简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Steadies as Fed Rate Cut Odds Stabilize - Calendar Driving Prices

Abstract:The US Dollar (via the DXY Index) has not seen significant follow through after breaking key technical levels last week. That simply may just be a function of the calendar.

Top FX News Talking Points:

热门外汇新闻谈话要点:

Fed rate cut odds have moderated in the past few days, with the probability of two rate cuts in 2019 dropping from 86% chance at the end of last week to 83% today.

美联储降息几率在过去几年有所缓和几天,2019年两次降息的概率从上周末的86%下降到今天的83%。

Without a further build in Fed rate cut expectations, the US Dollar (via the DXY Index) has not seen significant follow through after breaking key technical levels last week, but that simply may just be a function of the calendar.

没有进一步在美联储降息预期的基础上,美元(通过DXY指数)在上周突破关键技术水平之后并没有出现明显的后续行动,但这可能只是日历的一个函数。

{3}

The IG Client Sentiment Indexshows that retail traders are continuing to buy the US Dollar during its fall.

After an exciting start to June, the second week of the month has been a lot less exciting. Case and point: the US Dollar (via the DXY Index) traded in a 1.04% range during the first three trading days of last week. Over the same period this week so far, the DXY Index has only traded in a 0.37% range. Volatility has calmed down, and in turn, price action across asset classes – US equities, US Treasuries, commodities, FX, etc. – has produced little meaningful movement over the past few days.

令人兴奋的开始到6月,这个月的第二周已经不那么激动了。案例和观点:美元(通过DXY指数)在上周的前三个交易日内交易区间为1.04%。在本周迄今同期,DXY指数仅在0.37%区间内交易。波动性趋于平缓,反过来,资产类别 - 美国股票,美国国债,大宗商品,外汇等 - 的价格走势在过去几天内几乎没有产生任何有意义的变动。

This trading environment may simply be a function of the calendar, however. Heres why.

Fed Rate Cut Odds Have Stabilized in Recent Days…

美联储降息的可能性在最近几天有所稳定......

After a speech last Tuesday in which Fed Chair Jerome Powellsaid that policymakers are now “closely monitoring” the impact of trade developments and that the Fed will “act as appropriate” to help sustain the expansion, market participants aggressively discounted dovish policy action by the FOMC by the end of this year.

在上周二发表讲话后美联储主席杰罗姆鲍威尔表示,政策制定者现在正在“密切关注”贸易发展的影响,以及美联储将“采取适当行动”来帮助维持扩张,市场参与者在今年年底前对FOMC采取温和的政策行动。

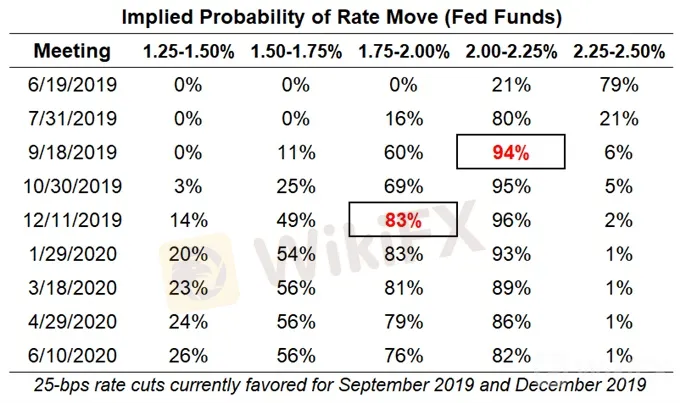

By the end of last week, according to Fed funds futures contracts, rates markets were pricing in a 96% chance of a 25-bps rate cut in September and an 86% chance of two 25-bps rate cuts by the end of 2019.

截至上周末,根据联邦基金期货合约,利率市场估计9月份降息25个基点的可能性为96%,机率为86%到2019年底两次降息25个基点。

Federal Reserve Rate Expectations (June 12, 2019) (Table 1)

美联储利率预期(6月)2,2019)(表1)

This week, however, rates markets have not continued their aggressive Fed rate cut pricing. Following the weaker than expected May US inflation report, rates markets were pricing in a 94% chance of a 25-bps rate cut in September and an 83% chance of two 25-bps rate cuts by the end of 2019.

然而,本周利率市场没有继续其积极的美联储降息定价。继5月美国通胀报告弱于预期之后,利率市场定价9月份降息25个基点的可能性为94%,到2019年底降息25个基点的可能性为83%。

While these are only modest changes in pricing, it stands to reason that if rising Fed rate cut odds were driving the US Dollar lower last week, the fact that they havent risen any further is a relief for the beleaguered greenback.

虽然这些只是价格的适度变化,但可以理解的是,如果上周美联储降息的可能性推动美元走低,那么它们没有进一步上涨的事实就是陷入困境的美元。

…But Thats Due to the Fed Blackout Period Ahead of the June FOMC Meeting

...但这是由于6月FOMC会议之前的美联储停电期间

It stands to reason that Fed Chair Powell was the motivating factor last week for rates market to kick into high gear and drag forward expectations for two rate cuts in 2019. But just because we havent seen a continuation of these efforts doesnt mean that the prospect for fresh stimulus has dissipated. As mentioned earlier, the trading environment – which has been driven by Fed rate cut odds – may be a function of the calendar.

它代表因为上周美联储主席鲍威尔是激励因素导致利率市场进入高位并拖累2019年两次降息预期的原因。但仅仅因为我们没有看到这些努力的延续并不意味着新的前景刺激已经消散。如前所述,交易环境 - 由美联储降价赔率推动 - 可能是历法的一个函数。

Now that we‘re officially in the ’blackout quiet period ahead of the June Fed meeting, neither Fed Chair Powell nor any Fed policymakers can issue commentary this week. Markets are currently deprived of the single most motivating factor for price action thus far in June.

现在我们正式进入'停电安静美联储主席鲍威尔和美联储政策制定者本周都不会发表评论。到目前为止,市场目前在6月份被剥夺了推动价格走势的唯一激励因素。

As discussed in the weekly US Dollar forecast, it‘s important to stage recent Fed commentary in the proper light: it’s been rather dovish, per shifting Fed funds futures, producing a weaker US Dollar, lower US yields, and a rally in US equities. Without the catalyst of dovish Fed officials, these recent market moves may simply be taking a breather ahead of the June Fed meeting – traders shouldn‘t look too deep into the fact that we haven’t seen continuation from last weeks efforts.

正如每周美元预测所讨论的那样,重要的是在美联储近期发表评论。适当的亮点:由于美联储基金期货转移,美元疲软,美国收益率下降以及美国股市反弹,这一点相当温和。如果没有温和的美联储官员的催化剂,这些近期的市场走势可能只是在6月美联储会议之前暂停 - 贸易商不应该过于深入了解我们没有从上周的努力中继续。

DXY INDEX TECHNICAL ANALYSIS: DAILY PRICE CHART (JUNE 2018 TO JUNE 2019) (CHART 1)

DXY指数技术分析:每日价格表(2018年6月至2019年6月)(图表1)

In our US Dollar price forecast last week, we noted “longer-term major topping potential.” With the DXY Index breaking five-week range support near 97.15, as well the rising trendline from the February 2018, March 2018, and March 2019 lows, it appears that the early stages of a major top for the US Dollar are unfolding.

在我们上周的美元价格预测中,我们注意到“长期主要顶部潜力。”随着DXY指数在97.15附近突破五周区间支撑,以及上升趋势线从2018年2月,2018年3月和2019年3月的低点来看,看起来美元主要顶峰的早期阶段正在展开。

It still holds then that were still in “the start of a double top pattern pointing towards 95.97/96.00 in the near-term, but longer-term major topping potential in the form of a bearish rising wedge – which would ultimately call for the DXY Index to decline back towards its 2018 lows near 88.25 over the next 16-months.”

它仍然存在然后仍然是在“近期的双顶模式开始指向95.97 / 96.00,但以看跌上涨的形式出现的长期主要顶部潜力 - 最终将要求DXY指数回落至2018年在88.25附近的低点接下来的16个月。”

DXY INDEX TECHNICAL ANALYSIS: DAILY PRICE CHART (JUNE 2018 TO JUNE 2019) (CHART 2)

DXY指数技术分析:每日价格表(2018年6月至2019年6月)(图2)

In the near-term, traders may want to be patient with the DXY Index: losses may have extended too far, too fast (similar to how gold prices rallied too quickly to the upside, signaling exhaustion). Now that prices have cracked the April swing lows near 96.75, traders may wait for the daily 8-, 13-, and 21-EMA envelope to eliminate the gap with the daily closing price in order for the oversold conditions to be worked off, as trading is both a function of price and time.

短期内,交易者可能希望对DXY指数保持耐心:损失可能已经延伸太快,太快(类似于黄金价格如此快速反弹上涨,信号耗尽)。现在价格已经突破了96.75附近的4月低点,交易商可能会等待每日8,13和21-EMA信封以消除与每日收盘价的差距,以便超卖情况得以消除,交易是价格和时间的函数。

Momentum is very negative at the moment, with both daily MACD and Slow Stochastics trending lower in bearish territory, with the latter holding in oversold condition. The DXY Index has closed below the daily 8-EMA every session since May 31, and until it does so, there is little reason to have anything other than a bearish bias looking to sell rallies given the starkly negative momentum picture.

目前势头非常消极,日线MACD和慢速随机指标均在看跌区域走低,后者持有超卖条件。自5月31日以来,DXY指数收于每日8-EMA以下考虑到负面的负面动力情况,除非出现这种情况,否则没有什么理由除了看跌卖空之外还有任何其他看法。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Fed Rate Cut Calls, Would NFP Tilt The Odds?

The latest data for the U.S. ISM Manufacturing PMI, released on August 1, 2024, shows a decline to 46.8, down from 48.5 in June. This marks the sixth consecutive month of contraction (a reading below 50) and remains well below the historical average of 52.88. On July, the Bank of Canada (BoC) announced a 25-basis-point cut in its benchmark interest rate, reducing it to 4.5%. This was the second consecutive rate cut, following a similar move in June. The latest ADP Nonfarm Employment Change for..

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Should You Choose Rock-West or Avoid it?

Scam Couple behind NECCORPO Arrested by Thai Authorities

Currency Calculator