简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Swedish Krona Watching Unemployment Data - NOK, SEK Eye Europe

Abstract:The Swedish Krona will be waiting for the release of Swedens unemployment rate while both NOK and SEK will be watching out for Eurozone flash PMIs.

TALKING POINTS – SWEDISH KRONA, SWEDEN UNEMPLOYMENT, EUROZONE FLASH PMI

Swedish Krona traders are waiting for unemployment data

NOK and SEK are eyeing Eurozone flash PMI publication

How will Sweden unemployment impact Riksbank policy?

See our free guide to learn how to use economic news in your trading strategy!

Swedish Krona traders will be eagerly waiting for the release of the country‘s unemployment rate. Analysts estimate that unemployment will remain unchanged at 6.6 percent. According to the Citi Economic Surprise Index, Sweden’s economy has been underperforming relative to expectations, with unemployment rising from 5.50 percent in November to its current rate.

Yesterday, German Finance Minister Olaf Sholz spoke in Berlin and cut growth forecasts for 2019 down to 0.5 percent. Eurozone CPI was published with all indicators falling in line with expectations. Neither events induced any major market volatility. This indicates that perhaps markets had already priced in a less-than-optimal outlook from Sholz, and since CPI came in at expectations it left SEK and NOK shrugging.

Later in the day, Italy‘s lower house will be debating the government’s economic forecast for growth in 2019. Current estimates show between 0.1-0.2 percent growth, down from the 1.0 forecast. The country recently entered into a technical recession with the broader regional slowdown lingering in the background. The risk of a Eurozone debt crisis with Rome at the center of it is a worrying (and not completely unrealistic) prospect.

Insight on the state of economic affairs in Europe will be further illuminated by the release of Eurozone Flash PMIs. Often viewed as a leading indicator, traders with exposure to European assets will be closely watching the publication. Nordic traders will also be keeping a close eye on the report due to the unique relationship Scandinavian countries have with their European counterparts.

Interested in learning more about European financial markets? Be sure to follow me on Twitter @ZabelinDimitri.

Riksbank policymakers will be closely monitoring unemployment data as the central bank approaches its rate decision on April 25. Officials have expressed concern and frustration over the stubbornly weak Krona and have been disappointed that inflation has been coming in under the central banks forecasts. The Riksbank is intending on raise rates in the latter half of 2019, though it is difficult to see how they could afford to do so.

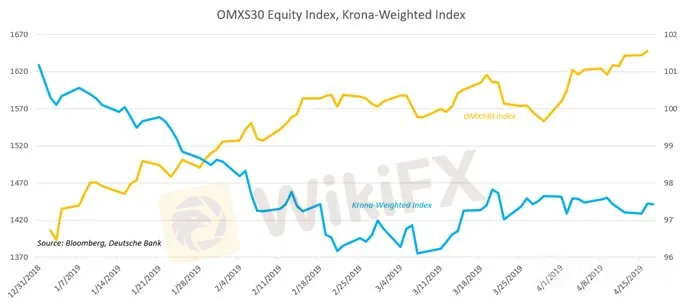

If key inflationary indicators continue to disappoint, it could force policymakers to delay the rate hike and continue to keep rates at -0.25 percent. While an accommodative monetary policy has helped Sweden‘s economy recover, it has also created unintended risks. Cheaper credit has also inflated the country’s OMX stock index, primarily due to investors taking advantage of cheap credit to inflate equities.

CHART OF THE DAY:

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Krona Plunges on Unemployment Data - Riksbank Rate Decision Ahead

The Swedish Krona plunged against all its major counterparts following the release of unemployment data. How will this impact the Riksbank rate decision and outlook next week?

Norwegian Krone Jumps on CPI, Swedish Krona Eyeing Inflation Data

NOK, SEK largely ignored volatility triggers from the ECB, Fed and Brexit-related developments with the Krone jumping on CPI. The Krona is now waiting for the release of local inflation data.

Norwegian Krone, Swedish Krona Eyeing Brexit, ECB, FOMC

NOK, SEK – along with global markets – will be eyeing tomorrow‘s release of the FOMC meeting minutes, the ECB rate decision and the EU’s verdict on whether the UK will get an extension.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator