简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

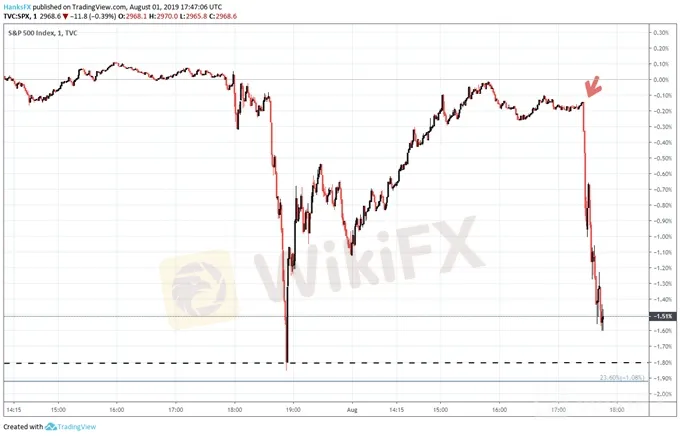

Stocks Sink After President Trump Announces New Tariffs on China

Abstract:Amidst a recovery rally from Wednesdays selloff, President Trump announced an additional round of tariffs on goods coming into the United States from China as stocks dived.

Stock Market Update:

President Trump announced the United States will put an additional tariff of 10% on remaining $300 billion of Chinese goods

In response, the S&P 500 and Dow Jones sank over 1% as trade wars rocket to the forefront of investor concern once again

Sign up for our Weekly Equity Outlook Webinar to gain earnings insight and stock market analysis through the lens of global macro trends.

Stock Market Update: Stocks Sink After President Trump Announces New Tariffs on China

Stocks sank after President Trump announced the United States will implement further tariffs on Chinese goods entering the US. Check back here as the story develops…

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Commodity prices Surge as Geopolitical Tension Rise

he market saw muted activity as both the U.S. and the U.K. observed public holidays in yesterday's session. The dollar index (DXY) edged lower, failing to hold above the 104.50 level. This decline comes as the market anticipates signs of cooling U.S. inflation ahead of the PCE reading due on Friday. Meanwhile, the U.S. Securities and Exchange Commission (SEC) announced a reduction in Wall Street settlement times, aiming to complete transactions in a single day.

eWarrant Japan Securities K.K. offers clients Nikkei and Dow Jones indices trading with MetaTrader 5

Warrant Japan Securities K.K. launched its new services eWarrant Direct, allowing its clients to trade covered warrants via a dedicated platform.

eWarrant Japan Securities K.K. offers clients Nikkei and Dow Jones indices trading with MetaTrader 5

eWarrant Japan Securities K.K. launched its new services eWarrant Direct, allowing its clients to trade covered warrants via a dedicated platform.

In the stock market, it’s become Apple, Microsoft and Alphabet vs everyone else

KEY POINTS Does a relative shortage of stocks combined with somewhat mechanical sources of buying explain the Dow rising to 29,000? What’s truly scarce are big, reliable cash flows that investors believe will endure economic wobbles and constant technological disruption. This has created a vastly bifurcated market, and an unusually wide spread between the valuation of the most expensive stocks and the cheapest ones. In aggregate Apple-Microsoft-Alphabet trades at 26-times this year’s profits, with no debt and enormous capacity to invest, buy back stock or fund future dividends. The broad market is below 19-times earnings.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

The Growing Threat of Fake Emails and Phishing Scams

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator