简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBPUSD Bounces Off Key Trendline Support from Flash Crash Low - US Market Open

Abstract:GBPUSD Bounces Off Key Trendline Support from Flash Crash Low - US Market Open

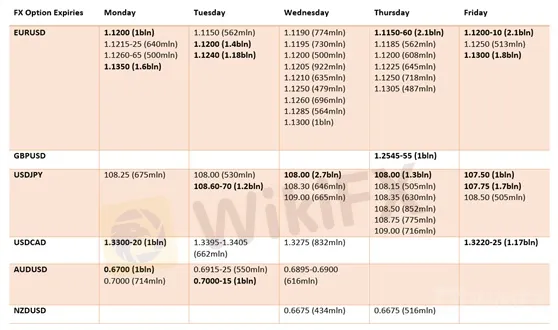

EUR: Amid the sizeable decline in inflation expectations, traders will be paying close attention to commentary from ECBs Draghi, who may provide fresh policy signals in order to address the plummet in inflation expectations. The Euro is slightly firmer this morning, with 1.12 holding in EURUSD, while EURGBP made another push above 0.8900. Of note, large option expiries between 1.12 and 1.13 could keep EURUSD within a relatively tight range ahead of the Fed meeting.

GBP: Initial weakness in the Pound had been curbed having bounced off the trendline support from the GBP flash crash low, while the slight pullback in the USD index had also aided the currency to test the 1.26 handle. Elsewhere, the BoE are scheduled to release their latest monetary policy outlook, however, while there has been increased hawkish rhetoric from several members, the central bank remains tight lipped by the ongoing Brexit uncertainty.

Source: DailyFX, DTCC

Source: DailyFX, Thomson Reuters

IG Client Sentiment

How to use IG Client Sentiment to Improve Your Trading

WHATS DRIVING MARKETS TODAY

“Gold Price Outlook Positive, Silver Price Continues to Struggle” by Nick Cawley, Market Analyst

{9}

“US Dollar Outlook Less Bullish, CHF Shorts Cut, CAD Longs Boosted - COT Report” by Justin McQueen, Market Analyst

{9}

“DAX 30 & CAC 40 Charts Stabilizing, Looking Higher” by Paul Robinson, Currency Strategist

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Economic Calendar Events for This Week (August 5-9, 2024)

This week's economic events include: Japan's Monetary Policy Minutes and U.S. Services PMI on Monday, impacting JPY and USD. Tuesday's RBA Interest Rate Decision affects AUD, with German Factory Orders influencing EUR. Wednesday sees German Industrial Production and U.S. Crude Inventories impacting EUR and USD. Thursday: RBA Governor speaks, with U.S. Jobless Claims. Friday: China's CPI and Canada's Unemployment Rate affect CNY and CAD.

Anticipating the Nonfarm Payroll Report

As we approach the Nonfarm Payroll (NFP) report on August 2, 2024, market participants are keenly observing the data for insights into the U.S. labor market. The report is expected to show an increase of 194,000 to 206,000 jobs for July, indicating modest growth. This suggests potential softening in the labor market. A weaker-than-expected report could prompt the Fed to consider rate cuts, influencing the USD. Major currency pairs and gold prices will likely see volatility around the NFP release

High Volatility Economic Events for This Week (GMT+8)

This week, key economic events expected to generate high volatility include China's Q2 GDP and retail sales data, impacting CNY. The US will release Core Retail Sales and Philadelphia Fed Manufacturing Index, affecting USD. The UK's CPI data will influence GBP, and the ECB Interest Rate Decision and Press Conference will impact EUR. These events will drive significant market movements due to their influence on monetary policy and economic outlooks.

Global Market Insights: Key Events and Economic Analysis Part 2

This week's global market analysis covers significant movements and events. Fed Chairman Powell's cautious stance on interest rates impacts the USD. TSMC benefits from Samsung's strike. Geopolitical tensions rise with Putin's diplomacy. PBOC plans bond sales to stabilize CNY. Key economic events include Core CPI, PPI, and Michigan Consumer Sentiment for the USA, and GDP data for the UK. These factors influence currency movements and market sentiment globally.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

ATFX Enhances Trading Platform with BlackArrow Integration

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

IG 2025 Most Comprehensive Review

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Scam Couple behind NECCORPO Arrested by Thai Authorities

Currency Calculator