简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Price Outlook: EUR/USD Eyes GDP, Trade Balance Data

Abstract:The US Dollar could be at risk in light of upcoming economic data releases during Thursday's trading session with Q2 GDP and July Advanced Goods Trade Balance serving as potential catalysts for volatility.

US DOLLAR PRICE AT RISK AHEAD OF Q2 GDP REPORT & ADVANCED GOODS TRADE BALANCE

The US Dollar could drop if Q2 US GDP report revisions paint a gloomier picture of the US economy which may accelerate Fed rate cut bets

USD currency pairs may also be at risk with the July advanced goods trade balance data set for release seeing that it could spark an adverse reaction from US President Trump

New to forex trading? Check out this free Forex for Beginners educational guide

The US Dollar could be at risk in light of upcoming economic data releases slated for Thursday‘s trading session. EURUSD implied volatility is subdued ahead of Thursday’s high-impact event risk listed on the DailyFX Economic Calendar, but the worlds most liquid currency pair has potential to react sharply to Euro-area economic data early on.

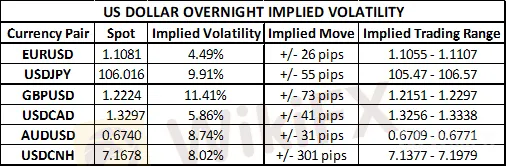

US DOLLAR CURRENCY VOLATILITY & IMPLIED TRADING RANGES

Germany – the EU‘s largest economy – is already on the brink of falling into a recession and upcoming datapoints on inflation and the labor market that fail to inspire confidence stand to weigh in on the market’s expectations for the ECB to provide an aggressive stimulus package.

EURUSD PRICE CHART: DAILY TIME FRAME (JUNE 14, 2019 TO AUGUST 28, 2019)

That is not to say that spot EURUSD will lack a response to updated Q2 US GDP data or the release of the latest US Advance Goods Trade Balance figures. Q2 US GDP data is expected to be revised downward by 0.1% from the initial 2.1% annualized reading according to Bloomberg‘s median estimate. Aside from the headline gross domestic product figure, market participants will likely scrutinize the sub-components for signs of relative strength or weakness across America’s economy. Attention could be focused on the positive contributions to Q2 US GDP growth including personal consumption expenditures and government outlays which were partly offset by falling net exports, inventories, and fixed investment.

US GDP & PRIVATE NONRESIDENTIAL FIXED INVESTMENT

Furthermore, a sharper than previously reported decline in fixed investment – likely owing to ongoing uncertainty surrounding the US-China trade war – could pressure the US Dollar as it has potential to accelerate the markets expectations for the Federal Reserve to cut interest rates.Also, the outstanding risk posed by a potential tweet from US President Trump in reaction to the closely watched economic data could sink the US Dollar as well.

US ADVANCED GOODS TRADE BALANCE

July‘s advance goods trade balance data could also serve as a catalyst that motivates Trump to bash the Federal Reserve and strong US Dollar. Although the US trade deficit improved slightly in June, the monthly figure still stands at roughly -$74 billion and is notably lower than when President Trump took office in 2017. As such, the US Dollar could be dragged lower if signs of a growing deficit and/or lower exports are revealed in tomorrow’s advance goods trade balance report. This is because it will likely increase the markets Fed rate cut bets while also encouraging President Trump to reaccelerate the US-China trade war.

USDCNH PRICE CHART: WEEKLY TIME FRAME (JANUARY 2018 TO AUGUST 2019)

That said, spot USDCNH may provide the cleanest depiction of downside risk faced by the greenback relative to other major US Dollar currency pairs. We previously brought to light how the Chinese Yuan could serve as a US-China trade war barometer with gains in spot USDCNH indicating tensions remain elevated and may even escalate further. While this may initially spark safe haven demand and send forex traders flocking to the US Dollar, price action could get strong-armed lower as the market reassess the likelihood of further Fed rate cuts.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

High Volatility Economic Events for This Week (GMT+8)

This week, key economic events expected to generate high volatility include China's Q2 GDP and retail sales data, impacting CNY. The US will release Core Retail Sales and Philadelphia Fed Manufacturing Index, affecting USD. The UK's CPI data will influence GBP, and the ECB Interest Rate Decision and Press Conference will impact EUR. These events will drive significant market movements due to their influence on monetary policy and economic outlooks.

What's happening with the US Dollar? Why do countries ditch USD?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world’s major emerging economies have agreed to ditch USD for trade!

What's happening with the US Dollar? Is it losing its dominance?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world's major emerging economies have agreed to ditch US dollar for trade!

GEMFOREX - weekly analysis

The week ahead: Top 5 things to watch

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator