简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Price Outlook: Still Looking to Fall Further

Abstract:The Euro remains weak against the US dollar, despite falling US Treasury yields, and EURUSD looks set to test the 1.1100 handle in the short-term, especially if upcoming US data beats expectations.

EURUSD Price, Chart and Analysis:

EURUSD set to test recent one-year low.

EURUSD technical set-up remains negative.

Q2 2019 EUR Forecast and USD Top Trading Opportunities

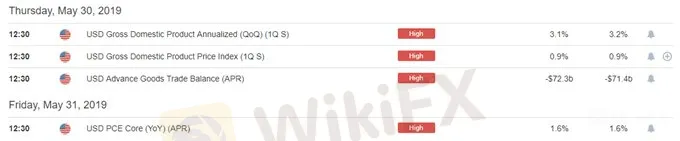

With little in the way of important Euro-Zone data this week, the EUR may well test the recent one-year low against the US dollar at just above 1.1100 and print yet another lower low. On the other side of the pair, the greenback is looking at some high-profile releases over the next couple of days and any better-than-expected prints may force EURUSD lower. Yesterdays US consumer confidence release beat expectations with ease – 134.1 vs 130.0 exp and 129.2 prior - boosting the USD back towards its two-year peak.

Keep up to date with all key economic data and event releases via the DailyFX Economic Calendar

The US dollar remains firm despite US Treasury yields falling to lows not seen since September 2017. Lower government bond yields normally weaken the currency, however the USD continues to attract a safe-haven bid as risk appetite continues to wane. The 10-year UST currently yields 2.236%, down from 3.23% in September 2018.

The EURUSD chart remains bearish with an unbroken pattern of lower highs prominent since the start of January this year. The pair are now trading under all three moving averages, a bearish set-up, and a re-test of the recent 1.1107 low print remains likely. The CCI indictor shows the pair nearing oversold territory but it should be noted that EURUSD has been heavily oversold on five occasions this year, and twice very heavily. To the upside, the pair may struggle to break through congestion between 1.1176 and1.1216.

EURUSD Daily Price Chart (August 2018 - May 29, 2019)

Retail traders are 58.8% net-long EURUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. However recent daily and weekly positional changes give us a stronger contrarian bearish bias.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

ATFX Enhances Trading Platform with BlackArrow Integration

Become a Full-Time FX Trader in 6 Simple Steps

IG 2025 Most Comprehensive Review

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Should You Choose Rock-West or Avoid it?

Scam Couple behind NECCORPO Arrested by Thai Authorities

Currency Calculator