简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

S&P 500 Outlook: Dark Clouds Forming Over US Markets

Abstract:An inverted yield curve, record buybacks and a buyback-blackout period look to cast a shadow over the S&P 500 and other US equity markets.

S&P 500 Outlook Talking Points:

The S&P 500 faces an inverted yield curve, an indicator which often precedes recessionary periods

Share buybacks reach an all-time high in 2018, as the majority of companies on the S&P 500 face a blackout period during April

For a deeper look into the equity space, sign up for my weekly webinar - Stock Market Catalysts in the Week Ahead

S&P 500 Outlook: Dark Clouds Forming Over US Markets

There may be trouble on the horizon for the S&P 500 and other US equity indices as various economic indicators show signs of danger. The most widely-watched yield curve – the ten year to three month - inverted on Friday, spooking investors just days after the FOMC announced it would not hike rates in 2019 and hike once in 2020. Fridays inversion is the first since mid-2007 for the 3-month and 10-year yields and many market participants view its appearance emblematic of an impending recession.

US Treasury Yield Curve: 10 Year – 3 Month Maturities (1982 to 2019) (Chart 1)

Why Does the US Yield Curve Inversion Matter?

While all inversions of the curve in the last 40 years have seen subsequent recessions within two years, the length and degree of contraction have been mixed. That said, the timeline could be shortened as investors grapple with similarly worrying economic signs elsewhere.

Share Buybacks Reach Record Heights

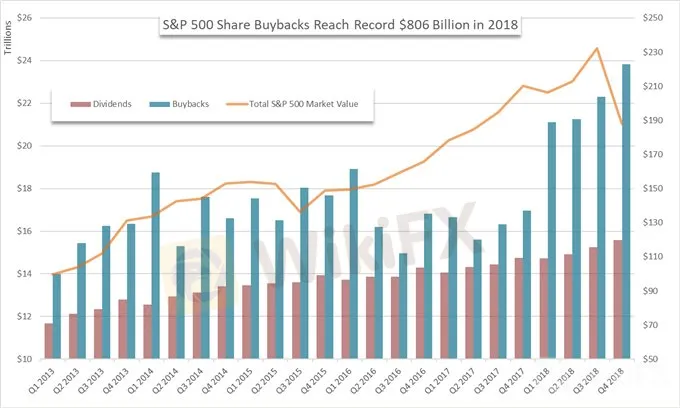

US equity sentiment may have been dealt another blow on Monday with the release of share buyback data from S&P Dow Jones Indices. The data revealed $806 billion in buybacks for 2018 - the largest amount of capital devoted to stock repurchases in a single year ever – with $223 billion on repurchases during 4Q 2018 alone. Repurchase totals from the most recent quarter mark the fourth consecutive quarterly record. Apple singlehandedly conducted $74.2 billion in buybacks during the year, the most of any single corporation.

S&P 500 Buybacks and Dividends (Chart 2)

Source: S&P Dow Jones Indices

The blistering pace at which companies have repurchased shares has drawn criticism from some market participants as they argue share prices are being buoyed by the considerable demand from the corporations themselves. Several politicians have also criticized the practice and proposed further regulation on share repurchases.

View the DailyFX Economic Calendar for big events scheduled in the week ahead.

While share repurchases are not inherently negative, some investors argue significant capital expenditure on ones own stock is indicative that external growth opportunities may be lacking. Whether record buybacks have been detrimental to the S&P 500 or not, their recent infamy has afforded them some influence over investor sentiment.

Buyback Blackouts – An Overblown Risk?

That influence could be leveraged throughout April as the largest share of companies on the S&P 500 enter share blackout periods. A blackout period occurs the month before a company is due to report quarterly earnings and effectively halts a corporation from repurchasing its own shares during the period. With a major buy-side player out of the market, some investors believe blackout periods are bearish for stocks. Coincidentally, the most recent blackout period occurred from October to November during which the S&P 500 shed 180 points or roughly 6.2%.

Buyback Blackout Period (Chart 3)

Despite Octobers equity rout, it is unlikely the bearish price action arose from buyback blackouts due to corporate policy regarding share repurchases and relative price performance. As for corporate policy, most companies conduct repurchases on a set schedule – often laid out in a quarterly or annual report – which allows them to continue buybacks during blackout periods. In other words, blackout periods impact immediate repurchases but have no implications on longer-term buyback plans.

Dow Jones Price Chart: Daily Time Frame (January 2018 – March 2019) (Chart 4)

Dow Jones overlaid with ratio of S&P 500 to Buyback Index (SPBUYUP)

Secondly, the S&P Buyback Index – an ETF that tracks the 100 companies with the highest buyback ratios on the S&P 500 - outperformed the broader S&P 500 during the prior blackout period which suggests a lack of buybacks was not to blame for equity turbulence. Furthermore, the index now trails the S&P 500 since early 2018 - despite the theoretical tailwind buyback index constituents should have received.

Learn the differences between the Dow Jones and the S&P 500

With the inversion of the yield curve, it is safe to say concern for the economy is warranted. That said, the current warning signs do not constitute an immediate recession and any prophetic claims may be self-fulfilled as investors exercise extra caution and erroneously point to the upcoming blackout periods as yet another headwind.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Dow Jones, FTSE 100 and DAX 30 Fundamental Forecast

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you‘re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

【MACRO Alert】The possibility of Trump winning the election is closely linked to market conditions! Could Japan become a big winner from this?

Although the market has responded positively to the prospect of Trump's possible re-election, and the Japanese stock market has shown an upward trend as a result, investors should also remain cautious and pay attention to the long-term impact of the election results on global economic policies and market sentiment. As strategist Tomo Kinoshita pointed out, while short-term market dynamics may be closely related to the election results, ultimately, the fundamentals of companies, economic data, an

Market Focus on Earnings Report

As we head into the second quarter earnings report season, the U.S. equity market is poised to capture significant attention. Recent geopolitical events, particularly the unconfirmed reports of an explosion in Iran's third-largest city last Friday, have injected volatility into commodities prices and bolstered the appeal of safe-haven assets like the U.S. dollar and Japanese Yen.

Daily Market Newsletter - February 8, 2024

Recap of Global Market Trends and Trading Opportunities

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

WikiFX Broker

Latest News

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

What Impact on Investors as Oil Prices Decline?

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

CPT Markets Secures UAE SCA License for FX and CFDs Services

What do Users say about "Titan Capital" on Trustpilot?

Currency Calculator