简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

SPY ETF Notches Largest Outflow in 2019, HYG Finds Buyers

Abstract:After Fed Chairman Jerome Powell struck a dovish tone at Wednesdays FOMC meeting, the SPY ETF notched two days of substantial outflows while the riskier-HYG ETF experienced robust demand.

SPY & HYG ETF Flows:

SPY&HYG ETF流量:

The SPY ETF saw its largest intraday outflow since October on Thursday

SPY ETF自10月以来出现盘中最大流出周四

On the other hand, the HYG ETF registered a steady streak of inflows as the appetite for risk mounts

另一方面,随着风险偏好的增加,HYG ETF注入了稳定的资金流入

{3}

Interested in stock trading? Read about the relationship between volatility and future returns

{3}

{5}

SPY ETF Notches Largest Outflow in 2019, HYG Finds Buyers

{5}{6}

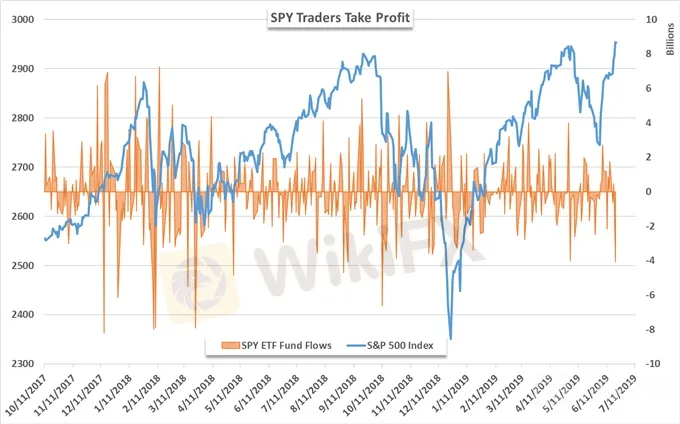

The SPY ETF saw roughly -$4 billion leave its coffers on Thursday as investors looked to take profit after the underlying S&P 500 tagged a record high. While it could be argued the outflow is indicative of waning demand, profit-taking is the more likely culprit as other risk asset-tracking funds saw considerable inflows following the dovish tone put forth by Fed Chairman Powell on Wednesday.

{6}

SPY ETF Fund Flows and S&P 500 Price Chart

SPY ETF基金流量和标准普尔500价格表

Data source: Bloomberg

数据来源:Bloomberg

Further, other broad-market tracking ETFs posted flows that were within range and largely insignificant. In aggregate, the SPY, IVV and VOO funds recorded roughly -$3 billion in outflows – with the latter two funds experiencing net inflows for the week. Meanwhile, the high-yield corporate debt ETF, HYG, notched a series of robust inflows.

此外,其他大盘跟踪ETF发布的流量在范围内且基本上无关紧要。总体而言,SPY,IVV和VOO基金的流出量约为30亿美元 - 后两个基金本周出现净流入。与此同时,高收益公司债券ETF,HYG也出现了一系列强劲的资金流入。

SPY, IVV, VOO ETF Fund Flows and S&P 500 Price Chart

SPY,IVV,VOO ETF基金流量和标准普尔500指数价格走势图

Data source: Bloomberg

数据来源:Bloomberg

Recording an inflow of $1 billion on Thursday, the HYG ETF added to its considerable capital haul for the week with a weekly net flow of $1.25 billion. As of Friday, the fund posted its largest weekly net inflow since early January when the fund received $1.8 billion in fresh capital. The flows are indicative of a risk-on attitude that would align with the continuation of relaxed monetary policy from the Federal Reserve. Similar sentiment was echoed in the JNK ETF.

记录流入10亿美元周四,HYG ETF本周增加了可观的资金,每周净流量为12.5亿美元。截至周五,该基金发布了它自1月初该基金获得18亿美元新资金以来每周最大净流入量。这些流动表明风险态度与美联储继续实施宽松货币政策相一致。类似的情绪在JNK ETF中得到了回应。

HYG ETF Fund Flows and S&P 500 Price Chart

HYG ETF基金流量和标准普尔500指数价格表

Data source: Bloomberg

数据来源:Bloomberg

JNK, which also provides exposure to high-yield corporate debt, currently boasts its longest streak of net inflows over the last year and a half. At 11 consecutive sessions, the consistent demand has seen $1.8 billion enter the fund. With the monetary policy path of the Federal Reserve seemingly locked in, investors have expressed a renewed appetite for riskier-allocations. Despite the outflows from SPY, the replenished demand for risk could signal investors willingness to continue the recent trend in the S&P 500.

JNK也提供高收益企业债务,目前拥有最长的净流入连续数过去一年半。连续11个交易日,持续需求已经达到18亿美元进入该基金。随着美联储的货币政策路径似乎被锁定,投资者已表达了对风险分配的新兴胃口。尽管SPY流出,但对风险的补充需求可能表明投资者愿意继续推动标准普尔500指数的近期走势。

JNK ETF Fund Flows and S&P 500 Price Chart

JNK ETF基金流量和标准普尔500价格表

Data source: Bloomberg

数据来源:Bloomberg

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

【MACRO Alert】The possibility of Trump winning the election is closely linked to market conditions! Could Japan become a big winner from this?

Although the market has responded positively to the prospect of Trump's possible re-election, and the Japanese stock market has shown an upward trend as a result, investors should also remain cautious and pay attention to the long-term impact of the election results on global economic policies and market sentiment. As strategist Tomo Kinoshita pointed out, while short-term market dynamics may be closely related to the election results, ultimately, the fundamentals of companies, economic data, an

Market Focus on Earnings Report

As we head into the second quarter earnings report season, the U.S. equity market is poised to capture significant attention. Recent geopolitical events, particularly the unconfirmed reports of an explosion in Iran's third-largest city last Friday, have injected volatility into commodities prices and bolstered the appeal of safe-haven assets like the U.S. dollar and Japanese Yen.

Daily Market Newsletter - February 8, 2024

Recap of Global Market Trends and Trading Opportunities

S&P 500 Price Outlook: Value Stocks Outperform Momentum, Tech Lags

After breaking outside of its August range, the road higher seemed to be laid out for the S&P 500, but tech and momentum stocks have been largely absent from the rally effort.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator