简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

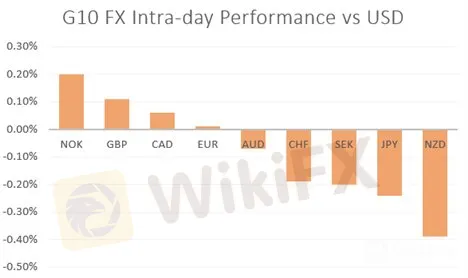

Japanese Yen Drops, GBP Briefly Above 1.27, NOK Outperforms - US Market Open

Abstract:Japanese Yen Drops, GBP Briefly Above 1.27, NOK Outperforms - US Market Open

MARKET DEVELOPMENT – Japanese Yen Drops, GBP Briefly Above 1.27, NOK Outperforms

市场发展 - 日元下跌,英镑兑1.27以上,NOK表现优于

DailyFX Q2 2019 FX Trading Forecasts

DailyFX Q2 2019外汇交易预测

GBP: Todays jobs report had been encouraging across the board with wages picking up, while the unemployment rate remained at a 44yr low. Consequently, GBPUSD pushed above 1.27, while EURGBP briefly broke below. While the firmer UK jobs data emboldens the recent hawkish commentary from BoE members, the fact remains the same in that the BoE are largely on the side-lines until Brexit clarity is found. As such, focus on Sterling will remain on who the next PM will be and how that will be impact the Brexit outlook. As it stands, the case for a 2019 rate hike remains doubtful.

GBP:今日就业报告令人鼓舞工资上涨的董事会,而失业率仍保持在44年低点。因此,英镑兑美元突破1.27,而欧元兑英镑短暂跌破。虽然较为稳固的英国就业数据鼓舞了英国央行成员近期强硬的评论,但实际情况仍然相同,因为在英国退出欧盟清晰度之前,英国央行主要处于边缘。因此,关注英镑将继续关注下一任总理将会是谁以及这将如何影响英国脱欧前景。目前看来,2019年加息的情况仍然令人怀疑。

NOK: One central bank that will continue its normalisation in interest rates is the Norges Bank. Softer than expected CPI pushed the NOK lower against the USD and EUR, however, volatile components (food prices, airplane tickets) had been the notable drags on inflation, which in turn is unlikely to derail the Norges Bank from raising rates next week. Alongside this, the latest regional network survey had been firmer, having highlighted that growth over the past 3-months had been the highest since Q3 2012, thus not only providing a green light for next weeks rate increase but also raises the potential that the central could perhaps raise its tightening path. This will also depend on how they see the impact of slowing global growth feeding into the domestic economy, which has been resilient thus far.

NOK:一家中央银行将继续其利息正常化费率是挪威银行。比预期更疲软的消费者物价指数推动挪威克朗兑美元和欧元走低,然而,不稳定的成分(食品价格,机票)一直是通胀的显着拖累,这反过来不太可能使挪威银行在下周加息。除此之外,最新的区域网络调查更加坚定,突显出过去3个月的增长是2012年第三季度以来的最高点,因此不仅为下周的加息提供了绿灯,而且还提升了中央的潜力。也许可以提高其紧缩之路。这也将取决于他们如何看待全球经济增长放缓对国内经济的影响,而国内经济迄今为止一直保持强劲。

JPY: The Japanese Yen is softer across the board, with the exception of the New Zealand Dollar as increased risk appetite keeps equity markets bid. Alongside this, with US 10yr yields basing out around 2.06%, now trading at 2.17%, USDJPY has continued to edge higher towards 109.00.

日元:日元全线走软除新西兰元外,风险偏好增加使股市继续竞价。除此之外,美国10年期国债收益率约为2.06%,目前交易价格为2.17%,美元兑日元继续走高至109.00。

{7}

Source: DailyFX, Thomson Reuters

{7}

DailyFX Economic Calendar: – North American Releases

DailyFX经济日历: - 北美版本

IG Client Sentiment

IG Client Sentiment

{10}

How to use IG Client Sentiment to Improve Your Trading

{10}

WHATS DRIVING MARKETS TODAY

今天的推动市场

“EURUSD Price Outlook Cloudy - ECBs Rehn Talks Rate Cuts and More QE” by Nick Cawley, Market Analyst

“欧元兑美元价格展望多云 - 欧洲央行雷恩谈判降息及更多量化宽松”,市场分析师Nick Cawley

“Currency Volatility: EURUSD, AUDUSD, USDTRY Weekly Outlook” by Justin McQueen, Market Analyst

货币波动:Justin Mc的“EURUSD,AUDUSD,USDTRY每周展望”女王,市场分析师

“GBPUSD, AUDUSD, Gold, and More - Technical Outlook” by Paul Robinson, Currency Strategist

“英镑兑美元,澳元兑美元,黄金等 - 技术展望”作者:货币策略师保罗罗宾逊

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX - weekly analysis

The week ahead: Top 5 things to watch

GemForex - weekly analysis

A week of consolidation Ahead amid renewed USD strength

British Pound Technical Analysis - GBP/USD. Trend to Resume or Reversal For Sterling?

GBP/USD Technical Analysis - the pair has bounced back after making a new low for the year. The Pound has seen increased volatility as it looks to hold ground. Will Sterling continue to be undermined and make fresh lows again?

All Round Major Pairs Technical Analysis: EUR/USD, AUDUSD, And GBPUSD

The start of November has been a dwindling moment for the general major currency market. As essential economic updates flood the surface of the entire foreign exchange market, in which most of the currency pairs especially the major pairs were greatly affected by the impact of the economic releases. However, the US dollar was discovered to have held the main currency exchange performance metrics as the central economic updates from the US region tend to have determined the significant changes that have occurred in the major currency market so far.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Broker Comparison: FXTM vs XM

Currency Calculator