简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

S&P 500 Earnings: Investors Brace for Season Start, Big Bank Results

Abstract:Earnings season begins in earnest next Friday when some of the countrys largest banks are due to report their performance from the prior quarter. Ahead of the reports, investors seek exposure.

S&P 500 Earnings Talking Points:

标准普尔500指数收益谈话要点:

SPY, IVV, and VOO saw muted fund flows this week, despite a solid gain for the broader S&P 500 index

SPY,IVV和VOO看到资金流动不畅本周,尽管更广泛的标准普尔500指数获得了稳固增长

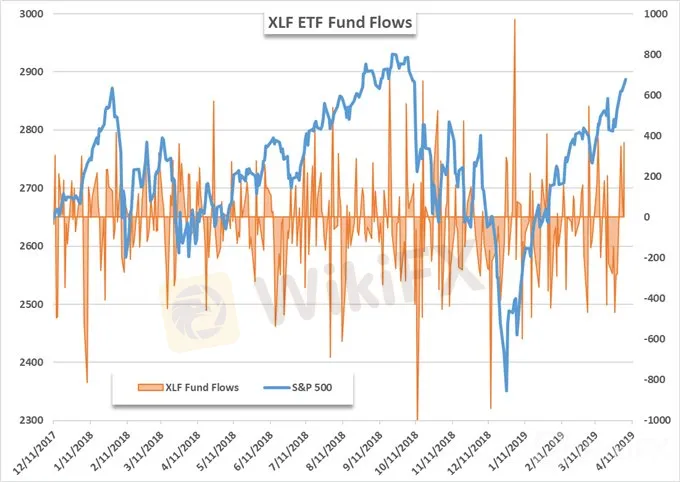

Elsewhere, the XLF ETF notched its first week of inflows in a month ahead of key earnings next week

其他方面,XLF ETF在关键时刻提前一个月进入第一周的资金流入下周收益

{3}

S&P 500 Earnings: Investors Brace for Season Start, Big Bank Results

标准普尔500指数收益:投资者支持季节开始,大银行业绩

The S&P enjoyed a bump on Friday from reassuring Non-Farm Payroll data. After a busy week for hard data out of the United States, next week looks to be much quieter - barring CPI and FOMC minutes. That said, next Friday marks the advent of earnings season which will undoubtedly spark price action for specific stocks, sectors and the index at large.

标准普尔指数周五因非农业薪资数据令人放心而受到欢迎。经过一周忙碌的美国硬数据后,下周看起来更安静 - 除非CPI和FOMC会议纪要。也就是说,下周五标志着收益季节的到来,这无疑会激发特定股票,行业和指数的价格行动。

Second Quarter Forecasts are out! View forecasts for the S&P 500, US Dollar, Gold and more.

第二季度的预测已经结束!查看标准普尔500指数,美元,黄金等的预测。

To kick off the season, JP Morgan, Wells Fargo and PNC Bank will report their quarterly results Friday before market open. The results are often looked to for insight regarding the upcoming quarter – in which financials may highlight the impact of dovish monetary policy.

为开启本赛季,摩根大通,富国银行和PNC银行将在市场开盘前周五公布季度业绩。结果往往是关于即将到来的季度的见解 - 其中金融可能突显温和的货币政策的影响。

XLF ETF Fund Flows (Chart 1)

XLF ETF基金流量(图1)

Learn tips and tricks to day trading the S&P 500

了解标准普尔500指数日内交易的提示和技巧

Perhaps in anticipation for next week‘s releases, the XLF ETF notched its first week of net inflows in a month. XLF grants exposure to some of the country’s largest banks with Berkshire Hathaway, JP Morgan and Bank of America as its largest holdings respectively.

也许是因为期待下周的发布,XLF ETF在一个月的第一周净流入量。 XLF分别向伯克希尔哈撒韦公司,摩根大通银行和美国银行分别持有该国一些最大银行的风险敞口。

As of Friday, the ETF saw nearly $600 million in fresh funds, contrasting the $1.8 billion in outflows registered in the three weeks prior. The flows could suggest investors are confident in the sectors earnings outlook but could also be explained by simple capital reallocation due to weeks of outflows. In similar fashion, the three mega-cap ETFs notched a fourth-consecutive week of inflows.

截至周五,ETF已接近6亿美元新资金,与之前三周注册的18亿美元资金流出形成鲜明对比。这些流动可能表明投资者有信心行业盈利前景,但也可以通过几周的资金重新分配来解释。以类似的方式,三只巨型股ETF连续第四周流入。

Aggregate Fund Flows of SPY, IVV and VOO ETFs (Chart 2)

SPY,IVV和VOO ETF的总资金流量(图2)

SPY, IVV and VOO continued their streak of net weekly inflows – now a month long. After a $2.6 billion aggregated inflow this week, the year to date total stands at nearly $3.8 billion. Last week I noted that investors were slow to buy into the recovery rally in January, moving funds elsewhere while the S&P 500 ascended.

SPY,IVV和VOO继续连续每周净流入 - 现在持续一个月。在本周汇总流入26亿美元之后,今年迄今为止的总流入量接近38亿美元。上周我注意到投资者在1月份买入复苏反弹的速度很慢,在标准普尔500指数上涨时将资金转移到其他地方。

I

With a strong start to Q2, earnings season will have to be weathered for the index to continue its climb to recapture all-time highs. With the season fast approaching, the takeaways from last season may return to the forefront of investor concern.

随着第二季度的强劲开局,盈利季节将不得不为指数继续攀升以重新夺回历史高位。随着赛季的临近,上赛季的外卖可能会回到投资者关注的最前沿。

Source: FactSet

来源:FactSet

{18}

At present however, there are few signs to suggest fundamental headwinds have negatively influenced investor sentiment. In fact, overwhelming short exposure in IG Client Positioning suggests bulls are seeking a continuation to the recent trend.

目前,很少有表明存在基本逆风的迹象受到投资者情绪的影响。事实上,IG客户定位中的短期风险表明多头正在寻求延续近期趋势。

Retail trader data shows 26.3% of traders are net-long with the ratio of traders short to long at 2.8 to 1. In fact, traders have remained net-short since Jan 07 when US 500 traded near 2344.13; price has moved 23.3% higher since then. The number of traders net-long is 4.7% higher than yesterday and 5.3% lower from last week, while the number of traders net-short is 2.0% higher than yesterday and 0.3% higher from last week.

零售交易者数据显示,26.3%的交易者是净持有者,其比率为交易商做空至2.8至1.事实上,自07年1月美国500指数交易于2344.13附近以来,交易商仍然保持净空头。价格此后上涨了23.3%。交易商净多头比昨天增加4.7%,比上周减少5.3%,而交易商净空头数比昨天增加2.0%,比上周增加0.3%。

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests US 500 prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week.

我们通常采取逆向观点来观察市场情绪,而交易商净空头表明美国500价格可能继续上涨。定位比昨天净空头少,但比上周更多净空。

Read more: Will the Stock Market Crash in 2019?

了解更多:2019年股市崩盘?

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you‘re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

DailyFX对各种货币(如美元或欧元)的预测可从DailyFX交易指南页面获得。如果您希望改善您的交易方法,请查看成功交易者的特征。如果您正在寻找外汇市场的入门介绍,请查看我们的新外汇指南。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

【MACRO Alert】The possibility of Trump winning the election is closely linked to market conditions! Could Japan become a big winner from this?

Although the market has responded positively to the prospect of Trump's possible re-election, and the Japanese stock market has shown an upward trend as a result, investors should also remain cautious and pay attention to the long-term impact of the election results on global economic policies and market sentiment. As strategist Tomo Kinoshita pointed out, while short-term market dynamics may be closely related to the election results, ultimately, the fundamentals of companies, economic data, an

Market Focus on Earnings Report

As we head into the second quarter earnings report season, the U.S. equity market is poised to capture significant attention. Recent geopolitical events, particularly the unconfirmed reports of an explosion in Iran's third-largest city last Friday, have injected volatility into commodities prices and bolstered the appeal of safe-haven assets like the U.S. dollar and Japanese Yen.

Daily Market Newsletter - February 8, 2024

Recap of Global Market Trends and Trading Opportunities

S&P 500 Price Outlook: Value Stocks Outperform Momentum, Tech Lags

After breaking outside of its August range, the road higher seemed to be laid out for the S&P 500, but tech and momentum stocks have been largely absent from the rally effort.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator