简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

RBA Minutes to Offer AUDUSD Little Relief Ahead of FOMC Meeting

Abstract:The RBA Minutes may do little to prop up AUDUSD ahead of the FOMC meeting as the exchange rate extends the series of lower highs and lows from the previous week.

Australian Dollar Talking Points

AUD/USD remains under pressure ahead of the Reserve Bank of Australia (RBA) Minutes, and the exchange rate may continue to depreciate going into the Federal Reserve meeting as it extends the series of lower highs and lows from the previous week.

RBA Minutes to Offer AUDUSD Little Relief Ahead of FOMC Meeting

The RBA Minutes may do little to curb the decline in AUDUSD as the central bank reverts back to its rate cutting cycle, and a batch of dovish comments may drag on the Australian Dollar as officials warn that “the downside risks stemming from the trade disputes have increased.”

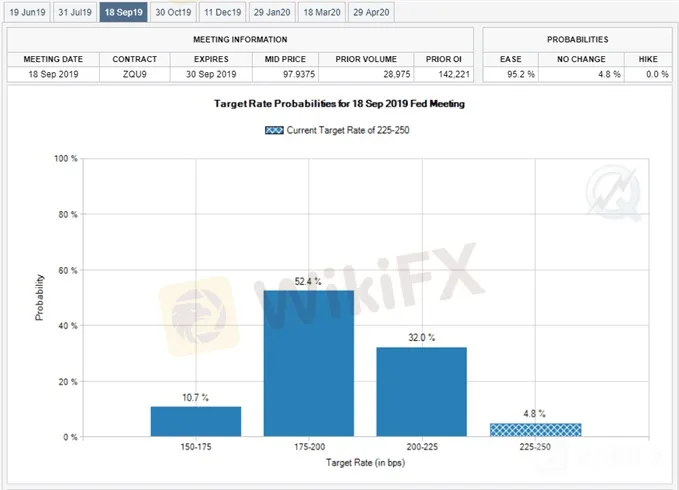

With that said, AUDUSD remains vulnerable ahead of the Federal Open Market Committee (FOMC) interest rate decision on June 19 as the central bank is widely expected to keep the benchmark interest rate in its current range of 2.25% to 2.50%. However, a material change in the Summary of Economic Projections (SEP) may influence foreign exchange markets as Fed Fund futures continue to reflect a greater than 90% probability for a September rate-cut.

It remains to be seen if Chairman Jerome Powell and Co. will project a lower trajectory for the benchmark interest rate as President Donald Trump tweets that “the Fed interest rate way too high.” A material change in the forward guidance for monetary policy is likely to alter the near-term outlook for AUDUSD as FX traders brace for an imminent change in regime.

Until then, downside targets remain on the radar for AUDUSD,but retail sentiment remains skewed even though the exchange rate takes out the May-low (0.6865) and extends the bearish sequence from the previous week.

The IG Client Sentiment Report shows75.9% of traders are net-long AUD/USD compared to 64.7% last week, with the ratio of traders long to short at 3.15 to 1. Keep in mind, traders have been net-long since April 18 when AUDUSD traded near 0.7160 even though price has moved 3.8% lower since then.

The number of traders net-long is 8.6% higher than yesterday and 20.6% higher from last week, while the number of traders net-short is 9.4% lower than yesterday and 28.6% lower from last week. Profit-taking behavior may account for the recent drop in net-short position, but the ongoing tilt in net-long interest offers a contrarian view as both price and the Relative Strength Index (RSI) continue to track the bearish trends carried over from late-2018.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Rate Daily Chart

Keep in mind, the AUDUSD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7112), with the exchange rate marking another failed attempt to break/close above the moving average in April.

In turn, AUDUSD remains at risk of giving back the rebound from the 2019-low (0.6745) as the wedge/triangle formation in both price and the Relative Strength Index (RSI) unravels.

Downside targets remain on the radar for AUDUSD as takes out the May-low (0.6865) and extends the series of lower highs and lows from the previous week.

The close below the Fibonacci overlap around 0.6850 (78.6% expansion) to 0.6880 (23.6% retracement) opens up the 0.6730 (100% expansion) region, but will keep a close eye on the RSI as the oscillator appears to be flat lining ahead of oversold territory, with a failed attempt to break below 30 raising the risk for a rebound in AUDUSD.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

USDCAD Rebound to Benefit from Sticky US Consumer Price Index (CPI)

Updates to the US Consumer Price Index (CPI) may keep USDCAD afloat as the figures are anticipated to highlight sticky inflation.

USDCAD Forecast: RSI Snaps Bullish Formation Following BoC Meeting

Recent developments in the Relative Strength Index (RSI) foreshadow a further decline in USDCAD as the indicator snaps the bullish formation carried over from July.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator