简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trend Lines

Abstract:In forex trading, trend lines are the most often used type of technical analysis. They're also one of the most obscure. They can be as exact as any other approach if drawn correctly. Most forex traders, unfortunately, draw them improperly or try to make the line represent the market instead of the other way around.

In forex trading, trend lines are the most often used type of technical analysis.

They're also one of the most obscure.

They can be as exact as any other approach if drawn correctly.

Most forex traders, unfortunately, draw them improperly or try to make the line represent the market instead of the other way around.

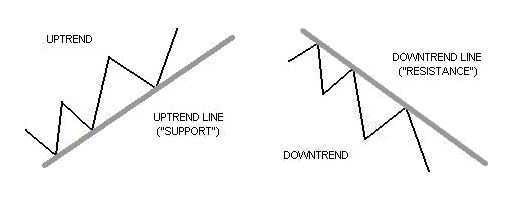

In its most basic form, an uptrend line is drawn along the bottom of clearly defined support zones (valleys).

This is referred to as a rising trend line.

In a downturn, the trend line is drawn around the top of clearly defined resistance points (peaks).

This is referred to be a descending trend line.

What is the most effective method for drawing trend lines?

Simply connect two large peaks or bottoms to create a proper forex trend line.

So, what's next?

Nothing.

Is that the end of the storey?

It's as simple as that.

Here are some examples of trend lines in the real world. Those waves are incredible!

Trends of Various Kinds

Three types of trends can be identified:

Lower highs indicate a downward trend.

Uptrend (lower lows)

The current trend is in the wrong direction (ranging)

Here are some important things to remember while using trend lines in forex trading:

At least two tops or bottoms are required for a respectable trend line, but a trend line must be verified by THREE tops or bottoms.

The STEEPER a trend line becomes, the less trustworthy it becomes and the more likely it is to break.

The more they are tested, trend lines, like horizontal support and resistance levels, become stronger.

Last but not least, NEVER try to force trend lines to fit the market. That trend line isn't genuine if they don't match together properly!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator