简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AUDUSD, AUDJPY & AUDCAD Eye Aussie GDP Post RBA Cut

Abstract:The Australian Dollar remains in focus in the wake of the RBA's rate cut with AUDUSD, AUDJPY and AUDCAD price action turning to Wednesday's Aussie GDP report.

AUDUSD, AUDJPY, AUDCAD CURRENCY VOLATILITY – TALKING POINTS

澳元兑美元,澳元兑日元,澳元兑美元汇率波动 - 谈话要点

Following the RBA rate cut early Tuesday, AUDUSD, AUDJPY and AUDCAD overnight implied volatility measures recede but remain elevated

提前降息周二,澳元兑美元,澳元兑日元和澳元兑加元隔夜隐含波动率指标回落但仍然走高

Aussie forex traders turn to Australias 1Q GDP report due for release on Wednesday

澳大利亚外汇交易商转向澳大利亚第三季度GDP报告将于周三公布/ p>

AUDUSD, AUDJPY and AUDCAD implied trading ranges and technical levels to watch highlighted

澳元兑美元,澳元兑日元和澳元兑加元意味着交易区间和技术水平需要突出显示

In the aftermath of the interest rate cut by the Reserve Bank of Australia (RBA) on Tuesday, currency market participants shift their attention to the upcoming Aussie 1Q GDP report. While one might expect a central bank rate cut to weigh negatively on a country‘s currency, the Australian Dollar has fared quite well against its major counterparts. The lack of AUD downside is primarily owed to markets already pricing in an RBA rate cut as near certainty prior to the RBA’s formal announcement.

In周二澳大利亚储备银行(RBA)降息后,货币市场参与者将注意力转移到即将到来的澳大利亚第一季度GDP报告上。虽然人们可能预期央行降息会对一国的货币造成负面影响,但澳元兑其主要货币的表现相当不错。澳元兑美元下跌的主要原因是市场已经在澳大利亚央行正式宣布之前确定了澳大利亚央行降息的定价。

Follow-up commentary provided by RBA Governor Lowe sent a relatively upbeat message which downplayed the potential need for further easing and helped boost the Aussie. Now, forex traders will likely turn to Australian GDP data due for release Wednesday at 1:30 GMT for clues to where the Australian Dollar might head next.

澳大利亚央行行长罗威发送的后续评论一个相对乐观的消息,淡化了进一步宽松的潜在需求,并帮助推动了澳元。现在,外汇交易商可能会转向周三格林威治标准时间1点30分发布的澳大利亚GDP数据,以寻找澳大利亚元可能接下来的线索。

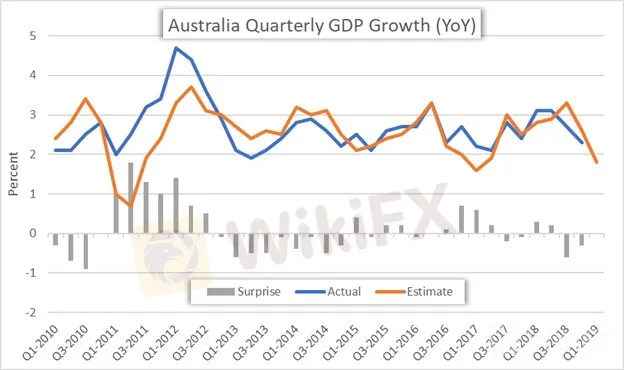

AUSTRALIA GDP BY QUARTER (YEAR-OVER-YEAR)

澳大利亚国内生产总值(季度) -OVER-YEAR)

Aussie Q1 GDP is expected to slow to 1.8 percent and is set to be the third consecutive quarter of decelerating economic activity. The high-impact data point will compare to the prior period‘s 2.3 percent reading which noticeably missed the market’s median consensus of 2.6 percent. Australia 2018 Q3 GDP of 2.7 percent also came in markedly lower than estimates of 3.3 percent.

澳元一季度国内生产总值预计将放缓至1.8%,并将成为经济减速连续第三个季度活动。高影响力的数据点将与前一个时期的2.3%读数相比,这显然错过了市场的中位数预测值2.6%。澳大利亚2018年第三季度GDP也为2.7%e显着低于估计的3.3%。

The risk of Australian GDP surprising to the downside once again cannot be ruled out considering the several hinderances faced by the Aussie economy.

考虑到澳大利亚国内生产总值再次出现下行意外的风险不能排除在外澳大利亚经济面临的几个阻碍因素。

AUDUSD PRICE CHART: DAILY TIME FRAME (DECEMBER 14, 2018 TO JUNE 04, 2019)

澳元兑美元价格图表:每日时间框架(12月14日, 2018年至2019年6月4日)

AUDUSD could continue on its recent steep ascent, however, if Australian GDP beats expectations Wednesday. Although, upside in spot AUDUSD may be limited as the currency pair faces technical resistance near the 50 percent retracement from the January flash crash low. This level is slightly above the upper bound of the 1-standard deviation trading range calculated from AUDUSD overnight implied volatility of 8.02 percent.

如果澳大利亚国内生产总值在周三超出预期,澳元兑美元可能继续近期陡峭上涨。虽然现货澳元兑美元的上行空间可能有限,因为货币对在1月份的闪电崩盘低点附近的50%回撤位附近面临技术阻力。该水平略高于1标准差交易区间的上限,根据澳元兑美元隔夜隐含波动率8.02%计算。

Downside in AUDUSD is estimated to be limited by the option implied lower bound of 0.6951 and technical support from the 61.8 percent Fibonacci retracement level. Yet, it is worth mentioning that AUDUSD price action could be clouded by moves in the US Dollar which is likely eying upcoming ISM services PMI data due Wednesday and nonfarm payrolls numbers expected Friday.

澳元兑美元下行估计受期权限制暗示0.6951的下限和61.8%的斐波纳契回撤水平的技术支撑。然而,值得一提的是,澳元兑美元的价格走势可能会受到美元走势的影响,这可能影响到周三即将公布的ISM服务PMI数据和周五预计的非农就业数据。

AUDJPY PRICE CHART: DAILY TIME FRAME (DECEMBER 14, 2018 TO JUNE 04, 2019)

AUDJPY PRICE CHART:每日时间框架(2018年12月14日至2019年6月4日)

AUDJPY is estimated to trade between 75.198 and 76.024 with a 68 percent statistical probability judging by overnight implied volatility of 10.45 percent. The currency pair faces technical resistance from downward sloping moving averages, but spot prices have potential to reclaim the 76.00 handle and trade above the 50 percent retracement from its year-to-date high if Aussie GDP beats estimates. Conversely, if the GDP data disappoints, AUDJPY could plunge quickly as risk aversion will likely grapple markets and send forex traders unwinding carry trades.

AUDJPY估计在75.198和76.024之间交易统计概率为68%,由隔夜隐含波动率10.45%判断。该货币对面临向下倾斜移动平均线的技术阻力,b如果澳元国内生产总值低于预期,那么现货价格有可能收回76.00关口并且从年初至今的高点回升至50%以上。相反,如果GDP数据令人失望,澳元兑日元可能会迅速暴跌,因为避险情绪可能会扼杀市场并让外汇交易者解除套利交易。

AUDCAD PRICE CHART: 4-HOUR TIME FRAME (APRIL 11, 2019 TO JUNE 04, 2019)

AUDCAD PRICE CHART:4小时时间框架( 2019年4月11日至2019年6月4日)

In contrast, while AUDCAD may be a less conventional currency pair, it may provide traders with a better look at the Australian Dollar‘s reaction to Wednesday’s GDP report. This is largely due to the fact that the Canadian Dollar will not face the same degree of distractions – or “noise” – as the US Dollar and Japanese Yen are set to experience over the coming days. That being said, the options derived trading range calculated using AUDCADs overnight implied volatility reading of 6.84 percent sees spot rates to fluctuating between 0.9337 and 0.94050 with a 68 percent statistical probability.

相比之下,虽然AUDCAD可能是较不常规的货币对,但它可能会为交易者提供更好地了解澳元对周三GDP报告的反应。这主要是因为加元不会面临同样程度的干扰 - 或“噪音” - 因为美元和日元将在未来几天内经历。话虽如此,期权衍生交易区间使用AUDCADs计算,隔夜隐含波动率读数为6.84%,即现货利率在0.9337和0.94050之间波动,统计概率为68%。

- Written by Rich Dvorak, Junior Analyst for DailyFX

- 书面作者:Daily DX初级分析师Rich Dvorak

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

High Volatility Economic Events for This Week (GMT+8)

This week, key economic events expected to generate high volatility include China's Q2 GDP and retail sales data, impacting CNY. The US will release Core Retail Sales and Philadelphia Fed Manufacturing Index, affecting USD. The UK's CPI data will influence GBP, and the ECB Interest Rate Decision and Press Conference will impact EUR. These events will drive significant market movements due to their influence on monetary policy and economic outlooks.

Australian Dollar Eyes Chinese Economic Data, Will AUD/USD React

Australian Dollar is in focus with Chinese economic data on tap to kick off APAC trading. Japan’s Q3 GDP crossed the wires at -3.0% q/q, missing analysts’ expectations of -0.7%. AUD/USD looks to move higher after a Bullish Engulfing candlestick pattern forms

Japanese Yen Technical Analysis: USD/JPY, AUD/JPY. Are They Establishing Ranges?

JAPANESE YEN, USD/JPY, AUD/JPY - TALKING POINTS

Currencies wait for RBA to kick off big central bank week

The dollar hovered below recent highs on Tuesday as traders waited for the Reserve Bank of Australia to lead a handful of central bank meetings set to define the rates outlook this week.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator