简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dow Jones Bulls Hold to Dovish Hopes Ahead of Fed Meeting

Abstract:The Dow Jones tracked marginally higher on Monday as traders prepared for Wednesdays FOMC meeting. With trade wars and an uncertain global growth outlook, dovish expectations are high.

Dow Jones Price Outlook:

The Dow Jones remains above 26,00 – consolidating before Wednesdays Fed meeting

If the Industrial Average is to continue higher, dovish expectations will have to be met

Retail traders are overwhelmingly short the Dow Jones, find out how to use IG Client Sentiment Data with one of our Live Sentiment Data Walkthroughs

Dow Jones Bulls Hold to Dovish Hopes Ahead of Fed Meeting

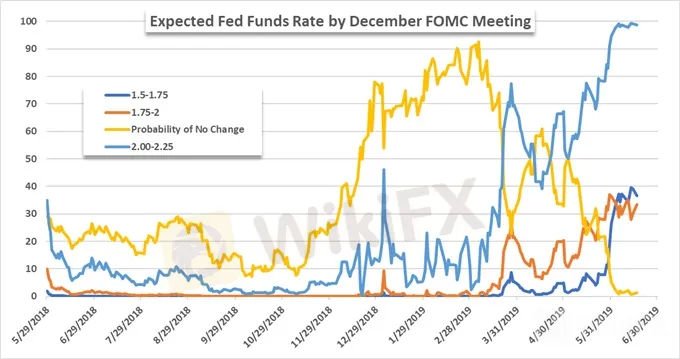

The Dow Jones approached Monday‘s close marginally higher as traders look to position ahead of Wednesday’s Fed meeting. With deteriorating economic data, waning global growth and the persistent threat of trade wars, the expectations for a cut to the Federal Funds rate by year-end have soared. The Industrial Average will cling to these hopes for trend continuation purposes.

That said, there is the risk that market expectations will overshoot the central banks actual view of the economy and the evidence for a reduction in the Fed funds rate. Fortunately for bulls, the put-to-call ratio of the S&P 500 remains comfortably at the 1-year average of 0.63. However, retail traders are less convinced – or perhaps unaware of the expectations – and remain net-short the Index.

Retail trader data shows 31.8% of traders are net-long with the ratio of traders short to long at 2.14 to 1. In fact, traders have remained net-short since June 3 when the Dow Jones traded near 24880.6; price has moved 5.0% higher since then. The number of traders net-long is 3.0% higher than yesterday and 2.5% lower from last week, while the number of traders net-short is 0.1% higher than yesterday and 12.6% higher from last week.

We typically take a contrarian view to crowd sentiment at DailyFX, and the fact traders are net-short suggests Wall Street prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. With a bullish signal from retail trader data and dovish expectations soaring, the Industrial Average looks primed to continue its June recovery which could see it test May highs around 26,700.

Dow Jones Price Chart: 4 - Hour Time Frame (February – June)

Should the dovish expectations come to fruition, the Average must first surmount the ascending trendline from February – now around 26,300 – before it can test 26,700. On the other hand, immediate support resides around 25,880 to 25,900 which kept the Index afloat throughout last week.

Quantitative Easing (QE) Explained: Central Bank Tool for Growth

As the anticipation for Wednesdays Fed meeting builds, the Dow Jones may continue to melt up. That said, volatility will likely remain muted until the meeting and implications on monetary policy unfold. For a post-FOMC breakdown and technical updates on the Dow Jones, follow @PeterHanksFX on Twitter.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Most Effective Technical Indicators for Forex Trading

What Can Expert Advisors Offer and Risk in Forex Trading?

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Currency Calculator