简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Silver Price Targets: XAG Surges to Fresh Yearly Highs– Trade Levels

Abstract:Silver prices have rallied to fresh yearly highs with the advance now targeting uptrend resistance. These are the levels that matter on the XAG/USD charts this week.

Silver prices rally to fresh yearly highs vulnerable into 18.04 - Constructive above 17.39

Check out our 2019 projections in our Free DailyFX Trading Forecasts

Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Silver prices have surged to fresh yearly highs with XAG/USD rallying six of the past seven weeks. These are the updated targets and invalidation levels that matter on the XAG/USD charts heading into the close of the week. Review this week's Strategy Webinar for an in-depth breakdown of this silver price setup and more.

Silver Price Chart – XAG/USD DailyChart

Prepared by Michael Boutros, Technical Strategist; Silver (XAG/USD) on Tradingview

Technical Outlook: In my last Silver Price Outlook we noted that XAG/USD was, “testing confluence uptrend resistance here and leaves the long-bias vulnerable while below the upper parallel.” Prices pulled back nearly 3% last week before stabilizing with the subsequent breakout taking Silver to fresh 20-month highs. The advance hit initial resistance objectives at 17.74 today after gapping higher into the open with the daily chart highlighting ongoing momentum divergence into these highs- risk for topside exhaustion is mounting.

A breach higher from here exposes channel resistance / the 1.618% extension of the November advance at 18.04 backed closely by the 61.8% retracement / August 2016 swing low at 18.37/40. Daily support rests at 16.95 with a broader bullish invalidation now raised to 16.61.

Silver Price Chart – XAG/USD 120min

Chart Prepared by Michael Boutros, Technical Strategist; Silver (XAG/USD) on Tradingview

Notes: A closer look at silver price action shows XAG/USD continuing to trade within the confines of ascending pitchfork formation extending off the late-June / July lows. The weekly opening-range is taking shape just below the 17.74 resistance target with initial support eyed at 17.52. Look for losses to be limited to the median-line / Fridays close at 17.39 IF prices are indeed heading higher on this stretch.

For a complete breakdown of Michaels trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: The Silver price breakout is maturing at fresh yearly highs and while the broader outlook remains constructive, the advance may be vulnerable near-term on the back of this three-week advance. From at trading standpoint, a good place to raise protective stops- look to reduce long-exposure on a stretch towards slope resistance- expect a bigger reaction there IF reached. Be on the lookout for possible downside exhaustion ahead of the Friday close to keep the immediate long-bias viable. Review my latest Silver Weekly Price Outlook for a longer-term look at the technical trading levels for GBP/USD heading.

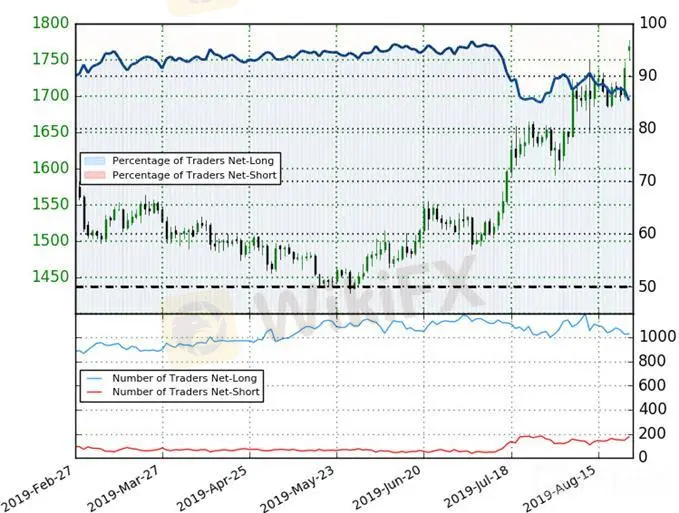

Silver Trader Sentiment (XAG/USD)

A summary of IG Client Sentiment shows traders are net-long Silver - the ratio stands at +5.85 (85.4% of traders are long) – bearish reading

The percentage of traders net-long is now its lowest since July 26th

Long positions are 1.0% lower than yesterday and 1.9% lower from last week

Short positions are 10.0% higher than yesterday and 12.8% higher from last week

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Silver prices may continue to fall. Yet traders are less net-long than yesterday & compared with last week. From a sentiment standpoint, the recent changes in positioning warn that the current Spot Silver price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in Silver retail positioning are impacting trend- Learn more about sentiment!

Active Trade Setups

Sterling Price Targets: Pound Reversal Tests Initial GBP/USD Hurdles

S&P 500 Price Targets: SPX Consolidation Levels – Technical Trade Outlook

Gold Price Targets: XAU/USD Bulls on a Break– Technical Trade Outlook

Canadian Dollar Price Targets: USD/CAD Bulls Eye Key Resistance Pivot

US Dollar Price Outlook: DXY Threatens Larger Recovery– Trade Targets

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

EBC Financial Group Partners with Taiwan Early Childhood Intervention Association to Support Early Childhood Development

EBC Financial Group (EBC) is partnering with Taiwan Early Childhood Intervention Association to provide vital early intervention for children in need.

【MACRO Alert】Federal Reserve officials are at odds over inflation and interest rates, with markets now betting on a Fed rate cut!?

After considering various perspectives from Federal Reserve officials, the latest trends in US economic data, and global central banks' monetary policy trends, the conclusion can be drawn: the future direction of US inflation and interest rate policies is fraught with uncertainty. Market expectations suggest that against a backdrop of slowing economic growth, the Fed may cut interest rates this year. Simultaneously, heightened geopolitical tensions have increased demand for safe-haven assets, le

EUR/USD Price Analysis: Downside bias remains intact, 1.1250 likely at risk

EUR/USD looks south, with 1.1250 at risks amid firmer USD, yields. Bearish RSI supports the potential move lower towards 1.1200. 1.1300 is the level to beat for the EUR bulls for any meaningful recovery.

Silver Sees Hopes of Further Gains After Spiking over 6%

Silver opened Monday's Asian trading session with a spike up to 6% at $28.8/ounce.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Broker Comparison: FXTM vs XM

Currency Calculator