简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

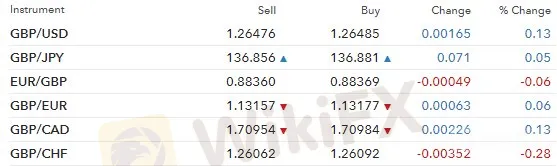

Sterling (GBP) Manages to Continue its Recovery Despite Dismal UK Manufacturing PMI

Abstract:The Pound was marginally stronger against all currency pairs despite UK Manufacturing PMI data coming in much worse than expected. Brexit stockpiling wind down was expected.

Sterling Talking Points:

英镑谈话要点:

The Pound was trading marginally higher against most major currencies

英镑对多数主要货币的交易略微走高

The race to become the new leader of the Conservative party will play a key role on the future of the Pound

成为保守党新领导人的竞选将在英镑的未来发挥关键作用

Despite a strong month of May for the Dollar as a safe-haven asset, economic outlook downgrades and falling bond yields have put downward pressure on the currency

尽管5月美元作为避险资产强劲,但经济前景评级下调且债券收益率下降已对该货币构成下行压力

The Pound continued its recovery in the morning session despite worse than expectedUK Manufacturing PMI figures. EURGBP remained subdued after the release following its 17-pip trading range in the overnight session. The pair was trading around 0.8838 after the release of the data, a strong push from the Pound coming back from the EURGBP high of 0.8875 seen last Friday May 31. The lack of volatility in the Pound points to the markets expecting the figures to be below forecast on the back of the wind down of stockpiling as Brexit is pushed back.

尽管英国制造业采购经理人指数低于预期,英镑早盘继续复苏。欧元兑英镑在隔夜交易区间17点的交易区间发布后仍然受到抑制。数据公布后该货币对在0.8838附近交易,英镑从上周五5月31日的欧元兑美元高点0.8875回升。英镑的波动性指向市场预期数据低于市场随着英国退欧被推迟,预测将在库存减少的情况下预测。

GBPUSD was pushing higher past 1.2640 trying to recover from its continued sell-off throughout the month of May. The pair was trading stronger as increasing belief that the Fed will cut rates by the end of the year brought in the Dollar bears.

英镑兑美元推升至1.2640以上,试图从中恢复整个五月持续抛售。由于人们越来越相信美联储将在今年年底前降息,从而带来美元空头,该货币对走强。

The UK IHS Markit Manufacturing PMI for the month of May came in at a new 34-month low of 49.4, well below last months reading of 53.1 and expectations of 52.2. The figure shows the sector is in contraction following increased difficulties in convincing clients to commit to new projects in the month of May. It is the biggest contraction in the industry since the July 2016 reading of 49.1 right on the back of the Brexit referendum. PMIs are considered to be forward-looking estimates of growth with a figure below 50 indicating economic contraction in the market.

5月英国IHS Markit制造业采购经理人指数进入新的34个月低点49.4,远低于上个月53.1的预期和52.2的预期。该数据显示,在说服客户在5月份承诺新项目的困难增加之后,该行业处于收缩状态。这是自英国脱欧公投后2016年7月读数为49.1以来该行业最大的收缩。 PMI被认为是对增长的前瞻性估计,数字低于50表明经济增长市场萎缩。

UK Services PMI is released on Wednesday with an expectation of an increase from 50.4 in the previous month to 50.6 for the month of May. These figures have a greater potential to impact the Pound as services account for 80% of the UKs economic activity.

英国服务业采购经理人指数周三公布,预计将从前一个月的50.4上升至五月份为50.6。这些数字更有可能影响英镑,因为服务占英国经济活动的80%。

Key Events to Look Out For

需要关注的重要事件

{11}

Sterling will continue to pay close attention to British politics and Brexit as a state visit from Donald Trump is likely to draw attention from the markets. The US President has been increasing his involvement in British politics in the last few weeks as he has shown continued support for hard-line Brexiteers Nigel Farage and Boris Johnson. Mr. Trump is very critical of the UKs divorce deal with the EU, which would leave the UK unable to create any trade deals with non-Europeans until 2021, by which time the next US President will be in office.

{11}

The future of the currency will be dependent on the stance on Brexit of future leaders of the Conservative Party. If Mr. Johnson manages to get through the first round of voting in Parliament and is put forward as one of the two remaining candidates, he is likely to win, which would continue to put downward pressure on the Pound as he pledged to take Britain out of the EU on October 31 with or without a deal.

货币的未来将取决于保守党未来领导人对英国退欧的立场。如果约翰逊先生设法在议会中进行第一轮投票,并作为剩下的两位候选人之一提出,他很可能会赢,这将继续给英镑带来下行压力,因为他承诺将英国赶出去无论是否有交易,欧盟将于10月31日结束。

On the Dollar side, focus will shift towards commentary from Federal Resave chairman Jerome Powell who is expected to give his outlook on the Fed policy in an event to take place in Chicago on Tuesday and Wednesday. Despite the Fed continuing to support a wait-and-see stance, markets are now pricing in at least two 0.25% rate cuts by the end of the year. Part of the downgrade in expectations on the future of the US economy is that yield curves have inverted signalling that a recession may be nearing. Of key importance to the Feds decision on rates will be non-farm payrolls and wages figures to be released on Friday.

在美元方面,焦点将转向联邦救援主席杰罗姆鲍威尔的评论,预计他将对此展望美联储政策将于周二和周三在芝加哥举行。尽管美联储继续支持观望态度,但市场现在至少在年底前将两次0.25%的降息定价。对美国经济未来预期下调的部分原因是,收益率曲线反映出经济衰退可能已接近尾声。英联邦关于利率决定的关键重要性将是非农就业数据和周五公布的工资数据。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Economic Calendar Events for This Week (August 5-9, 2024)

This week's economic events include: Japan's Monetary Policy Minutes and U.S. Services PMI on Monday, impacting JPY and USD. Tuesday's RBA Interest Rate Decision affects AUD, with German Factory Orders influencing EUR. Wednesday sees German Industrial Production and U.S. Crude Inventories impacting EUR and USD. Thursday: RBA Governor speaks, with U.S. Jobless Claims. Friday: China's CPI and Canada's Unemployment Rate affect CNY and CAD.

Today's analysis: USDJPY Poised for Decline Despite Recent Upsurge; Mixed BOJ Signals

Bank of Japan board members are divided on rate hikes due to high living costs and price risks. Some urge caution, while others push for early action. The BoJ will closely monitor data ahead of potential interest rate adjustments. USD/JPY rallied past 158.40 to 159.00, maintaining a bullish trend towards the next target of 160.20.

GemForex - weekly analysis

A week of consolidation Ahead amid renewed USD strength

British Pound Technical Analysis - GBP/USD. Trend to Resume or Reversal For Sterling?

GBP/USD Technical Analysis - the pair has bounced back after making a new low for the year. The Pound has seen increased volatility as it looks to hold ground. Will Sterling continue to be undermined and make fresh lows again?

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator