简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Yen May Rebound as US Banks Report First-Quarter Results

Abstract:The anti-risk Japanese Yen may return to the offensive as US banks JPMorgan and Wells Fargo report first-quarter results, highlighting a slowdown in global growth.

TALKING POINTS – US DOLLAR, YEN, EURO, STOCKS, US BANKS, EARNINGS

US Dollar retracing lower in APAC trade, Powell a possible trigger

Yen down as Nikkei gains, may rebound on US bank earnings reports

Euro broadly higher vs G10 FX, newswires citing one-off catalysts

The US Dollar fell in Asia Pacific trade, with prices seemingly retracing after yesterdays spirited advance. Worried comments attributed to Fed Chair Powell may have helped. Bloomberg cited unnamed sources claiming he told Democratic lawmakers at their annual retreat that softer growth in China is having an impact on US performance while the slowdown in Europe has turned out to be more severe than expected.

The Yen declined as Japan‘s benchmark Nikkei 225 stock index traded higher, sapping the anti-risk currency’s appeal. Fast Retailing – the parent company of Uniqlo and Theory – led the charge upward after second-quarter operating profit of ¥68.3 billion topped the ¥62.9 billion forecast. Rising bond yields punished the go-to funding unit yesterday as higher lending rates spurred carry trade demand.

Meanwhile, the Euro powered higher, scoring gains against all its G10 FX counterparts. A discrete catalyst for the move was not apparent. The newswires attributed gains to heavy EUR/JPY buying at the Tokyo currency fix. Bloomberg cited unnamed regional traders as saying that this activated a wave of stop-loss activation on short positions.

YEN MAY REBOUND AS US BANKS REPORT FIRST-QUARTER RESULTS

The spotlight now turns first-quarter earnings reports from US bank giants JPMorgan and Wells Fargo. The former is expected to see earnings per share (EPS) of $2.35, a rebound from the one-year low of $1.98 in the fourth quarter. The latter is projected to see deceleration, with EPS ticking down to $1.09 in the first three months of the year compared with $1.11 previously.

Traders are likely to be at least as interested in the lenders forward guidance – looking for that to inform global business cycle expectations amid broad-based signs of slowdown – as they are in headline statistics. Downbeat rhetoric may cool risk appetite, renewing haven demand for the Greenback and putting the Yen back on the offensive while commodity bloc FX bears the brunt of selling pressure.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

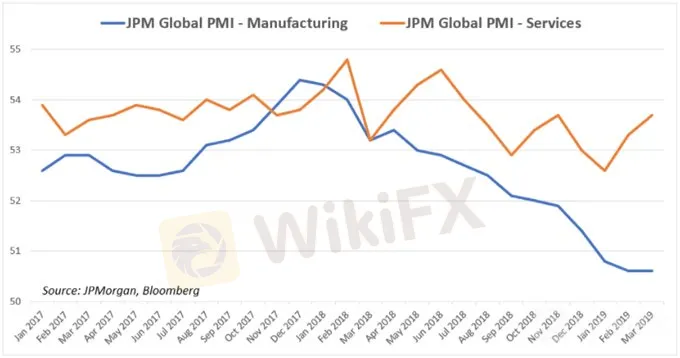

CHART OF THE DAY – MANUFACTURING SLUMP DRIVING GLOBAL SLOWDOWN

A slump in manufacturing looks to be driving the broad downturn in economic growth since the beginning of last year. JPMorgan global PMI data shows that factory-sector activity growth has slowed precipitously while performance in the services has held up.

It is tempting to take heart in this divergence. After all, services contribute over 60 percent of global GDP (accoring to data from the CIA). Such optimism may be premature. Manufacturing is more cycle-sensitive than services. The slump in the former may thus be a leading indicator of whats to come for the latter.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Today's analysis: USDJPY Set to Rise Amid Bank of Japan Policy Shift

USD/JPY (USD/JPY), an increase is expected as the Bank of Japan may reduce bond purchases and lay the groundwork for future rate hikes. Technical indicators show an ongoing uptrend with resistance around 157.8 to 160.

GemForex - weekly analysis

A Rat Race to the bottom in the rescue of the Dollar

GemForex - weekly analysis

Analysis for the week ahead: Markets remain worried by global recession fears

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Scam Couple behind NECCORPO Arrested by Thai Authorities

Top Profitable Forex Trading Strategies for New Traders

Currency Calculator