简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Rises on Non-Committal Fed, GBP & EUR Extends Losses - US Market Open

Abstract:US Dollar Rises on Non-Committal Fed, GBP & EUR Extends Losses - US Market Open

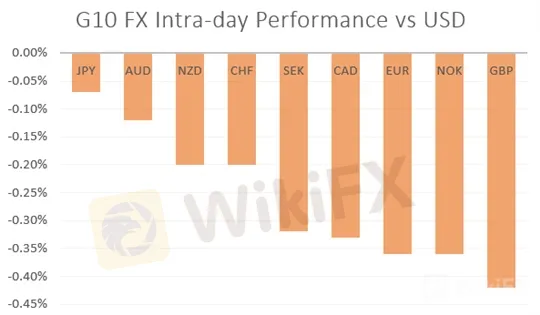

MARKET DEVELOPMENT –US Dollar Rises on Non-Committal Fed, GBP & EUR Extends Losses

市场发展 - 非美元美联储,美元和欧元的美元汇率上涨损失

DailyFX 2019 FX Trading Forecasts

DailyFX 2019外汇交易预测

USD: The US Dollar has continued to extend on its Fed induced gains with the greenback rising across the board. Yesterday, saw the Fed cut interest rates for the first time since December 2008. However, Powells press conference in which he stated that this is a mini-cycle adjustment has casted some doubts as to whether the central bank will deliver the number of cuts that markets had expected. Consequently, the US Dollar is notably firmer and with the summer lull upon us, low FX volatility may indeed bode well for the greenback which can benefit from carry trades. Alongside this, tighter USD liquidity following the debt ceiling agreement is also another supportive factor in the near-term.

美元:美元继续随着美元全线上涨,延续其美联储引发的涨幅。昨天,看到美联储自2008年12月以来首次降息。然而,鲍威尔斯在新闻发布会上表示,这是一个小周期调整,这对于央行是否会提供削减数量产生了一些疑问。市场此前预期。因此,美元显着走强,随着夏季的平静,我们认为,对于可以从利差交易中受益的美元来说,低汇率波动可能确实是个好兆头。除此之外,债务上限协议后更严格的美元流动性也是近期的另一个支撑因素。

GBP: The Pound had once again been on the decline, hitting a fresh 31-month low at 1.2086 before reclaiming the 1.21 handle. Today‘s Bank of England Quarterly Inflation Report was far from ’super with the central bank cutting their near-term growth outlook. Overall, there was little in the way of new information from the BoE given that they are effectively sitting on the side-lines until Brexit clarity is found, therefore focus moves back towards the Brexit headline watch.

英镑:英镑在重新回到1.21关口之前,再次一路走低,触及新的31个月低点1.2086。今天的英格兰银行季度通胀报告与央行削减其近期增长前景相差甚远。总的来说,英国央行提供的新信息很少,因为他们实际上是坐在边线上,直到找到英国脱欧的清晰度,因此重点转向英国脱欧标题手表。

{6}

EUR: The Euro is on the backfoot amid a wave of disappointing manufacturing PMI surveys from the Eurozone, further fuelling the need for ECB stimulus. Alongside this, marginally wider US/German 2yr bond spreads has also kept the Euro pressured, which is now eying a move to test the 1.10 handle.

{6}

Source: DailyFX, Thomson Reuters

来源: DailyFX,汤森路透

IG Client Sentiment

IG客户情绪

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Economic and Political Shifts Impact Global Markets Part 2

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

Economic and Political Shifts Impact Global Markets Part 1

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

GEMFOREX - weekly analysis

The week ahead: 5 things to watch

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

The Impact of Interest Rate Decisions on the Forex Market

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

STARTRADER Spreads Kindness Through Ramadan Campaign

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

How a Housewife Lost RM288,235 in a Facebook Investment Scam

The Daily Habits of a Profitable Trader

Currency Calculator