简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

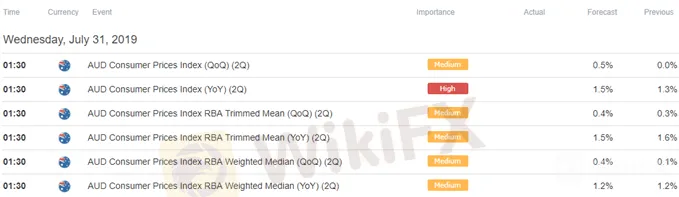

Lackluster Australia CPI to Keep AUDUSD Rate Under Pressure

Abstract:Updates to Australias Consumer Price Index (CPI) may do little to curb the recent decline in AUDUSD as the core rate of inflation is expected to narrow to 1.5% from 1.6%.

Trading the News: Australia Consumer Price Index (CPI)

交易新闻:澳大利亚消费者价格指数(CPI)

Updates to Australias Consumer Price Index (CPI) may impact the near-term outlook for AUDUSD as the headline reading is projected to increase to 1.5% from 1.3% per annum in the first quarter of 2019.

澳大利亚消费者价格指数(CPI)的更新可能会影响澳元兑美元的近期前景预计2019年第一季度的标题阅读量将从每年1.3%增加到1.5%。

Signs of stick price growth may curb the recent decline in AUDUSD as it encourages the Reserve Bank of Australia (RBA) to revert back to a wait-and-see approach at the next meeting on August 6.

标价增长的迹象可能遏制近期澳元兑美元下跌,因为它鼓励澳大利亚储备银行(RBA)在8月6日的下一次会议上恢复观望态度。

However, the details of the report may do little to curb the recent decline in AUDUSD as the core rate of inflation is expected to narrow to 1.5% from 1.6% during the same period. In turn, a batch of lackluster data prints may drag on the Australian dollar as it puts pressure on the RBA to further embark on its rate easing cycle.

但是报告的细节可能无助于抑制近期澳元兑美元的下跌,因为核心通胀率预计将从同期的1.6%收窄至1.5%。反过来,一批低迷的数据显示可能拖累澳元,因为它给澳洲联储施加压力,要求进一步开始降息周期。

Impact that the Australia CPI report had on AUD/USD during the previous release

澳大利亚CPI报告对上一次发布期间对澳元/美元的影响 p>

{6}

| Period | Data Released | Estimate | Actual | Pips Change(1 Hour post event ) | Pips Change(End of Day post event) |

| 1Q2019 | 04/24/2019 01:30:00 GMT | 15.% | 1.3% | -50 | -75 |

1Q 2019Australia Consumer Price Index (CPI)

{6}

AUD/USD 15-Minute Chart

澳元/美元15分钟图表

Australias Consumer Price Index (CPI) narrowed more than expected during the first three months of 2019, with the headline reading slipping to 1.3% from 1.8% per annum in the fourth quarter of 2018. A deeper look at the report showed a similar development for the core rate of inflation, with the trimmed mean index printing at 1.6% versus projections for a 1.7% print.

澳大利亚消费物价指数(CPI)收窄幅度超过预期冷杉2019年的三个月,标题读数从2018年第四季度的每年1.8%下滑至1.3%。对报告的深入研究显示核心通胀率有类似的发展,平均指数平均值为1.6 1.7%印数的预测百分比与预期一致。

The Australian dollar struggled to hold its ground following the batch of lackluster data prints, with AUDUSD falling below the 0.7050 area to close the day at 0.7015. Learn more with the DailyFX Advanced Guide for Trading the News.

澳元兑美元在数据打印数据不佳之后挣扎,澳元兑美元跌破0.7050区域以收盘于收盘日0.7015。使用DailyFX交易新闻高级指南了解更多信息。

AUD/USD Rate Daily Chart

澳元/美元汇率每日图表

Keep in mind,the AUDUSD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7083), with the exchange rate marking another failed attempt to break/close above the moving average in July.

请记住,货币市场闪电崩盘后澳元兑美元反弹受到200日均线(0.7083)以及汇率的限制标志着7月份再次失败的尝试突破/收盘高于移动平均线。

In turn, the broader outlook for AUDUSD remains tilted to the downside, with the exchange rate still at risk of giving back the rebound from the 2019-low (0.6745) as both price and the Relative Strength Index (RSI) continue to track the bearish formations from late last year.

反过来,澳元兑美元的更广阔前景仍然向下倾斜,由于价格和相对强弱指数(RSI)继续跟踪去年年底的看跌形态,汇率仍有可能从2019年低点(0.6745)回吐反弹的风险。

{13}

Moreover, the advance from the June-low (0.6832) has sputtered ahead of the Fibonacci overlap around 0.7080 (61.8% retracement) to 0.7110 (78.6% retracement), which lines up with the 200-Day SMA (0.7083), with the near-term outlook for AUDUSD mired by the recent series of lower highs and lows.

{13}

The Fibonacci overlap around 0.6850 (78.6% expansion) to 0.6880 (23.6% retracement) sits on the radar, with a break of the June-low (0.6832) raising the risk for a move towards 0.6730 (100% expansion).

Fibonacci重叠在0.6850附近(78.6%扩张)至0.6880(23.6%回撤位)在雷达上,突破6月低点(0.6832)提高了向0.6730(100%扩张)的风险。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

US Stocks Fall as Inflation Holds Pace

Dow Jones Drops 173 Points, S&P 500 Sheds 27 Points, Nasdaq 100 Closes Lower by 57 Points

USDCAD Rebound to Benefit from Sticky US Consumer Price Index (CPI)

Updates to the US Consumer Price Index (CPI) may keep USDCAD afloat as the figures are anticipated to highlight sticky inflation.

AUDUSD Range Vulnerable to Dovish RBA Forward Guidance

AUDUSD may face a more bearish fate over the coming days if the Reserve Bank of Australian (RBA) prepares Australian household and businesses for lower interest rates.

USDCAD Rebound Unravels Ahead of Fed Symposium Amid Sticky Canada CPI

USDCAD pullbacks ahead of the Fed Economic Symposium as Canadas Consumer Price Index (CPI) comes in stronger-than-expected in July.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Broker Comparison: FXTM vs XM

Currency Calculator