简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Analysis: Risks Tilted to Upside, Iran Plans to Break Nuclear Deal Limit

Abstract:Crude Oil Analysis: Risks Tilted to Upside, Iran Plans to Break Nuclear Deal Limit

Oil Price Analysis and News

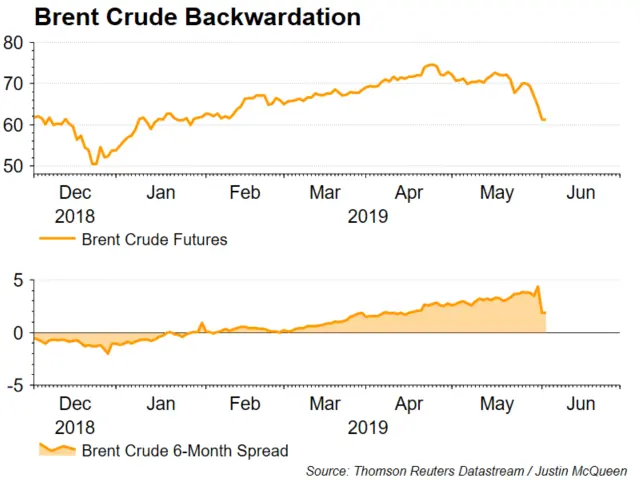

Crude Oil Prices Buoyed by Geopolitical Tensions

Iran Plans to Break Nuclear Deal Limit

Geopolitical Risks Buoy Oil Prices

Rising geopolitical risks stemming from tensions between the US and Iran keep momentum tilted to the upside for the oil complex. Secretary of State Pompeo highlighted that significant sanctions would be announced for Iran, thus tensions between the two nations will remain high, as such, a further escalation raises the risk of oil price spikes going forward.

Iran Planning to Break Nuclear Deal Limit

On June 27th, Iran plans to breach the limit on its stockpile of enriched uranium set by the nuclear deal, which in turn should see the rising geopolitical risk premium keep oil prices buoyed. Elsewhere, despite US sanctions impacting the production in both Iran and Venezuela, the fragile nature of the oil given the concerns of a global slowdown should see OPEC rollout the production cuts throughout the rest of the year.

Brent Crude Price: Daily Time Frame (Sep 2018 – Jun 2019)

Oil Impact on FX

Net Oil Importers: These countries tend to be worse off when the price of oil rises. This includes, KRW, ZAR, INR, TRY, EUR, CNY, IDR, JPY

Net Oil Exporters: These counties tend to benefit when the price of oil rises. This includes RUB, CAD, MXN, NOK.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator