简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EUR/CHF Outlook: SNB Steps up Currency Intervention

Abstract:EUR/CHF Outlook: SNB Steps up Currency Intervention

CHF Price Analysis and Talking Points:

SNB Steps up Currency Intervention

EUR/CHF May Continue to Head Lower Despite Intervention

See our quarterly FX forecast to learn what will drive prices throughout Q3!

SNB Steps up Currency Intervention

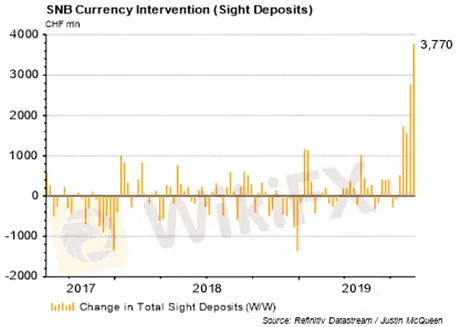

Since EUR/CHF has broken below the 1.1000 handle, the Swiss National Bank has stepped up its currency intervention in order to curb the appreciation in the Swiss Franc. Total sight deposits, which are used to gauge potential intervention from the SNB has shown a consistent trend higher, with the latest figures showing sight deposits increasing by CHF 3.770bln in the week to August 16th. However, this has been to little effect thus far with the Swiss Franc trading at its best levels in nearly 2yrs vs. Euro to hover around 1.0850 (2yr low 1.0834).

Source: Refinitiv Datastream

EUR/CHF May Continue to Head Lower Despite Intervention

Yesterday, the Bundesbank warned that Germany could potentially enter a technical recession, raising the need for the ECB to announce a fresh stimulus package (likely to come in the September meeting). That said, with risks evidently tilted to the downside for the Euro and with the global economic environment deteriorating, this raises the possibility for EUR/CHF to head lower. Consequently, this could further raise concerns for the SNB in regard to the strength in the Swiss Franc, raising questions as to whether the SNB can or will move in lockstep with the ECB. That said, since the 1.1000 handle has been breached, markets are now testing for the next line in the sand for the SNB to act more aggressively in preventing CHF gains.

EURCHF Price Chart: Weekly Time Frame (Jul 15 – Aug 19)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

SNB Raised Bets on US Tech Stocks in Q1, 2020

Hit by the coronavirus pandemic, Swiss National Bank(SNB) lost US$39.34 billion in Q1, 2020, the heaviest quarterly loss since its establishment in 1907.

US Dollar May Rise Against Euro as Italian Political Risk Mounts

The US Dollar and Swiss Franc may rise against the Euro as Italian politics may temporarily steal the spotlight as the biggest political risk in Europe next to Brexit.

SNB Likely Wary Of Any EURCHF Floor Even If ECB Eases Again

Markets believe the European Central Bank will ease policy this year. This could be bad news for the Swiss National Bank, but its not clear that it will resort to old remedies.

Franc Gains as EURCHF, USDCHF Sink. US Dollar Rising Support Held

The Swiss Franc outperformed, EURCHF, USDCHF tumbled with US-Iran tension fears. While the Dollar extended declines, it was unable to breach rising support from September 2018.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator