简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURCHF Rate Trades to Fresh 2019 Low Ahead of ECB Meeting

Abstract:EURCHF trades to a fresh yearly-low ahead of the ECB meeting, with recent price action warning of a further decline as the bearish momentum appears to be gathering pace.

EUR/CHF Rate Talking Points

EURCHF trades to a fresh yearly-low (1.0965) ahead of the European Central Bank (ECB) meeting, and recent price action warns of a further decline in the exchange rate as the Relative Strength Index (RSI) pushes into oversold territory.

EURCHF Rate Trades to Fresh 2019 Low Ahead of ECB Meeting

The ECB meeting may keep EURCHF under pressure even though the central bank is widely expected to keep Euro area interest rates on hold as the Governing Council endorses a dovish forward guidance for monetary policy.

Recent remarks from ECB officials suggest the central bank will take additional steps to insulate the monetary union as the account of the June meeting insists that “the Governing Council needed to be ready and prepared to ease the monetary policy stance further by adjusting all of its instruments, as appropriate, to achieve its price stability objective.”

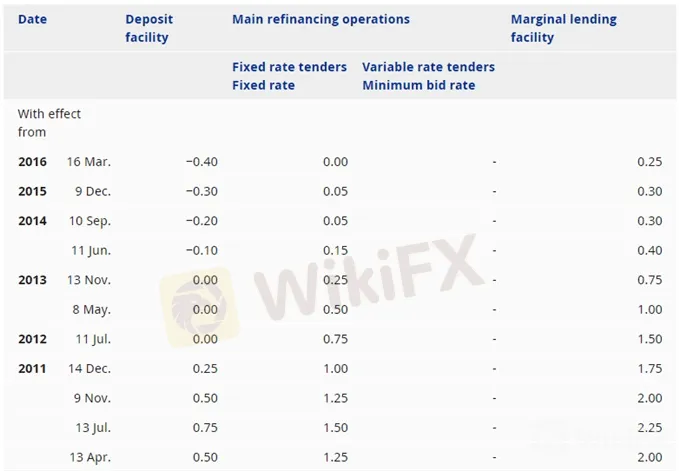

It seems as though the ECB will continue to utilize its non-standard measures as the central bank prepares to launch another round of Targeted Long-Term Refinance Operations (TLTRO) in September, and the Governing Council may show a greater willingness to implement a negative interest rate policy (NIRP) for the Main Refinance Rate, its flagship benchmark for borrowing costs, as “weak global trade and the prolonged presence of uncertainties continued to be a drag on euro area growth developments.”

With that said, the Swiss National Bank (SNB) may find itself in a similar situation as the central bank warns that “an unexpectedly sharp slowdown internationally would quickly spread to Switzerland.”

As a result, Chairman Thomas Jordan and Co. may gain increased attention as the central bank insists that “the negative interest rate and the SNBs willingness to intervene in the foreign exchange market as necessary remain essential in order to keep the attractiveness of Swiss franc investments low and thus ease pressure on the currency.”

However, the lingering threat of a trade war may continue to drag on EURCHF, and the SNBs policy may do little to curb the appreciation in the Swiss Franc as there appears to be a flight to safety.

In turn, EURCHF may continue to trade to fresh yearly lows over the coming days, with the exchange rate at risk of extending the recent series of lower highs and lows as recent developments in the Relative Strength Index (RSI) suggest the bearish momentum is gathering pace.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

EUR/CHF Rate Daily Chart

Broader outlook for EURUSD remains tilted to the downside as the former floor around 1.2000 turns to resistance, and the exchange rate stands at risk of extending the decline from earlier this month as it carves a series of lower highs and lows.

At the same time, recent developments in the RSI suggest the bearish momentum is gathering pace as the oscillator slips below 30 and pushes into oversold territory; need a move back above 30 to favor a rebound in the exchange rate.

The move below 1.0990 (61.8% expansion) opens up the Fibonacci overlap around 1.0820 (50% retracement) to 1.0860 (78.6% expansion), with the next area of interest coming in around 1.0680 (100% expansion).

For more in-depth analysis, check out the 3Q 2019 Forecast for Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

EURUSD Rate Rebound Unravels as Attention Turns to ECB Meeting

EURUSD gives back the rebound from earlier this month, with the Euro at risk of exhibiting a more bearish behavior as the ECB is expected to deliver a rate cut.

Euro Sinks Ahead of ECB & Draghi, Implied Volatility Surges

Euro selling pressure builds as implied volatility measures skyrocket and dovish expectations fester while forex traders anxiously await the high-impact September ECB meeting slated for Thursday.

EURUSD Forecast: Monthly Opening Range on Radar Ahead of ECB Meeting

EURUSD holds the monthly opening range ahead of the ECB meeting, but fresh updates from the Governing Council are likely to alter the near-term outlook for the Euro.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

What Can Expert Advisors Offer and Risk in Forex Trading?

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

The Most Effective Technical Indicators for Forex Trading

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Currency Calculator