简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD Rate Carves Lower Highs and Lows Ahead of Fed Rate Decision

Abstract:USDCAD initiates a fresh series of lower highs and lows, with the exchange rate at risk for a further decline as the Federal Reserve is expected to deliver a rate cut.

Canadian Dollar Talking Points

The near-term rebound in USDCAD appears to have stalled ahead of the Federal Reserve interest rate decision, and the exchange rate may continue to give back the advance from the monthly-low (1.3016) as it initiates a fresh series of lower highs and lows.

USDCAD Rate Carves Lower Highs and Lows Ahead of Fed Rate Decision

USDCAD stands at risk of facing a more bearish fate over the next 24-hours of trade as the Federal Open Market Committee (FOMC) is widely expected to alter the path for monetary policy.

The FOMC appears to be on track to deliver an insurance cut in July as “participants generally agreed that downside risks to the outlook for economic activity had risen materially since their May meeting, particularly those associated with ongoing trade negotiations and slowing economic growth abroad.”

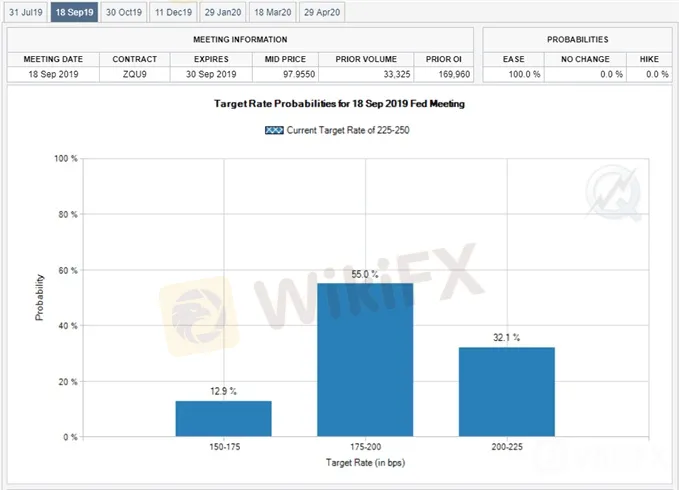

It seems as though the FOMC will insulate the US economy from the shift in trade policy, but it remains to be seen if Chairman Jerome Powell and Co. will establish a rate easing cycle as Fed Fund futures still highlight a greater than 60% probability for another reduction at the September 18 interest rate decision.

With that said, the Feds forward guidance for monetary policy is likely to influence the near-term outlook for USDCAD, and the exchange rate may exhibit a more bearish behavior over the coming days if the FOMC shows a greater willingness to reverse the four rate hikes from 2018.

In contrast, the Bank of Canada (BoC) may face a different fate as “growth in the second quarter appears to be stronger than predicted,” and Governor Stephen Poloz and Co. looks poised to keep the benchmark interest rate on hold at the next meeting on September 4 as “the degree of accommodation being provided by the current policy interest rate remains appropriate.”

In turn, the diverging paths for monetary policy casts a bearish outlook for USDCAD, with the exchange rate at risk of giving back the advance from the monthly-low (1.3016) as it carves a fresh series of lower highs and lows.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Rate Daily Chart

Keep in mind, the broader outlook for USDCAD is no longer constructive as the advance from the April-low (1.3274) stalls ahead of the 2019-high (1.3665), with the break of trendline support raising the risk for a further decline in the exchange rate.

Moreover, the break of the February-low (1.3068) suggests theres a broader shift in USDCAD behavior, with the Relative Strength Index (RSI) highlighting a similar dynamic as the oscillator tracks the bearish formation from earlier this year.

In turn, USDCAD stands at risk of extending the fresh series of lower highs and lows as the rebound from the monthly-low (1.3016) sputters ahead of the 1.3220 (50% retracement) region, with a break/close below the 1.3120 (61.8% retracement) to 1.3130 (61.0% retracement) area raising the risk for a move towards 1.3030 (50% expansion).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

FX Week Ahead - Top 5 Events: August Canada Inflation Report & USD/CAD Rate Forecast

The August Canada inflation report (consumer price index) is due on Wednesday, September 18 at 12:30 GMT.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator