简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

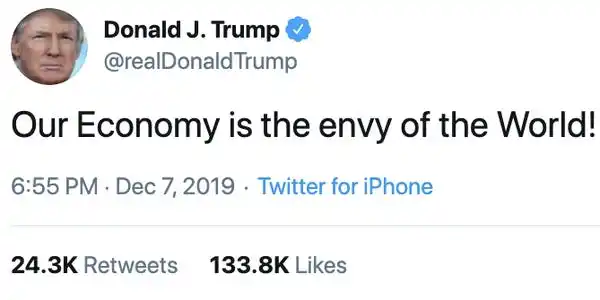

Stock markets are soaring after Trump delays tariffs on Chinese goods

Abstract:Trump's tweet about "substantial progress" on trade talks sent Chinese stocks to their best one-day surge since July 2015.

Global stock markets rallying after President Donald Trump tweets about “substantial progress” in trade talks with China. The Shanghai Composite Index soared 5.6%, its best one-day rally since 2015. “The US has made substantial progress in our trade talks with China on important structural issues,” Trump tweeted Sunday.“There's nothing quite like kicking the can down the road for another day to deliver a sugar rush to markets,” said one analyst. Stock markets around the world are rallying after President Donald Trump's tweets about “substantial progress” in trade talks with China fueled optimism about a swift resolution to the US-China trade war. “I am pleased to report that the US has made substantial progress in our trade talks with China on important structural issues including intellectual property protection, technology transfer, agriculture, services, currency, and many other issues,” Trump tweeted Sunday. “As a result of these very productive talks, I will be delaying the U.S. increase in tariffs now scheduled for March 1.”The delay comes less than a week before the 90-day trade war truce agreed to by Trump and Chinese President Xi Jinping was set to expire. After the original March 1 deadline, US tariffs on $200 billion worth of Chinese goods were set to increase from 10% to 25%.“There's nothing quite like kicking the can down the road for another day to deliver a sugar rush to markets,” said Neil Wilson, chief market analyst for Markets.com. “However, we must always caution that the US and China still need to work hard to secure a deal. This is an extension of the truce, not a peace treaty.”Chinese and Trump administration officials have held three rounds of formal talks among high-level officials since the original truce was agreed to in December. Chinese officials stayed over the weekend to continue talks in Washington, adding on two days to their original trip.Read more: One chart shows just how badly US companies are getting whacked by Trump's trade warHere's the roundup: The Shanghai Composite Index ended the trading session with its best close since July 9, 2015, up 5.6%. US futures tracking the Nasdaq and the Dow are rallying at least 0.4%, while those for the S&P 500 are up 0.3%.European markets are also up: The Euro Stoxx 50 and Germany's DAX are up at least 0.3%, while France's CAC Index is up 0.1%.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

UK Will Cut Tariffs, France and Germany Fight Pandemic Together

As the world's second epicenter after China, Europe, after months of hard work, had survived the worst period of the epidemic and gradually began to shift the focus to economic recovery.

Trump retweets call to fire Fauci who said US response will cost lives - Business Insider

It's not clear whether it's more than a vague threat, but Trump has fired several prominent public servants over the last few weeks.

Bad news for Trump — 60% of Americans say the surging stock market doesn't affect them - Business Insider

Only 40% of respondents in the Financial Times poll said that the stock market had gone up this year. The S&P 500 has soared about 26% in 2019.

Here's everything you need to know about the upcoming round of US-China trade war talks

US and Chinese officials are meeting in Washington on Thursday and Friday in an attempt to settle their ongoing trade war. Here's what's at stake.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

What Can Expert Advisors Offer and Risk in Forex Trading?

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

The Most Effective Technical Indicators for Forex Trading

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Currency Calculator