used Margin

$770 = $1,000 - $230

The Free Margin is $770.

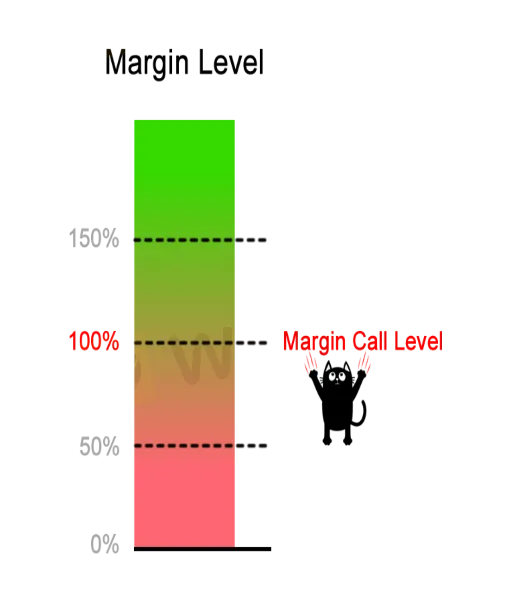

Step 6: Calculate Margin Level

Since we know the Equity, we can now calculate the Margin Level:

Margin Level = (Equity / Used Margin) x 100%

435% = ($1,000 / $230) x 100%

The Margin Level is 435%.

Here, this is how your account metrics would look in your trading platform:

EUR/USD drops 500 pips!

Reports arise from the Paris of a Zombie outbreak and causes the drops of EUR/USD. EUR/USD falls 500 pips and is now trading at 1.10000.

Let us look and observe how your account is affected.

Used Margin

Due to the exchange rate has changed, the Notional Value of the position has changed. And you will observe the change In the Used Margin. And it requires recalculating the Required Margin. Whenever theres a change in the price for EUR/USD, the Required Margin changes.

With EUR/USD now trading at 1.1000 (instead of 1.15000), lets see how much Required Margin is needed to keep the position open.

As our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the Notional Value of the trade.

$1.10 = €1

$11,000 = €10,000

The Notional Value is $11,000.

Previously, the Notional Value was $11,500. Since EUR/USD has fallen, this means that EUR has weakened. And since your account is denominated in USD, this causes the positions Notional Value to decrease.

We can can calculate the Required Margin:

Required Margin = Notional Value x Margin Requirement

$220 = $11,000 x .02

Notice that because the Notional Value has decreased, so has the Required Margin.

Since the Margin Requirement is 2%, the Required Margin will be $220.

Previously, the Required Margin was $230 (when EUR/USD was trading at 1.15000).

The Used Margin is updated to reflect changes in Required Margin for every position open.

In this example, since you only have one position open, the Used Margin will be equal to the new Required Margin.

Floating P/L

EUR/USD has fallen from 1.15000 to 1.10000, a difference of 500 pips.

Since youre trading 1 mini lot, a 1 pip move equals $1.

This means that you have a Floating Loss of $500.

Floating P/L = (Current Price - Entry Price) x 10,000 x $X/pip

-$500 = (1.1000 - 1.15000) x 10,000 x $1/pip

Equity

The Equity is now $500.

Equity = Balance + Floating P/L

$500 = $1,000 + (-$500)

Free Margin

Your Free Margin is now $280.

Free Margin = Equity - Used Margin

$280 = $500 - $220

Margin Level

Your Margin Level has decreased to 227%.

Margin Level = (Equity / Used Margin) x 100%

227% = ($500 / $220) x 100%

Your Margin Level is still above 100% so all is still well.

Account Metrics

This is how your account metrics would look in your trading platform:

EUR/USD drops another 288 pips!

EUR/USD has falls again, with another 288 pips and is now trading at 1.07120.

Used Margin

With EUR/USD now trading at 1.07120 (instead of 1.10000), lets see how much Required Margin is expected to keep the position open. Because our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the Notional Value of the trade.

$1.07120 = €1

$10,712 = €10,000

The Notional Value is $10,712.

Now we can calculate the Required Margin:

Required Margin = Notional Value x Margin Requirement

$214 = $10,712 x .02

Notice that because the Notional Value has decreased, so has the Required Margin. Since the Margin Requirement is 2%, the Required Margin will be $214.

Previously, the Required Margin was $220 (when EUR/USD was trading at 1.10000). The Used Margin is updated to reflect changes in Required Margin for every position open.

In this example, since you only have one position open, the Used Margin will be equal to the new Required Margin.

Floating P/L

EUR/USD has now fallen from 1.15000 to 1.07120, a difference of 788 pips.

Since youre trading 1 mini lot, a 1 pip move equals $1.

What this means is you have a Floating Loss of $788.

Floating P/L = (Current Price - Entry Price) x 10,000 x $X/pip

-$788 = (1.07120 - 1.15000) x 10,000 x $1/pip

Equity

The Equity is now $212.

Equity = Balance + Floating P/L

$212 = $1,000 + (-$788)

Free Margin

Your Free Margin is now –$2.

Free Margin = Equity - Used Margin

-$2 = $212 - $214

Margin Level

Your Margin Level has decreased to 99%.

Margin Level = (Equity / Used Margin) x 100%

99% = ($212 / $214) x 100%

Here, your Margin Level is below the Margin Call Level.

Account Metrics

Your account metrics would look in your trading platform as:

MARGIN CALL!

This is where your broker will automatically close your trade. And when that happens two things are likely to happen;

● Your Used Margin will be released.

● Your Floating Loss will be realized.

And your new account balance will be updated to reflect the Realized Loss. Since your account has no open positions and become flat, then your Free Margin, Equity, and Balance will be the same all. There will be no Margin Level or Floating P/L because there are no open positions.

Now that some changes happened to your trading account from start to finish, let us Check.

Recall, Before the trade, you had $1,000 in cash. Now youre left with $212!

Youve lost 79% of your capital.

% Gain/Loss = ((Ending Balance - Starting Balance) / Starting Balance) x 100%

-79% = (($212 - $1,000) / $1,000) x 100%

Some traders suffer a terrible side effect when finding out their trade has been automatically liquidated.

In our next lesson, we will discuss and provide a different trading scenario where your broker has a separate Margin Call and Stop Out Level.

Lets see the difference between happens there versus what happened here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator