简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Apple Event: AAPL Stock Price Tends to Rise After iPhone Launch

Abstract:The Apple iPhone launch date is among the biggest events of the year for the company and AAPL investors. However, US-China trade wars also complicate the outlook for the company.

Apple (AAPL) Analysis and Talking Points

Apple Shares Tend to Rise Following iPhone Launch

Wall Street Remains Bullish Despite US-China Trade War Backdrop

Consequently, the Nasdaq 100 will keep a watchful eye on AAPL and its suppliers

Apple Event: AAPL Stock Price Tends to Rise After iPhone Launch

As is usually the case, the Apple iPhone launch date is among the biggest events of the year for the company and Apple investors. While the share of revenue generated from the iPhone has decreased over time as Apple diversifies, it still makes up over half of the companys revenue and therefore remains integral to the growth outlook for the company.

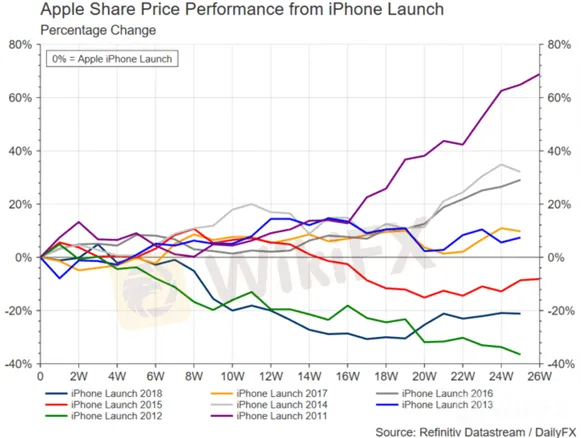

Since the 2011 iPhone launch, Apple shares have on average gained 1.5% in the following 3-months (Hit ratio = 75%) and over 10% in 6-months (Hit ratio = 62.5). That said, the external environment can of course play a role in the companys performance. This had been evidenced last year as concerns over slowing global growth amid the US-China trade war sparked a violent Q4 sell-off in global equity markets.

Chart prepared by Justin McQueen

Wall Street Remains Bullish Despite US-China Trade War Backdrop

The other important date for Apple investors will be December 15th, where the US administration is expected to place fresh tariffs on Chinese made goods, including cellphones and laptops, therefore providing a headwind for Apple going forward. However, despite this, Wall Street remain optimistic on Apple shares with a median price target of $223.74 (4.4% upside).

Chart prepared by Justin McQueen

Apart from AAPL and its immediate suppliers, the broader equity market should also take note of the event. Viewed as a bellwether of market performance by some due to its size and track-record, Apple can carry significant sway over stock sentiment - as evidenced by January‘s currency flash crash following Apple’s forecast downgrade.

As the event progresses, check back for updates and share price reactions…

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dow Jones Suffers Largest Decline in 2019 as Trade War Fears Rage

The Dow Jones Industrial Average sank over 750 points on Monday as the US-China trade war entered a new phase over the weekend which shook investor confidence to the core.

Nasdaq 100 Forecast: AAPL Stock Price Pops on Earnings Beat

Apples stock price popped after-hours following a robust quarterly report from the iPhone-maker. While the company commands significant sway in the Nasdaq 100, stock traders await the Fed.

Stock Market Outlook: Top 3 Themes to Watch in AAPL Earnings

Stock traders eagerly await Apple (AAPL) earnings due Tuesday afternoon. Past hiccups from the company have spurred equity turmoil and currency flash crashes, here are the top 3 themes to watch.

Nasdaq 100 Outlook: FB, TSLA Earnings to Drive Stock Sentiment

After an abysmal earnings miss from Boeing (BA), Facebook (FB) and Tesla (TSLA) will look to prop up sentiment -particularly for the Nasdaq 100 and the tech sector.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator