简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Immediate Edge Review 2025: Is it safe?

Abstract:Launched in 2019, Immediate Edge claims to be an automated cryptocurrency trading platform using AI technology for crypto trading services. The platform requires a minimum deposit of $250 to begin trading, which is relatively expensive for many investors. During its short operation, Immediate Edge failed to establish a positive reputation. The platform has undergone frequent domain changes and has repositioned itself as an intermediary connecting users with investment firms—a move that appears designed to obscure its actual operations. Immediate Edge restricts services to investors from the United States; it remains accessible to users in other regions.

| Immediate Edge | ⭐ |

| |

| Founded in | 2019 |

| Registered in | United Kingdom |

| Regulations | Not Regulated |

| Minimum Deposit | $250 |

| Trading Fees | 2% |

| Supported Cryptocurrencies | BTC, ETH, LTC, XRP, DOGE, ADA, etc |

| Leverage Trading | Yes |

| Demo Account | Yes |

| Withdrawal Fees | No |

| Websites (Mostly Unaccessible) | www.immediateedgebot.comimmediate-edge.co.ukimmediateedgetradingapp.comimmediateedge-uk.comimmediateedgepro.comimmediateedgeai.comimmediate-edge.coimmediate-edge.softwareimmediate-edge.io |

| FCA Warnings | Yes |

What is Immediate Edge?

Launched in 2019, Immediate Edge claims to be an automated cryptocurrency trading platform using AI technology for crypto trading services. The platform requires a minimum deposit of $250 to begin trading, which is relatively expensive for many investors. During its short operation, Immediate Edge failed to establish a positive reputation. The platform has undergone frequent domain changes and has repositioned itself as an intermediary connecting users with investment firms—a move that appears designed to obscure its actual operations. Immediate Edge restricts services to investors from the United States, it remains accessible to users in other regions.

Immediate Edge Pros and Cons

✅Where Immediate Edge Shines:

- A free demo account provided

- Allow for automated cryptocurrency trading

- Leverage trading supported

- No fees for account registration and withdrawals

❌Where Immediate Edge Falls Short:

- Operating outside of regulatory oversight

- Frequently changed and poorly designed websites

- Unstable trading services

- Relatively high minimum deposit of $250, unfriendly to beginners

- A transaction fee of 2%, slightly expensive trading costs

Is Immediate Edge Legit?

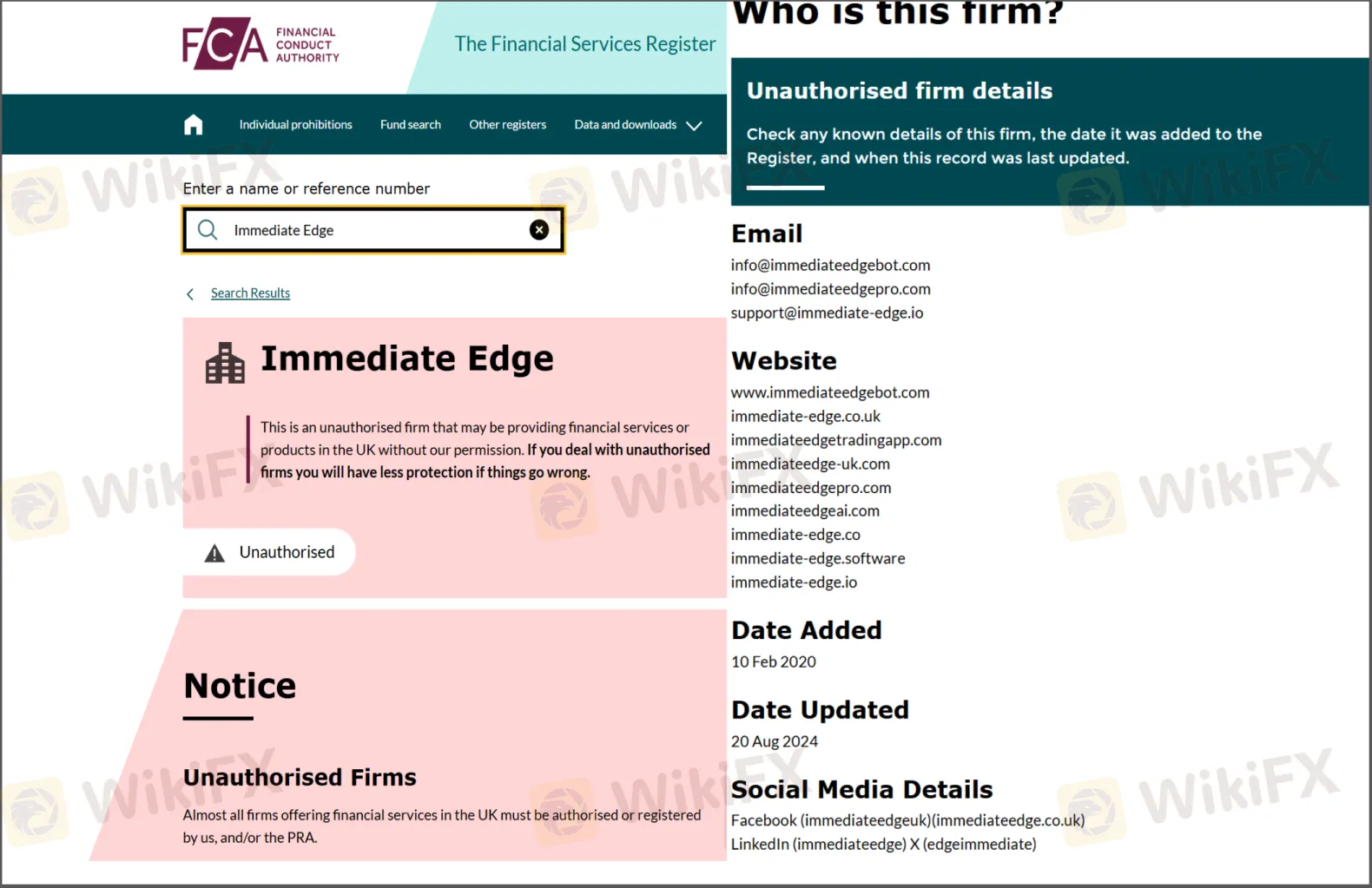

As a UK-born trading platform, Immediate Edge is not regulated by the FCA within this region. A search on the FCA website confirms that it is listed as an authorized firm, which means this broker is not permitted to provide financial services or products in the UK.

Beyond the FCA in the UK, we also verified this broker's regulatory status with other authorities and only found that this broker is not regulated by any of them.

| Regulator | Established Year | Operation Country | Regulated or Not | |

| FCA (Financial Conduct Authority) | 2013 | United Kingdom |  | ❌ |

| ASIC (Australia Securities & Investment Commission) | 1998 | Australia |  | ❌ |

| CYSEC (Cyprus Securities and Exchange Commission) | 2001 | Europe |  | ❌ |

| CONSOB (The Commissione Nazionale per le Società e la Borsa) | 1974 | Italy |  | ❌ |

| BaFin (Federal Financial Supervisory Authority) | 2002 | Germany |  | ❌ |

| FINMA (Swiss Financial Market Supervisory Authority) | 2007 | Switzerland |  | ❌ |

The regulation is considered the most important factor before investors engage with a forex broker. Firstly, regulated brokers are required to put clients funds in a separate account with their operational funds to give client protection before trading. Secondly, traders can report any scams to relevant regulatory authorities.

Immediate Edge -Uncover Its Unethical Practices

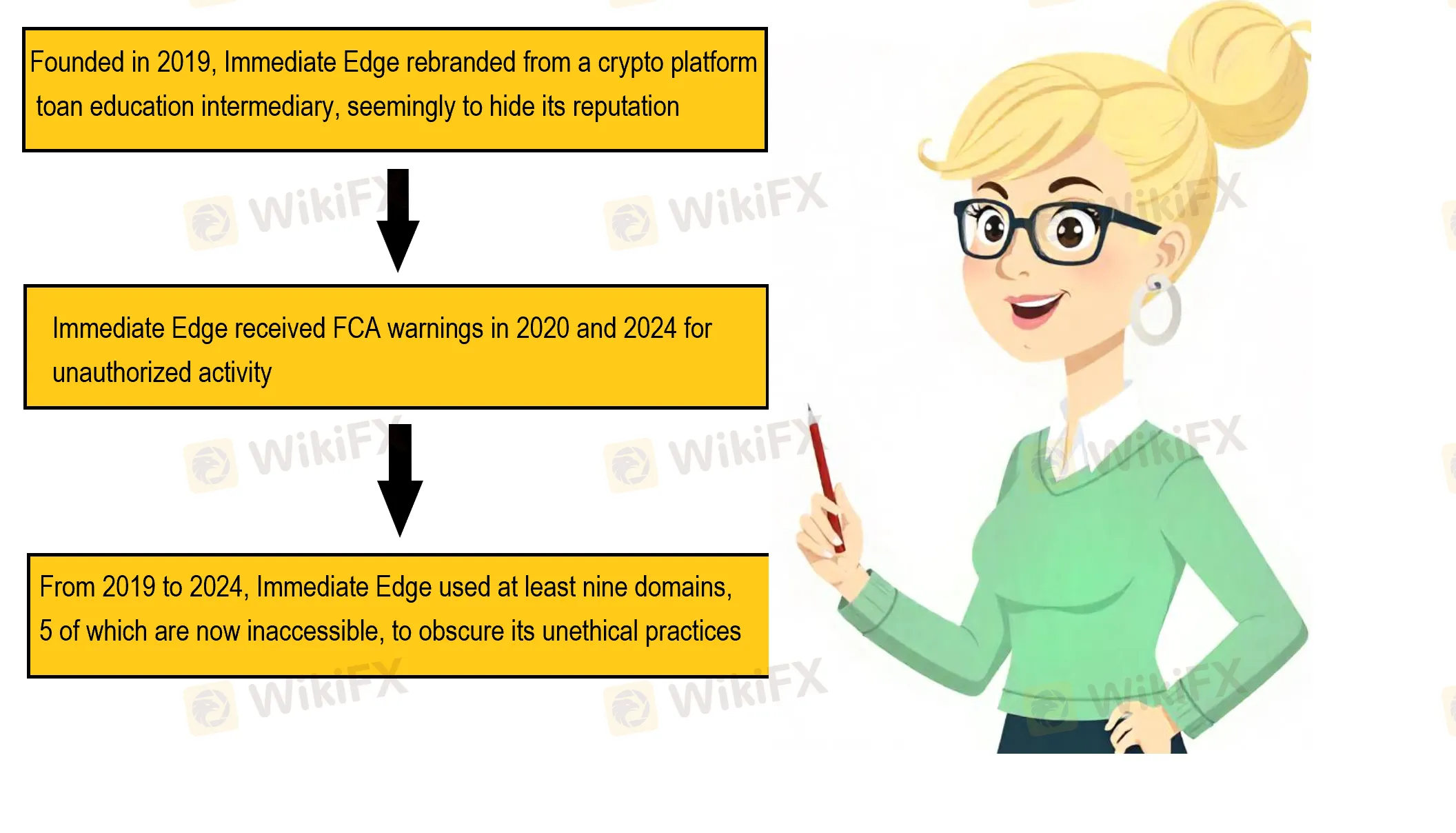

Established on June 11, 2019, Immediate Edge initially boasted that it is a cryptocurrency trading platform. Later, the company rebranded as an intermediary connecting users with investment educational firms offering courses on cryptocurrency, forex, and other investment products—a shift apparently intended to distance itself from its negative reputation. Across its social media presence, Immediate Edge keeps promoting itself as a platform enabling ordinary people to access substantial wealth and fortune.

On February 10, 2020, the UK's Financial Conduct Authority (FCA) added Immediate Edge to its list of unauthorized firms, warning that the broker was operating without regulatory permission. The FCA updated this warning on August 20, 2024.

Between 2019 and 2024, Immediate Edge has frequently changed its domain names, operating through at least nine different websites. However, five of these domains are inaccessible now. The reason behind this is that Immediate Edge uses new websites to obscure its questionable ethical practices and history.

Immediate Edge -Some Concerning Features to Consider

Repeated FCA Warnings

Immediate Edge was added as an unauthorized firm by the UK's Financial Conduct Authority (FCA), and prohibited from providing trading services to UK investors. The FCA initially issued this warning on February 10, 2020, and subsequently updated it on August 20, 2024. During this period, Immediate Edge operated without FCA authorization or regulation at least since 2020. Even more troubling is the platform's continued operations despite these clear regulatory warnings. Rather than address these regulatory concerns or seek proper authorization, apparently, Immediate Edge has chosen to ignore these warnings.

Unstable & Failing Domains

During its operation from 2019 to 2024, Immediate Edge has registered at least 9 different websites according to Whois information, with 5 of these domains now completely inaccessible. More concerning is the strategic purpose behind these domain changes: Immediate Edge uses this tactic to deliberately obscure its past unethical practices. By abandoning compromised domains and launching fresh websites again and again, clearly, the platform tries to wipe clean its digital footprint.

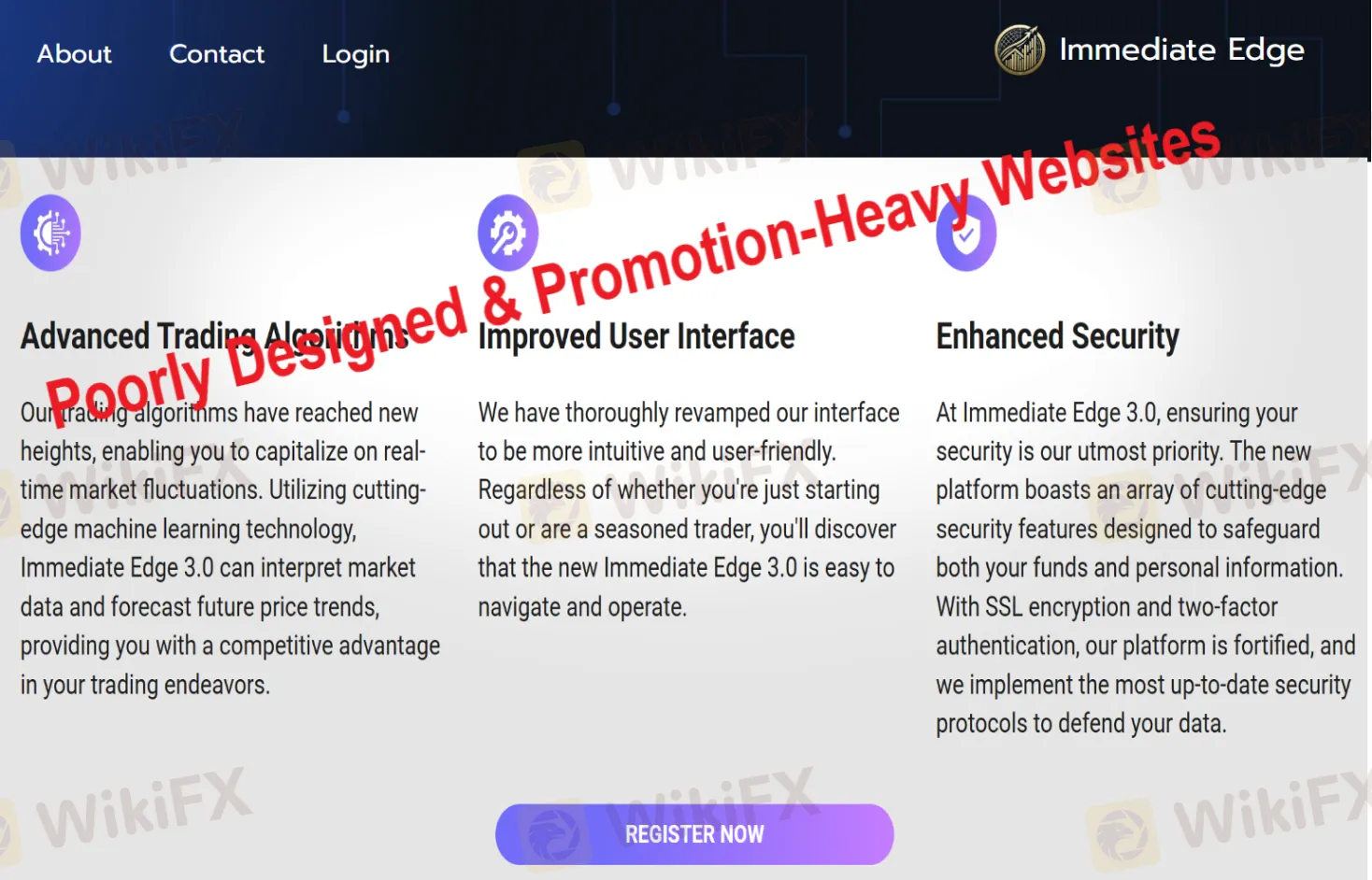

Poorly Designed & Promotion-Heavy Websites

What impresses me most after looking through the Immediate Edge website, unquestionably not in a positive light, is its poorly designed websites. The site features basic navigation buttons that lead users to useless content, while promotional materials dominate the page space. These promotional elements make dubious claims about an “advanced, improved user interface” and “enhanced security” that directly contradict the actual user experience.

The truth is ridiculous: Immediate Edge uses poor tactics to deceive investors. The basic conflict between what it promises and what it offers is the most telling indicator of its true nature.

Prominent Registration Page

When visiting Immediate Edge's website, you'll immediately notice that the registration page dominates the homepage, clearly designed to lure investors into rapid registration and immediate deposits. This design choice is a typical tactic employed by many cryptocurrency scams, where the website serves merely as a facade, while the prominently featured “Register” section represents the true intent of capturing potential investors in their scheme. Edge's primary goal is to funnel users toward making deposits as quickly as possible, rather than giving them reasonable investment suggestions.

Promotable Social Media

Immediate Edge maintains a presence across three social media platforms at the moment: Facebook, X (formerly Twitter), and LinkedIn. Without exception, the content across all these platforms is full of promotional content, promising the average person access to wealth and profits from the cryptocurrency trading boom. The low-quality content further suggests that this broker has little genuine value to offer and appears primarily focused on deceiving investors. The absence of educational content, transparent communication about risks, or legitimate customer testimonials—instead relying solely on unrealistic promises of wealth—further uncovers its true intentions.

Poor Customer Services

Immediate Edge websites only support customer support through a basic contact form, while some more direct and time-saving communication channels are lacking. In contrast, regulated brokers tend to provide a full suite of contact channels to address trading problems rapidly. Among phone support, email support, online chat, and even WhatsApp, contact form is the most time-consuming and ineffective approach.

In most cases, clients cannot get a response from the Immediate Edge platform. The only truth is that Immediate Edge, this unregulated platform hides its real contact information on purpose. They move from passively being asked questions to actively choosing whether to respond to clients. Simply put, Immediate Edge exists solely to make money, with no intention of returning it.

Immediate Edge Registration -Something unusual happens

I registered an account with Immediate Edge and, to be honest, its account opening process was quite unusual. After providing basic personal information (name, email address, and phone number), I was redirected to an entirely different website: www.proxtrend.com. According to information on Wikibit, Proxtrend is a newly established cryptocurrency trading platform registered in Comoros—an island nation in East Africa known for its problematic reputation with booming scams.

Upon reaching the deposit stage, the platform displays multiple payment methods including VISA, MasterCard, American Express, JCB, cryptocurrency options, and bank wire transfers. However, I noted two strange things: Firstly, Immediate Edge restricts deposit currency options to Chinese Yuan (CNY) only, with ¥25,000 (approximately $3,500) through most payment methods. Secondly, deposits via Wire Transfer need a minimum deposit of $500. The unusually high minimum deposit required, coupled with the redirect to a separate platform registered in a jurisdiction known for weak financial regulations, all say this broker is operating illegal practice.

Conclusion

So Immediate Edge is not considered a solid cryptocurrency trading platform. As we analyze its unusual operation and true intention, this platform can be identified as a 100% scam. Once again, online trading is super risky. Don't fall for those crazy profit promises scams make. Trade smart always.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Nigeria’s Oil and Gas Sector Gains Momentum

Nigeria’s oil and gas industry is experiencing a surge in investment, fueled by policy reforms and international collaboration, paving the way for continued energy expansion.

The Global Tariff War Escalates: Who Suffers the Most?

The global trade war is intensifying as countries continue to raise tariffs, aiming to protect their own economies while creating greater market uncertainty. In this tit-for-tat game, who is truly bearing the brunt?

BSP Restricting Offshore Forex Trades to Control Peso Volatility

BSP tightens rules on offshore forex trades, including NDFs, to reduce systemic risks and peso volatility. Stakeholders’ feedback due by March 26.

Gold Price Hits Record High Amid Economic Uncertainty and Policy Shifts

Gold prices soared to an all-time high, nearing the key $3,000 per ounce threshold, as investors responded to heightened tariff uncertainty and growing expectations of monetary policy easing by the U.S. Federal Reserve.

WikiFX Broker

Latest News

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

The ‘Boom-S’ Scam: How a Simple Click Led to RM46,534 in Losses

Royal Forex’s CySEC License Revoked: Can It Still Operate Legally?

Trump vs. Powell: The Showdown That Will Shape Global Markets

Currency Calculator