简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Gasoline Price Record Surge Likely to Continue as US Targets Russian Oil

Abstract:Gasoline prices have soared in the United States and elsewhere as Russian sanctions, brought on by its invasion into Ukraine, have effectively removed a large amount of Russia‘s oil from global markets.

GASOLINE, OIL, RUSSIAN OIL IMPORTS, INFLATION - TALKING POINTS

Gasoline prices break all-time record in United States amid Ukraine conflict

Prices likely to rise further as lawmakers take aim at Russian oil imports

Gasoline prices exhibit extreme strength and may soon target $4.00

Despite no official Western sanctions on Russian oil, the situation has cast a cloud of confusion over exporters who have largely stopped shipping barrels out of the countrys ports.

US prices at the pump rose to a national average of 4.065 per gallon on March 7, according to AAA. In the United Kingdom, petrol rose to 155.62 pence per liter, according to RAC fuel watch. That puts a gallon of fuel in the UK at over £7 per gallon. And prices are only expected to rise with surging WTI crude and Brent oil prices. The price of gasoline – a product derived from oil – is expected to rise further in the coming days.

The unprecedented rise in fuel costs has bolstered an already precarious inflation outlook, causing fear that it will eat into consumer demand in the post-Covid era. The Federal Reserves calculus to initiate a rate liftoff on March 16 is also being called into question, serving to inflame uncertainty in the global economy. US breakeven rates – a bond-based inflation outlook metric – have surged, with the 1-year and 10-year rates rising to 5.52% and 2.86%, respectively.

Oil prices, and by effect, gasoline prices are likely to rise further in the coming weeks by all indications. Russia continues its military advance into Ukraine amid reports of heavy fighting, and the White House is considering a ban on Russian oil. The Biden administration is currently speaking with congressional leaders who are pushing through legislation targeted at banning Russian oil imports, a move that has bipartisan support on Capitol Hill.

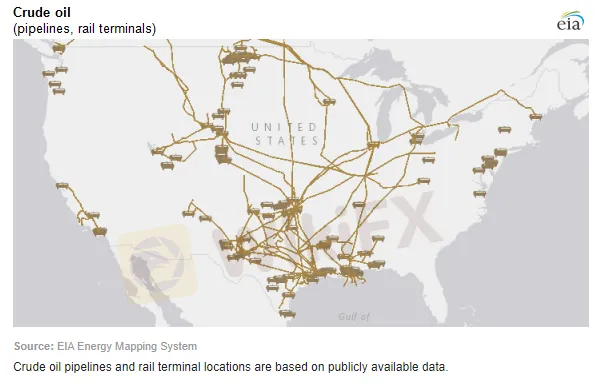

US CRUDE OIL INFRASTRUCTURE CHART

Currently, US producers are rushing to boost domestic production of oil through the Permian Basin, although those increases will come gradually, lagging the pace needed to bridge the gap if the US moves to cut off Russias nearly 200k barrels per day. The US West Coast is most likely to feel the full force of such a move. The Biden administration is reportedly considering easing sanctions on Venezuela to help support global oil markets. The South American county could produce 1.3 million barrels a day in 2019, according to the Energy Information Administration (EIA).

Meanwhile, Russia is threatening to stop the flow of natural gas to Europe by cutting off its Nord Stream 1 pipeline. Germany, an EU country that most heavily relies on Russian energy, is unlikely to join the US ban on Russian imports but says it is taking steps to diversify its energy supply, according to German Chancellor Olaf Scholz. Overall, gasoline prices are likely to continue rising in the short term as long as Western sanctions remain in place.

GASOLINE TECHNICAL FORECAST

US gasoline prices are trading above the 261.8% Fibonacci extension from the 2021 October to December move after prices failed to hold above the level on an intraday basis yesterday. The Relative Strength Index (RSI) is at its highest levels since early 2021, and the MACD oscillator is signaling extreme upward momentum at its highest reading on record. A pullback below the 261.8% Fib level may see prices drop to the 9-day Exponential Moving Average (EMA), but continued strength may see prices quickly target the 4.00 level.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Unmasking the ‘Datuk’: The Anatomy of a RM638,205 Investment Scam

Authorities in Malaysia have launched an extensive investigation into a fraudulent stock investment scheme, which has resulted in losses amounting to RM638,205.

Unmasking the ‘Datuk’: The Anatomy of a RM638,205 Investment Scam

Authorities in Malaysia have launched an extensive investigation into a fraudulent stock investment scheme, which has resulted in losses amounting to RM638,205.

ATFX Enhances Trading Platform with BlackArrow Integration

ATFX integrates the BlackArrow trading platform, offering advanced tools for forex, crypto, and stocks with automation and real-time analytics for traders.

Exposing the Truth: What Happened with the Losses of Thousands of Dollars on the GlobTFX Platform?

The facts are clear and undeniably shocking—GlobTFX has caused significant financial losses to well-known traders in the Arab world. Eighteen victims have confirmed a total loss exceeding $22,372! But this is just the tip of the iceberg…

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Currency Calculator