简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Will Facebook Libra Cryptocurrency Undermine Financial System?

Abstract:Facebooks intention to implement its world-wide Libra cryptocurrency has sparked controversy among regulators and central banks who fear it could undermine global financial stability.

FACEBOOK LIBRA, CRYPTOCURRENCIES, BLOCKCHAIN – TALKING POINTS

-

Facebook is intending to create, implement its own cryptocurrency known as Libra

Digital coin will operate on open-source blockchain, value derived from FX basket

Global regulators getting nervous about whether it will put financial system at risk

See our free guide to learn how to use economic news in your trading strategy!

Facebook is looking to introduce a low-volatility cryptocurrency known as Libra that can be used to facilitate peer-to-peer transactions all over the world by using blockchain technology. The tech giant is expected to launch the digital coin in June 2020 and is anticipating to encounter significant resistance and regulatory hurdles from policymakers all over the world in governments, central banks and financial institutions.

HOW DOES LIBRA WORK?

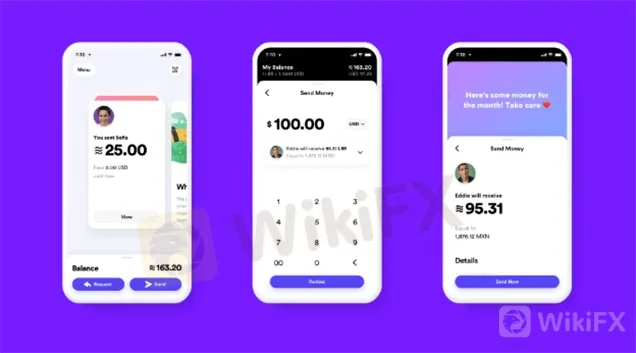

In order to use Libra, users will need to provide a government-issued ID and will have to convert their local currency into the digital coin. The cryptocurrency will be accessible through the Messenger app, WhatsApp and Calibra, a subsidiary of Facebook designed to store Libra and manage transactions. The digital wallet optimizes for cheap and fast peer-to-peer transactions and users do not need a Facebook account to sign up.

A Possible User Interface Model

Source: Calibra

Facebook also stated that information stored on the social media site and Calibra will not be shared and emphasized that financial data will not be used to target ads at users. Facebook will also have to apply many of the same measures banks undertake to protect their customers deposits. This includes using software and/or staff that will be used to monitor activity and prevent fraudulent behavior.

In addition to Calibra, an independent non-profit organization called the Libra Association was created to govern the currency. It is headquartered in Geneva, Switzerland – apropos, considering the countrys reputation of maintaining neutrality in world affairs. It is composed of 28 founding members which include giants such as Mastercard and Uber as well as academic institutions and nonprofit organizations.

Founding Members of the Libra Association

Source: Libra Association

Each member has to pay a $10 million fee to join. Upon admittance, the membership grants each participant one vote which can be used to select new founding members, elect a managing director and appoint an executive team. Upon completion of the associations charter, the initial group of organizations will be officially classified as Founding Members, with the intention of having 100 representatives by the launch date.

Chain of Command

“Members of the association [will also] run the validator nodes that operate the libra blockchain. Validator nodes are responsible for securing the network and validating transactions on the blockchain”. The association will also be responsible for managing the Libra Reserve, participating in key decisions about the development of the Libra Blockchain and “the approach to social impact grant-making”.

“Blockchains are described as either permissioned or permissionless in relation to the ability to participate as a validator node. In a ”permissioned blockchain,“ access is granted to run a validator node. In a ”permissionless blockchain,“ anyone who meets the technical requirements can run a validator node. In that sense, Libra will start as a permissioned blockchain.”

HOW DOES THE LIBRA BLOCKCHAIN WORK?

In lieu of using existing blockchains, Facebook elected to create its own on the condition that it will be secure, scalable and flexible enough to power “future innovations in the financial system”. Facebook is now designing the open-source programming language known as Move that will be used for “implementing custom transaction logic and ‘smart contracts’ on the Libra Blockchain.”. Here is an excerpt from the White Paper:

“Move enables the secure implementation of the Libra ecosystems governance policies, such as the management of the Libra currency and the network of validator nodes. Move will accelerate the evolution of the Libra Blockchain protocol and any financial innovations built on top of it.”

Learn more here about the technicalities underlying Libra Blockchain!

HOW IS LIBRA DIFFERENT FROM OTHER CRYPTOCURRENCIES?

Like other cryptocurrencies, Libra will be operated using a blockchain network to facilitate transactions where users‘ identity will remain anonymous and their financial activity will be recorded in a public ledger. The network is estimated to be able to handle 1,000 transactions per second, which is substantially higher than Bitcoin’s seven per second, but also significantly lower than Visas 24,000 per second. Therein lies the issue.

The problem of scalability – meaning, how many transactions can a blockchain network process over a given time frame – continues to be an issue among crypto enthusiasts. If Libra becomes a worldwide digital currency, the Association will have to find a way to reconcile the high level of usage with the efficiency of processing transactions. Lags and delays could be a major deterrent to wide-spread adoption.

Unlike other cryptocurrencies like Ethereum and Bitcoin, Libra will be backed by a reserve of stable and liquid assets as a way to tame volatility and offer the assurance of price predictably. The currency basket will include the Japanese Yen, US Dollar, the British Pound and the Euro. The idea is that an index of currencies will protect Libra users from violent price swings from one particular currency.

The Libra Reserve will be responsible for managing the currency basket. It will use deposited funds from Libra users to invest in “bank deposits and short-term government securities in currencies from stable and reputable central banks”. The interest garnered from these assets will then be used to fund operational expenses and pay dividends to early investors once the initial overhead is covered.

Therefore, Libras stability and return for investors relies on wide-spread adoption. If more users exchange their local currency for Libra, the fund grows and the volume of capital flowing into income-generating assets increases. The costs relative to the size of growing returns will become smaller, leaving a greater proportion of spare funds that can be used to pay dividends to the Libra Association for their contributions.

Furthermore, if even just a fraction – say, one percent – of all of Facebook‘s 2.38 billion users sign up and use Libra, it would already have a user base of 23.8 million. For a point of reference, that’s slightly over Taiwan‘s population of 23.7 million (recorded in 2019). Increased usage among users and businesses is expected to incentivize the latter to post ads on Facebook and increase the social network’s revenue stream.

HOW WILL OTHER CRYPTOCURRENCIES REACT TO LIBRA?

In the short term, cryptocurrencies may rally on the expectation that an increased interest in digital tokens may cause the flood gates to open and lead to capital pouring into crypto FX markets. While this may cause an initial spike, it will likely then fizzle out as traders remember that the speculative nature of first-generation cryptocurrencies remain a key feature of their existence.

Following the Great Recession, trust in banking institutions substantially eroded and led the disillusioned and emboldened skeptics to embrace and promote fiat alternatives like Bitcoin and other cryptocurrencies. The current fundamental outlook suggests a recession may be approaching, and if the severity of it sparks another backlash – politically or otherwise – interest in crypto assets may once again surge.

ROADBLOCKS: REGULATIONS AND REPUTATIONS

Facebook has acknowledged that it will have to overcome numerous regulatory obstacles not only in the US but all over the world. Officials from governments and financial institutions have expressed concern about the tech giants already-expansive reach across the world and the prospect that its influence will be amplified by the implementation of a world-wide digital currency.

Facebook is already encountering criticism from the Peoples Bank of China (PBoC), where a senior official expressed concern that Libra could severely disrupt monetary policy and destabilize exchange rates. One risk an official referenced was if countries with volatile currencies – particularly those in emerging markets –switch to Libra, it could spark a rapid depreciation in the local currency.

On July 10 during Fed Chairman Jerome Powell‘s testimony in front of the House Financial Services Committee, he expressed concern about Libra, saying that its wide use may be a threat to financial stability. He had a meeting with Facebook about the tech giant’s proposal, but that clearly did not quell Mr. Powells concerns, as he alluded to a likely intervention from the Financial Stability Oversight Council.

Barry Lynn, the Executive Director of an antitrust advocacy group called the Open Markets Institute said that “[Facebook has] fires all over the world with regulators. And its only going to get worse”. He has a point. Facebook‘s reputation for maintaining privacy has been tarnished over the years and was only made worse during the Cambridge Analytica scandal that exposed the company’s use of Facebook users data without their consent.

As such, Facebook will have to contend with both external and internal barriers. On the outside, the tech giant will have to undergo severe regulatory scrutiny from agencies all over the world. And on the inside, it will have to atone for the sins of its past and regain the trust of its users. Accomplishing such a task will be difficult as major technology companies continue to face backlash against their growing influence.

Because the road ahead is so uncertain, and there is no telling how the regulatory landscape will shift over the coming months or years, some of Libras features and the overall process of implementation may be radically altered or delayed. When Facebook Newsroom published the announcement of its new Libra cryptocurrency, it added the following disclaimer:

“This announcement contains forward-looking statements regarding our future product and business plans and expectations. These forward-looking statements may differ materially from actual results due to a variety of factors and uncertainties, many of which are beyond our control. Please note that the date of this announcement is June 18, 2019 and any forward-looking statements contained herein are based on assumptions that we believe to be reasonable as of this date. We undertake no obligation to update these statements as a result of new information or future events.”

FX TRADING RESOURCES

-

Join a free webinar and have your trading questions answered

Just getting started? See our beginners guide for FX traders

Having trouble with your strategy? Heres the #1 mistake that traders make

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Should You Beware of Forex Trading Gurus?

Vanuatu Passes VASP Act to Regulate Crypto and Digital Assets

Currency Calculator