简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

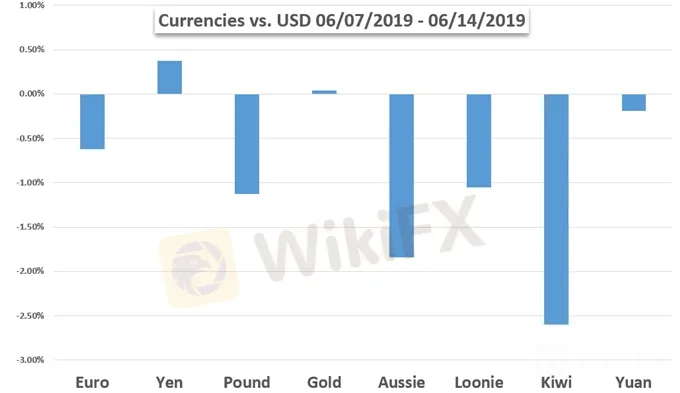

Weekly Trading Forecast: Fed Hopes Compete with Trade War Fears

Abstract:A week ago, it seemed that some relief from trade wars would filter through to stimulate further relief rallies. As we move into the new trading week, it is clear that this persistent theme is once again firmly a concern – and reinforced by flagging economic growth. Will Fed support

Weekly Trading Forecast: Fed Hopes Compete with Trade War Fears

每周交易预测:美联储希望与贸易战恐慌竞争

US Dollar (USD) Weekly Forecast: Fed to Confirm Interest Rate U-Turn

美元(USD)每周预测:美联储确认利率掉头

The US dollar (USD)is biding time ahead of next weeks FOMC monetary policy decision where it is expected that Chair Jerome Powell will indicate that interest rate cuts are coming with the July meeting the most likely starting point.

美元(USD)将在下周FOMC货币政策决定之前等待时间,预计主席杰罗姆鲍威尔将在7月会议上表明降息最有可能开始点。{/ p>

S&P 500, FTSE 100 Outlook: Trade War Deadline, Brexit Vote, Fed Powell Testimony in Focus

标准普尔500指数,富时100指数展望:贸易战争截止日期,英国退欧投票,美联储鲍威尔的焦点证词

S&P 500, DAX and FTSE 100 look to Fed, ECB and BoE monetary policy outlook.

标准普尔500指数,DAX指数和富时100指数看美联储,欧洲央行和英国央行的货币政策前景。

{7}

Euro at Risk as the ECB Sets Up for a Dovish Policy Trajectory

{7}

The Euro may come under pressure as the ECB Forum drafts a dovish policy path while EU bigwigs pick its next President with an eye on that visions execution.

随着欧洲央行论坛起草一份温和的政策路径而欧盟大佬选择其欧元,欧元可能面临压力下一任总统关注该愿景的执行情况。

Australian Dollar Won't Be Spared By This Week's Focus On the Fed

澳大利亚元将不会被本周的焦点放在美联储身上

The Australian Dollar faces too many headwinds for anything other than bearishness now, even if the Fed may take some attention away from it in the coming week.

澳大利亚元也面临着人现在,即使美联储可能会在未来一周内对此采取一些措施,也会对利空以外的任何因素产生不利影响。

GBPUSD Rate Outlook Hinges on Bank of England (BoE) Forward Guidance

英镑兑美元英国央行(英国央行)前瞻指引利率展望铰链

The Bank of England (BoE) meeting on June 20 may shake up the near-term outlook for the British Pound if the central bank alters the forward guidance for monetary policy.

6月20日英国央行(BoE)会议可能会改变英镑近期前景如果中央银行改变货币政策的前瞻性指引。

Crude Oil Prices May Seesaw Between Iran Politics, Growth Sentiment

原油价格可能在伊朗政治与增长情绪之间徘徊

The Euro put in for a notable retreat through the second half of last week, but its reversal is not as intense as EURUSD may insinuate. Will momentum spread in the week ahead?

欧元兑美元汇率在上周下半年进行了显着的撤退,但其逆转并不像欧元兑美元可能暗示的那样强烈。未来一周势头会不会扩散?

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Economic and Political Shifts Impact Global Markets Part 2

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

Economic and Political Shifts Impact Global Markets Part 1

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

GEMFOREX - weekly analysis

The week ahead: 5 things to watch

WikiFX Broker

Latest News

eToro Adds ADX Stocks to Platform for Global Investors

Why Do You Keep Blowing Accounts or Making Losses?

B2BROKER Launches PrimeXM XCore Support for Brokers

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Checkout FCA Warning List of 21 FEB 2025

Google Bitcoin Integration: A Game-Changer or Risky Move?

IG 2025 Most Comprehensive Review

Why Should Women Join FX Market?

ED Exposed US Warned Crypto Scam ”Bit Connect”

Currency Calculator