简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Summary: Trading Support and Resistance

Abstract:The peak reached before the price falls back is now resistance when it moves up and then retracts. As the price climbs back up, the lowest position hit before the climb is now considered support.

You learned how to trade support and resistance in prior lessons.

Let's go over everything you've learned thus far.

The peak reached before the price falls back is now resistance when it moves up and then retracts.As the price climbs back up, the lowest position hit before the climb is now considered support.Support and Resistance are Zones

It's vital to remember that bullish levels aren't always exact numbers.

To help you filter out false breakouts, think of support and resistance as “zones” rather than precise figures.

These zones can be found by charting trend lines on a line chart instead of a candlestick chart.

Support and Resistance Can Reverse Roles

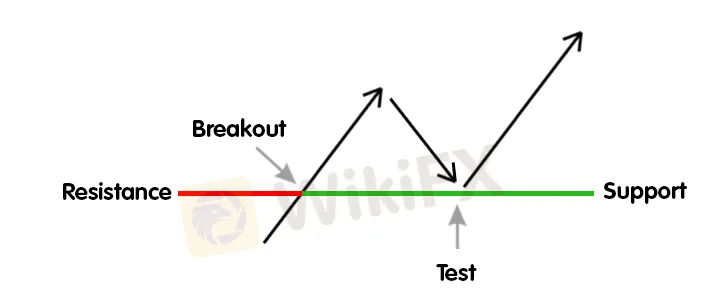

Another thing to keep in mind is that when price goes through a level of resistance, that level of resistance may turn into support.

A support level could be affected in the same way. When a support level is broken, it becomes a resistance level.

“Role reversal” is the term for this concept.

Trend Lines

An uptrend line is formed along the bottom of clearly defined support zones in its most basic form (valleys).

In a downturn, the trend line is drawn around the top of clearly defined resistance points (peaks).

Trends can be divided into three categories:

Uptrend (higher lows)

Downtrend (lower highs)

Sideways or trendless (ranging or flat)

Trend Channels

Trend channels can be divided into three categories:

Ascending channel (higher highs and higher lows)

Descending channel (lower highers and lower lows)

Horizontal channel (ranging)

Draw a parallel line at the same angle as an uptrend line and move it to where it crosses the most recent high to construct an up (ascending) channel.

To create a down (descending) channel, just draw a parallel line parallel to the downtrend line and advance it until it intersects with the most recent falling line valley.

To make a sideways (horizontal) channel, just draw a parallel line at a zero or flat angle.

How to Trade Support and Resistance

There are two approaches to trading bullish levels.

The “bounce”

The “break”

When trading the bounce, we want to locate some form of proof that the support or resistance level will remain.

Instead of purchasing or selling immediately away, wait for it to bounce by first making a decision.

You prevent those occasions when price moves so quickly that it slices through support and upthrust like a knife through heated butter by doing so.

Alternatively, your warm hand.

There are two approaches to trading the break: aggressive and conservative.

You purchase or sell when the price readily crosses through a support or resistance zone when trading aggressively.

The cautious method is to wait for a price “pullback” to the broken support or resistance level, then enter once the price bounces back.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator