简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Investing in the space industry: Who are the players, how much money - Business Insider

Abstract:Space Angels, a venture-capital firm Behind SpaceX, the rocket company founded by Elon Musk, a crop of new private space ventures has emerged

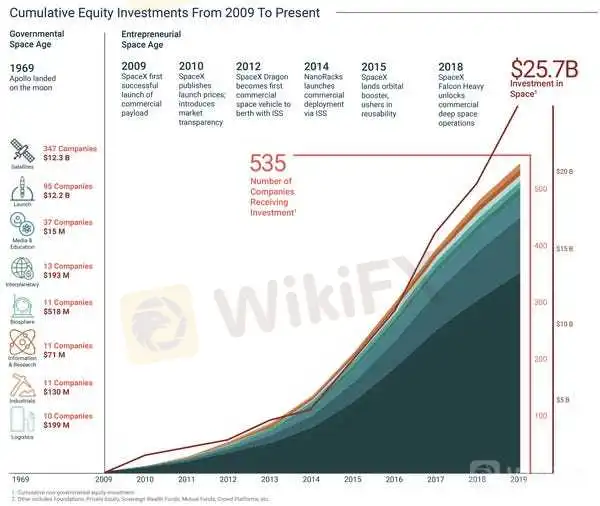

A new quarterly report by venture-capital firm Space Angels says the “dawn of the entrepreneurial space age” is here.The report's data suggest non-governmental, private equity investment in space startups has surged from almost nothing in 2009 to a cumulative $25.7 billion in 2019.Last year was a record-breaking year for investments, too, both in the number of rounds and total capital.Further growth is expected in the near future as new businesses and disruptive technologies mature, even as barriers to investing come down.Click here to read more BI Prime stories.You'd be forgiven if the words “SpaceX” and “Elon Musk” summon audacious images of Martian cities complete with wet bars and pizza joints. After all, Musk, the private rocket company's founder, has repeatedly said he wants all these things on the red planet.But behind this sci-fi visionary veneer is a serious startup that, circa 2009 — with SpaceX's first successful launch of a commercial payload into orbit — began smashing up a walled garden and opening up a flood of ideas within, and investment into, the space industry.In just 10 years, the total of private investments soared from essentially nothing to $25.7 billion today. That's according to data in the latest “Space Investment Quarterly” report, which was published this week by Space Angels, a venture capital and angel investment firm that focuses on private space companies like SpaceX.“The last decade was transformational, but it's still growing — 2019 was a record year,” Chad Anderson, the CEO of Space Angels, told Business Insider.Last year not only broke the annual investment record set in 2017 by roughly $750 million, but was also a 77% surge compared to investments in 2017, according to Space Angels' report.There were 198 investment rounds totaling $5.8 billion among private space companies in 2019, and of these 143 were early stage, representing $686 million of the total. (One of the larger early stage rounds — with buy-in from actor and singer Jared Leto — was $140 million for Relativity Space, a company that aims to 3D-print entire rockets in days.)“That's really promising. It shows there's a lot of capital to support these companies as they get larger, and there's a lot of new ideas coming in,” he said. “There's a very healthy pipeline and a healthy front end of the funnel.”The 'dawn of the entrepreneurial space age' is coming down to Earth

Space Angels

The report's lead chart shows the total non-governmental, private equity investments in the space industry from 2009 through 2019 — and it's striking. Space Angels titled this graphic “Dawn of the Entrepreneurial Space Age.”Anderson says that dawn is in large thanks to SpaceX (a company in which Space Angels has a vested interest). “Prior to SpaceX, there was not much of anything. There was no way for entrepreneurs to go out and raise seed capital for ways they wanted to play in the space economy. Because you didn't know how much it cost to get to orbit,” Anderson said.Then came SpaceX. The company not only published the price of its rockets online — a move that rattled industry titans — but those flights ended up being tens of millions of dollars cheaper than competitors.“Before 2009, it was a cartel of defense contractors. If you needed to launch something to orbit, you'd fly out a team of executives, make your pitch, and fly back home. And the numbers would come back anywhere between $90-100 million per payload.”SpaceX's Falcon 9 rocket, meanwhile, is posted today at $62 million — and the company also offers a rideshare program for smaller payloads for a fraction of that cost.“Now you can build a business plan and become a space entrepreneur,” Anderson said.What's more, Anderson said earlier companies are maturing enough for people who aren't millionaires to invest in. Virgin Galactic went public in July 2019, for example, allowing practically anyone to invest in its planned business of high-flying space tourism. Anderson also sees more milestones for the industry in the very near future.“I think in 2020 we're going to see the first venture-backed private space company go public,” he said.Anderson declined to say which startup might soon announce that step. However, he said private companies are typically acquired after three to five years while “going public takes about six to eight years,” leaving a small pool of candidates.Getting in before a space company goes public is getting easier, too, since Anderson says there's an increasing number of employees who are working in the industry, vesting shares, and gaining the ability to sell or transfer them.“There are more and more people in your circles who work for these companies,” Anderson said.The sky is certainly not the limit

SpaceX's 164-foot-tall Starship Mark 1 rocket prototype stands in Boca Chica, Texas, amid a background of stars in the night sky in September 2019.

SpaceX

It's hard to say just how far the private space industry might surge in the coming years, but that appears to be the ongoing trend.Companies like OneWeb, SpaceX, Amazon, and even Apple are racing to launch fleets of thousands of internet-providing satellites. There are also new services coming online with the help of smaller, less expensive satellites.More importantly, the cost of rocket launches is poised to go down — way, way down — in the next few years.Blue Origin, founded by Jeff Bezos, is working on a mostly reusable New Glenn rocket, which would add competition to SpaceX. China is also working on partly reusable rockets, as is the United Launch Alliance and ArianeGroup and others.But SpaceX itself aims to pull the rug out from under the entire rocket-launch industry with a fully reusable system called Starship. If realized, the final two-stage vehicle would stand 387 feet tall and cost just $2 million to launch, according to Musk — roughly a 99% reduction compared to NASA's forthcoming Space Launch System.“The numbers are ridiculous,” Anderson said. “Any other launch vehicle will have trouble competing.”Read Space Angels' full Q4 2019 report below

Space Angels: 2019 Q4 Space Investment Quarterly (PDF)

Space Angels: 2019 Q4 Space Investment Quarterly (Text)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Tough truths about starting a business, from ban.do founder Jen Gotch - Business Insider

Jen Gotch, founder of accessories and stationery brand ban.do, said sometimes the best thing you can do is just say yes and figure it out later.

Morgan Stanley: 12 energy stocks to buy now as oil markets recover - Business Insider

After a historic oil price rout, energy markets appear set to recover. Morgan Stanley says these 12 oil and gas stocks will benefit most.

Bank of America hires Citi exec Diane Daley for AI governance role - Business Insider

Diane Daley spent over two decades at Citigroup, eventually serving as a managing director and the head of finance and risk management infrastructure.

Here's how much home prices fell in April in 26 of the largest US cities - Business Insider

Of the 100 largest US metro areas, Zillow found that 26 saw a month-over-month decrease in median listing price, ranging from 0.1% to 3.3%.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

The One Fear That’s Costing You More Than Just Profits

Currency Calculator