简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AUDUSD Rate at Risk Ahead of Aussie Jobs Data, RBA Cut Bets

Abstract:AUDUSD price action hinges on upcoming employment data out of Australia as the report is anticipated to dictate whether or not the RBA will slash its policy interest rate at upcoming meetings.

AUDUSD CURRENCY VOLATILITY – TALKING POINTS

AUDUSD overnight implied volatility explodes to 12.25 percent

Australia employment data expected Thursday is in focus

Aussie jobs report will likely move odds that the RBA will cut interest rates

The Australian Dollar has recorded a steady decline since mid-April which intensified after US President Trumps tariff tweets sent currency volatility surging. Spot AUDUSD now trades near the 0.6926 mark – its lowest level since the Yen flash crash on January 2. Fears over escalating trade tensions negatively impacted risk assets as uncertainty surrounding slowing global growth quickly resurfaced.

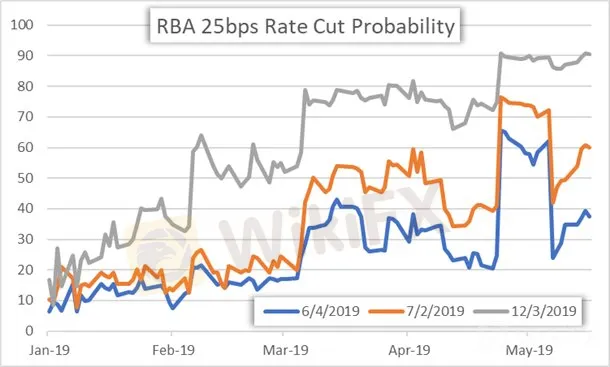

RBA INTEREST RATE CUT PROBABILITY PRICE CHART: DAILY TIME FRAME (JANUARY 01, 2019 TO MAY 15, 2019)

Since the last RBA meeting minutes were released, the odds that Australias central bank will lower its policy interest rate by 0.25 percent has climbed steadily. In fact, the probability that the RBA cuts its Overnight Cash Rate at its meeting on June 4 has jumped to 37.5 percent ahead of tomorrow's job data.

With the RBA noting that a rate cut would likely be warranted if “inflation did not move any higher and unemployment trended up,” markets are now placing extra emphasis on Thursday‘s job report due for release at 1:30 GMT. Bloomberg’s median consensus lists an expectation of 15K job additions with the unemployment rate holding steady at 5.0 percent.

AUDUSD PRICE CHART: DAILY TIME FRAME (DECEMBER 21, 2018 TO MAY 15, 2019)

According to overnight implied volatility of 12.25 percent, currency traders might anticipate spot AUDUSD to trade between 0.6881 and 0.6969 with a 68 percent statistical probability. With spot prices beneath the 61.8 percent Fibonacci retracement level shown above and sharp bearish downtrend serving as near-side technical resistance, upside in AUDUSD could be limited.

Although, a stellar jobs report tomorrow could crush the market‘s rate cut expectations and shoot AUDUSD towards the 0.7000 handle. Conversely, a disappointing reading on Australia’s labor market has potential to send the Aussie plunging towards the 76.4 Fibonacci retracement level.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Australian Dollar Eyes Chinese Economic Data, Will AUD/USD React

Australian Dollar is in focus with Chinese economic data on tap to kick off APAC trading. Japan’s Q3 GDP crossed the wires at -3.0% q/q, missing analysts’ expectations of -0.7%. AUD/USD looks to move higher after a Bullish Engulfing candlestick pattern forms

Currencies wait for RBA to kick off big central bank week

The dollar hovered below recent highs on Tuesday as traders waited for the Reserve Bank of Australia to lead a handful of central bank meetings set to define the rates outlook this week.

Stocks Mixed As RBA Leaves Rates Alone, Australian Data Mixed Too

Equities were mostly lower, if not by very much. Australian interest rates remained at record lows. That was as expected, but retail sales disappointed as the current account surged ahead

Australian Dollar Ticks Up, China Caixin PMI Flags Surprise Expansion

The Australian Dollar got a small burst of life on news that Chinas private manufacturing sector did better than its large, state-run partner last month.

WikiFX Broker

Latest News

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Currency Calculator