简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBP/USD: Pound Sterling Eyes Q2 GDP Amid Rising Brexit Risks

Abstract:The British Pound faces major event risk with UK Q2 GDP data due for release Friday which looks to provide the latest health check on the British economy amid prolonged Brexit uncertainty.

GBP PRICE OUTLOOK TURNS TO UK Q2 GDP REPORT

Spot GBPUSD has traded in a narrow range so far this month, but Friday‘s UK Q2 GDP report has potential to reignite the currency pair’s slide lower

The British Pound Sterling and UK economy activity remains subdued by prolonged Brexit uncertainty

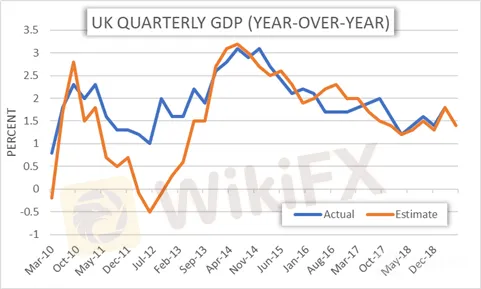

GBPUSD currency traders are gearing up for heightened price action in the Pound Sterling with the UK Q2 GDP report on deck for release Friday at 8:30 GMT. The British economy is expected to grow at a year-over-year annual rate of 1.4% - a modest decline from the 1.8% figure printed in the first quarter.

UK QUARTERLY GDP (YEAR-OVER-YEAR)

UK GDP growth has been on a steady decline and is not likely to return to post-recession highs any time soon with Brexit uncertainty weighing negatively on consumption, business confidence and investment. Also, with new PM Boris Johnson now at the helm of UK Parliament – a Brexit hardliner – the impact of heightened fears over no-deal Brexit could begin to show signs in the UK Q2 GDP report.

While there may be evidence of further inventory stockpiling which boosts economic output, which was the case found in the Q1 GDP report, this development is expected to serve as a headwind to GDP growth going forward. Yet, the British economy has remained quite resilient on balance all else considering.

GBPUSD PRICE CHART: DAILY TIME FRAME (APRIL 15, 2019 TO AUGUST 08, 2019)

GBPUSD price action is expected to maintain a downward bias, however, considering the dominant headwind of no-deal Brexit risk even if tomorrow‘s UK GDP report provides a positive sign for the economy. That said, spot GBPUSD might be expected to trade between 1.2083-1.2189 with a 68% statistical probability judging by the currency pair’s overnight implied volatility reading of 8.37%.

SPOT GBPUSD & IG CLIENT SENTIMENT INDEX PRICE CHART: DAILY TIME FRAME (FEBRUARY 11, 2019 TO AUGUST 08, 2019)

According to IG Client Sentiment data, 77.2% of GBPUSD retail forex traders are net-long resulting in a long-to-short ratio of 3.39 to 1. Traders have remained net long since 06 May when the cable traded near 1.2981; spot GBPUSD has moved 6.4% lower since then. Furthermore, the number of traders net long is 5.6% lower than last week while the number of traders net-short is 1.7% higher than last week. Seeing that we typically take a contrarian view to crowd sentiment, spot GBPUSD could continue to drift lower.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

KVB Market Analysis | 21 August: USD/JPY Stalls Near 145.50 Amid Diverging Economic Indicators

USD/JPY holds near 145.50, recovering from 144.95 lows. The Yen strengthens on strong GDP, boosting rate hike expectations for the Bank of Japan. However, gains may be limited by potential US Fed rate cuts in September.

KVB Market Analysis | 20 August: Gold Prices Remain Near Record High Amid US Rate Cut Expectations

Gold prices remain near record highs, driven by expectations of a US interest rate cut and a weakening US Dollar. Investors are focusing on the upcoming Jackson Hole Symposium, where Fed Chair Jerome Powell's speech will be closely watched for clues on the Fed's stance. Additionally, the release of US manufacturing data (PMIs) is expected to influence gold's direction.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator