简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What Impact Do Cross Currency Pairs Have On Dollar Pairs?

Abstract:Let's say the Federal Reserve raises interest rates. The market rapidly begins to purchase the US dollar in all major currencies.

Let's say the Federal Reserve raises interest rates.

The market rapidly begins to purchase the US dollar in all major currencies.

The EUR/USD and GBP/USD currencies are falling, while the USD/CHF and USD/JPY currencies are rising.

You were short EUR/USD and were thrilled to see price move in your favour, gaining some pips, but just as you were about to light up the cigar, you see your friend who was long USD/JPY had gained a lot more pips than you.

“What's up with it, yo?” you wonder.

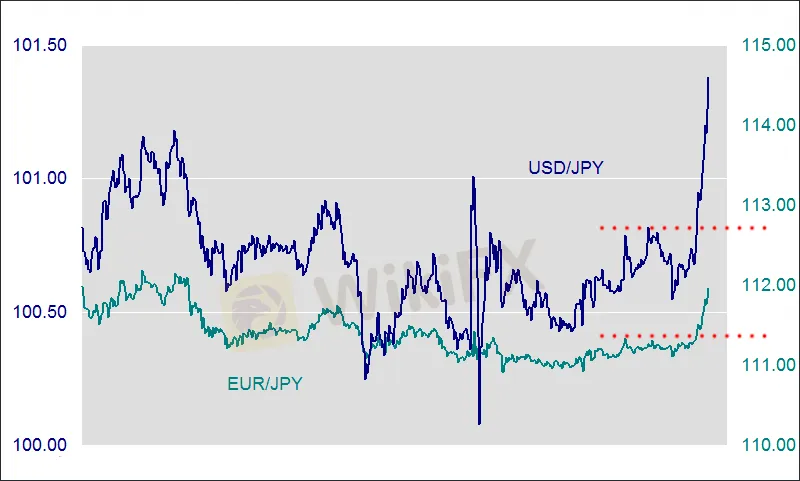

When you compare the EUR/USD and USD/JPY charts, you can see that USD/JPY has made the larger move.

It surged up 200 pips after breaking over a big technical resistance level, while EUR/USD barely dropped 100 pips and failed to break through a major support level.

“How come my EUR/USD trade appears so weak compared to my friend's USD/JPY trade if the US currency was being bought across the board?” you wonder.

This is due to currency conversions! EUR/JPY is the currency pair in this case.

The combination of stop losses being hit and breakout traders jumping on the bandwagon pushed USD/JPY even higher as it broke over its significant resistance level (red dashed line and 101.00 handle).

Because buying more USD/JPY weakens the yen, EUR/JPY (and probably other yen-based pairs) would be able to break through their main resistance level. EUR/JPY continues to hit stops and attract breakout traders, driving the currency pair farther higher.

When resistance is broken, stops are triggered, and breakout traders start fresh positions and go long, causing the EUR/JPY to rise even further.

As a result, the euro strengthens, slowing the decline of your EUR/USD transaction.

Because the EUR/JPY cross purchasing works as a “parachute,” the EUR/USD did not move as much or as quickly as the USD/JPY.

Cross-currency pairs have an impact on your trades even if you simply trade the major currencies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator