简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD Rate Eyes April-Low Ahead of NFP, Canada Employment Report

Abstract:USDCAD continues to give back advance from the April-low (1.3274) ahead of the NFP report as Federal Reserve officials change their tune.

Canadian Dollar Talking Points

加元讨论点

USDCAD remains under pressure ahead of the U.S. Non-Farm Payrolls (NFP) report as Federal Reserve officials change their tune, and the exchange rate may continue to retrace the advance from the April-low (1.3274) as it initiates a series of lower highs and lows.

随着美联储官员改变他们的调整和交易所美元非农就业人数(NFP)报告,美元兑加元仍面临压力汇价可能继续从4月低点(1.3274)回撤,因为它开始出现一系列较低的高点和低点。

USDCAD RateEyes April-Low Ahead of NFP, Canada Employment Report

美元加元兑美元汇率4月低点在NFP之前,加拿大就业报告

Recent comments coming out of the Federal Reserve suggest the central bank will ultimately respond to the shift in U.S. trade policy as Chairman Jerome Powellinsists that the committee “will act as appropriate to sustain the expansion,” and USDCAD may continue to depreciate ahead of the Federal Open Market Committee (FOMC) interest rate decision on June 19 amid growing speculation for a change in regime.

美联储最近提出的评论表明,央行将最终回应美国贸易政策的转变,因为主席杰罗姆鲍威尔主义者认为该委员会“将采取适当行动扩张,”美元兑加元可能在6月19日联邦公开市场委员会(FOMC)利率决定之前继续贬值,因为人们越来越多地猜测政权的变化。

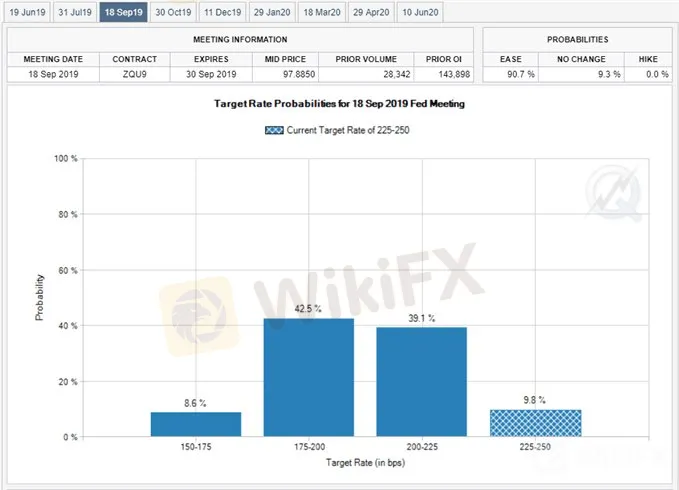

In fact, fresh developments coming out of North America may do little to influence the monetary policy outlook even though the NFP report is anticipated to show a 175K expansion in May as Fed Fund still reflect a greater than 90% probability for a September rate cut.

事实上,尽管预计NFP报告预计5月将出现17.5万美元的扩张,但北美的新发展可能对货币政策前景影响不大基金仍然反映9月降息的可能性超过90%。

As a result, Chairman Powell and Co. may forecast a lower trajectory for the benchmark interest rate as the Trump administration continues to rely on tariffs to push its agenda, and the central bank may introduce a dovish forward guidance as Fed Governor Lael Brainard, a permanent voting member on the FOMC, adds that “trade policy is definitely a downside risk to the economy.”

因此,鲍威尔董事长和公司可能会预测由于特朗普政府继续依靠关税来推动其议程,基准利率的轨迹较低,央行可能会引入温和的前瞻性指引,因为美联储理事加尔布雷纳德(FOMC的永久投票成员)补充说“交易”政策绝对是经济的下行风险。

In contrast, the Bank of Canada (BoC) may face a different fate as the Canadian economy is anticipated to add another 5.0K jobs in May following the 106.5K expansion the month prior.

相比之下,加拿大央行(BoC)可能面临不同的命运加拿大经济预计5月份新增5.0万个就业岗位前一个月的106.5万扩张。

{8}

Signs of a robust labor market may keep the BoC on the sidelines as “the slowdown in late 2018 and early 2019 is being followed by a pickup starting in the second quarter,” and Governor Stephen Poloz and Co. may largely endorse a wait-and-see approach at the next meeting on July 10 as “the Bank expects CPI inflation to remain around the 2 per cent target in the coming months.”

{8}{9}

With that said, speculation for an imminent change in U.S. monetary policy may keep USDCAD under pressure, and the near-term outlook for USDCAD is no longer constructive as the advance from the April-low (1.3274) stalls ahead of the 2019-high (1.3665).

{9}

USD/CAD Rate Daily Chart

USD / CAD Rate Daily Chart

USDCAD stands at risk for a larger pullback following the failed attempt to close above the 1.3540 (23.6% retracement) hurdle, with the lack of momentum to hold above the 1.3420 (78.6% retracement) to 1.3460 (61.8% retracement) region bringing the downside targets back on the radar.

在试图收于1.3540(23.6%的回撤位)上方失败后,美元兑加元面临更大回调的风险,缺乏动力将1.3420(78.6%回撤位)保持在1.3460(61.8%回撤位)上方带来下行空间目标重新回到了雷达上。

The fresh series of lower highs and lows raises the risk for move towards the Fibonacci overlap around 1.3290 (61.8% expansion) to 1.3310 (50% retracement), with the next area of interest coming in around 1.3130 (61.0% retracement).

新一系列的低点和低点提升了走向斐波那契重叠1.3290附近的风险(扩大61.8%)至1.3310(50%回撤位),下一个区域位于1.3130附近(61.0%回撤位)。

May see USDCAD threaten the upward trend from earlier this year as the Relative Strength Index (RSI) continues to track the bearish formation from March, with the exchange rate at risk of facing a more bearish fate following the failed run at the 2019-high (1.3665).

可能看到USDCAD向上威胁今年早些时候的趋势是,相对强弱指数(RSI)继续追踪3月份的看跌形态,汇率处于2019年高点(1.3665)失败后面临更加看跌的命运风险。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator