简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EUR/USD, EUR/JPY Rates Rebound Off Lows after September ECB Meeting

Abstract:Euro rates have seen volatility around the September ECB meeting as outgoing President Draghi's alter ego “Super Mario” made an appearance.

ECB Meeting Review

Euro rates have seen volatility emerge on Thursday around the September ECB meeting as outgoing President Mario Draghi both disappointed and surprised on the easing front. But to be clear: “Super Mario” did, in fact, make an appearance.

Even as the ECB embarks on a new QE program, it still holds that the ECB only cut its main rate by 10-bps; the Federal Reserve will be able to outpace the ECB in a rate cut cycle, given that the ECB is already in negative territory.

The IG Client Sentiment Index suggest that EURJPY and EURUSD may rebound in the coming days.

Looking for longer-term forecasts on the Euro? Check out the DailyFX Trading Guides.

Euro rates have seen volatility emerge on Thursday around the September ECB meeting as outgoing President Mario Draghi both disappointed and surprised on the easing front. But to be clear: “Super Mario” did, in fact, make an appearance. And if traders got the feeling that the European Central Bank is turning Japanese, they may not be wrong.

Here‘s a summary of the key decision taken today by the ECB’s Governing Council, the last meeting by outgoing President Mario Draghi at which a new set of Staff Economic Projections (SEP) were produced:

Interest Rates: 10-bps cut, as expected; open to more rate cuts

QE: €20 billion/month beginning November 2010; open-ended

TLTROs: Removal of 10-bps spread over deposit rate

Deposit Tiering: Japanese model

Forward Guidance: Rates to “remain at their present or lower levels”; linked to core inflation

On one hand, the lack of a 20-bps rate cut – of which there was nearly a 50% chance of occurring, per overnight index swaps ahead of the September ECB meeting – proved to be a disappointment for some market participants. Similarly, investors were looking for the Swiss model (exemptions as a percentage of minimum reserves) instead of the Japanese model (based on excess reserves).

On the other hand, with forward guidance clear, there is still an overtly dovish tilt to rate pricing (more on that below). The announcement of the QE program was a surprise, as was the change to the TLRO program. It can very much be considered that the “Super Mario” version of ECB President Draghi made an appearance today.

Eurozone Economic Data Still Disappointing

Now that the ECB is putting its foot back on the monetary pedal, and that forward guidance is explicitly linked to shifts in inflation, investors may see markets become more sensitive to Eurozone economic data in the coming periods.

The ECBs efforts come when Eurozone economic data is seemingly improving, relatively speaking. The Citi Economic Surprise Index for the Eurozone, a gauge of economic data momentum, is currently at -36.8; one month ago, it was at -52.8.

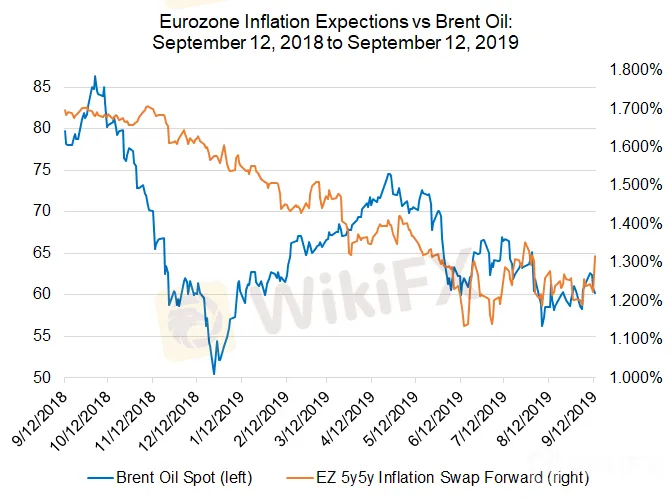

Eurozone Inflation Expectations versus Brent Oil Prices: Daily Timeframe (September 2018 to September 2019) (Chart 1)

Outgoing ECB President Mario Draghis preferred measure of inflation, the 5y5y inflation swap forwards, are currently trading at 1.319%, higher than where they were one week ago at 1.256% and one month earlier at 1.279%, and still significantly above the yearly low set on June 17 at 1.141%. It would appear that the latest efforts by the ECB are provoking a sharp jump in inflation expectations – a sign that the Euro may prove resilient despite the next wave of easing measures.

ECB Rate Cut Cycle Has Only Just Started

Now that the ECB cut interest rates in September – meeting expectations, given that overnight index swaps were discounting a 100% chance of a 10-bps rate cut entering today – investors are quickly shifting their expectations for future policy moves. Given the tone deployed by outgoing ECB President Draghi, particularly around the forward guidance that leaves the door open to more rate cuts, interest rate markets are still pricing in more easing over the coming months.

European Central Bank Interest Rate Expectations (September 12, 2019) (Table 1)

Overnight index swaps are currently pricing in a 62% chance of a 10-bps rate cut at the October ECB meeting. If not, there is a 71% chance of a second 10-bps rate cut coming at the December ECB meeting. But this is the big move: whereas last week rates markets were pricing in three 10-bps rate cuts in September and October 2019 and January 2020; after the September rate cut, rates markets now see the next cuts coming in October 2019 and July 2020. That the third rate cut has been pushed back by six months may give the Euro some room to breathe in the short-term.

EURUSD TECHNICAL ANALYSIS: DAILY RATE CHART (MAY 2018 TO September 2019) (CHART 2)

In our last EURUSD technical forecast update, it was noted that “the area where EURUSD rates found support is familiar: channel support dating back to the August and November 2018 lows. Similarly, the descending trendline from the January and April 2019 swing highs is proving as support as well…If the EURUSD reversal is going to gather pace, traders may want to see rates breach the August 23 bullish outside engulfing low at 1.1052.”

While EURUSD has been unable to clear out 1.1052 thus far, the support region from last week that produced the yearly low at 1.0926 has held up so far; the low around the September ECB meeting was 1.0927. As a result, were now seeing a range form for EURUSD between 1.0926 and 1.1052. The measured target on a bullish reversal attempt higher would be 1.1178.

IG Client Sentiment Index: EURUSD RATE Forecast (September 12, 2019) (Chart 3)

EURUSD: Retail trader data shows 58.8% of traders are net-long with the ratio of traders long to short at 1.43 to 1. In fact, traders have remained net-long since Jul 01 when EURUSD traded near 1.1369; price has moved 3.1% lower since then. The number of traders net-long is 3.7% higher than yesterday and 11.5% lower from last week, while the number of traders net-short is 2.5% higher than yesterday and 25.6% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bearish contrarian trading bias.

EURJPY TECHNICAL ANALYSIS: DAILY RATE CHART (FEBRUARY 2017 TO September 2019) (CHART 4)

In our last EURJPY technical forecast update, it was noted that “the scope of the reversal today speaks to potential for a greater reversal, particularly if the daily 8-, 13-, and 21-EMA envelope is broke to the topside: rates have closed below the daily 21-EMA every session since July 12. With daily MACD and Slow Stochastics starting to turn higher in bearish territory, a move above the daily 21-EMA would suggest a more significant EURJPY bottoming effort is afoot.”

There has been meaningful follow through in the bullishreversal attempt, now that EURJPY hasreturnedabove the 61.8% Fibonacci extension at 118.67 (Fibonacci extension of the September 2018 high to January 2019 low to March 2019 high move). EURJPY rates are above the daily 8-, 13-, and 21-EMA envelope which is shifting into bullish sequential order.

Meanwhile, Slow Stochastics has reached overbought territory while daily MACD continues to run higher (albeit in bearish territory). The path of least resistance may be higher at the moment, and if so, a return back to the descending trendline from the 2017 high may be in focus near 120.00.

IG Client Sentiment Index: EURJPY Rate Forecast (September 12, 2019) (Chart )

EURJPY: Retail trader data shows 56.8% of traders are net-long with the ratio of traders long to short at 1.32 to 1. In fact, traders have remained net-long since April 25 when EURJPY traded near 125.27; price has moved 5.1% lower since then. The number of traders net-long is 5.7% lower than yesterday and 1.5% lower from last week, while the number of traders net-short is 17.4% higher than yesterday and 21.8% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURJPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EURJPY price trend may soon reverse higher despite the fact traders remain net-long.

FX TRADING RESOURCES

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Today's analysis: USDJPY Set to Rise Amid Bank of Japan Policy Shift

USD/JPY (USD/JPY), an increase is expected as the Bank of Japan may reduce bond purchases and lay the groundwork for future rate hikes. Technical indicators show an ongoing uptrend with resistance around 157.8 to 160.

GemForex - weekly analysis

A Rat Race to the bottom in the rescue of the Dollar

GemForex - weekly analysis

Analysis for the week ahead: Markets remain worried by global recession fears

Euro (EUR) Price Outlook: No End Yet in Sight for EUR/USD Weakness

EUR/USD continues to tumble, with no sign yet of a rally or even a near-term bounce.. The pair has dropped already beneath the support line of a downward-sloping channel in place since late May this year to its lowest level since July 2020 and there is now little support between here and 1.1170. From a fundamental perspective, the Euro is suffering from a continued insistence by the European Central Bank that much higher Eurozone interest rates are not needed.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

The Growing Threat of Fake Emails and Phishing Scams

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator