简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Sterling (GBP) Ignores UK Labour/Wages Data, Focus Remains Brexit

Abstract:Sterling (GBP) is little changed after slightly better-than-expected UK wages and Labour data as Brexit remains the driver of the British Pound.

UK Employment and Wages Data and Sterling (GBP) Prices, Charts and Analysis:

英国就业和工资数据及英镑(GBP)价格,图表与分析:

Wages tick higher as UK employment rises.

随着英国就业人数的增加,工资率会上升。

Brexit remains the main driver of Sterling price action.

英国脱欧仍然是英镑价格走势的主要推动因素。

Q3 2019 GBP Currency Forecasts andTop Trading Opportunities

Q3 2019年英镑货币预测和顶部交易机会

{4}

Keep up to date with all key economic data and event releases via the DailyFX Economic Calendar

{4}

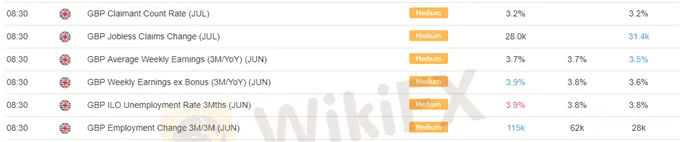

The latest UK wages and employment data showed a mixed-to-better set of numbers with wages rising, the claimant count falling, the employment rate rising but the unemployment rate ticking marginally higher. The numbers left Sterling unchanged against other majors.

英国最新的工资和就业数据显示,该数据好坏参半。随着工资上涨,申请人数下降,就业率上升但失业率略有上升。这些数字使Sterling与其他专业保持不变。

Commenting on today‘s figures, ONS deputy head of labour market statistics Matt Hughes said: “Employment continues to increase, with three-quarters of this year’s growth being due to more women working. However, the number of vacancies has been falling for six months, with fewer now than there were this time last year.Excluding bonuses, real wages are growing at their fastest in nearly four years, but pay levels still have not returned to their pre-downturn peak.”

评论今天的数据,ONS劳动力市场统计副主管Matt Hughes说: “就业继续增加,今年增长的四分之三是由于更多的女性工作。然而,空缺数量已连续六个月下降,现在比去年同期少。除了奖金外,实际工资增长速度近四年来最快,但薪酬水平仍未恢复到预期水平。低迷的高峰。”

Sterling, however is increasingly ignoring hard data and re-focusing on Brexit and the likelihood of the UK leaving the EU on October 31 with no-deal. The latest wages and employment and data would in normal times see the Bank of England prepare the market for a round of rate hikes. However, with UK growth falling away, due to Brexit fears, and the economy likely needing a boost, there is a reasonable possibility that a no-deal Brexit on October 31 will be followed by a rate cut at the next BoE meeting. Wednesday sees the latest UK inflation release with core CPI expected unchanged at 1.8% y/y while CPIH is expected to tick down to 1.8% from 1.9% y/y.

英镑越来越无视硬数据,重新关注英国退欧以及英国于10月31日以无交易方式离开欧盟的可能性。最新的工资,就业和数据将在正常情况下看到英格兰银行准备市场进行一轮加息。然而,随着英国经济增长的消退,由于英国脱欧的担忧以及经济可能需要提振,10月31日的无交易脱欧将有可能在下一次英国央行会议上降息。周三英国公布的最新通胀数据显示核心CPI预期维持在1.8%不变预计CPIH将从1.9%同比下降至1.8%。

Later today there is a preliminary hearing at the Court of Session in Scotland to prevent the UK leaving the EU without a deal on October 31. The legal challenge, which is backed by 70 MPS according to the BBC, argues that shutting down Parliament to force through a no-deal Brexit would be unlawful.

今天晚些时候在苏格兰法院举行初步听证会,以阻止英国离开欧盟未在10月31日达成协议。根据英国广播公司的说法,法律挑战得到了70 MPS的支持,认为关闭议会强制通过无交易脱欧将是非法的。{/ p>

GBPUSD Price Chart (November 2018 – August 13, 2019)

GBPUSD价格走势图(2018年11月 - 2019年8月13日)

Retail traders are 75.4% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. However recent daily and weekly positional changes suggest that GBPUSD may soon reverse higher.

零售交易商净值为75.4%英镑兑美元最新的IG Client Sentiment Data,一个看跌逆势指标。然而,最近的每日和每周位置变化表明英镑兑美元可能很快反转走高。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GemForex - weekly analysis

The week ahead: The Dollar keeps dictating the markets

GemForex - weekly analysis

A Rat Race to the bottom in the rescue of the Dollar

British Pound Technical Analysis - GBP/USD. Trend to Resume or Reversal For Sterling?

GBP/USD Technical Analysis - the pair has bounced back after making a new low for the year. The Pound has seen increased volatility as it looks to hold ground. Will Sterling continue to be undermined and make fresh lows again?

British Pound (GBP) Price Outlook: GBP/USD Falling Ahead of BoE, Fed Meetings

GBP/USD PRICE, NEWS AND ANALYSIS:

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

Currency Calculator