简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Online Grocery Shopping Industry in 2020: Market Stats & Trends - Business Insider

Abstract:Business Insider Intelligence looks at the growing online grocery shopping market and delivery trends in the industry to look out for in 2020 and beyond.

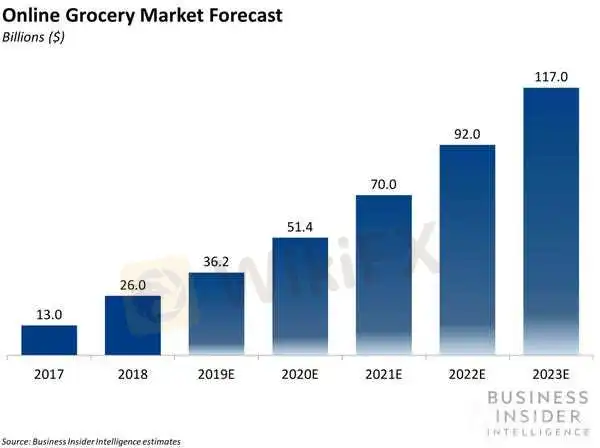

This is a preview of the Business Insider Intelligence Online Grocery Report & How Coronavirus Will Impact Online Grocery premium research reports. Purchase these reports here.Business Insider Intelligence offers even more e-commerce and payments coverage with our Payments & Commerce Briefing. Subscribe today to receive industry-changing retail news and analysis to your inbox.The coronavirus pandemic is transforming consumers' needs and behaviors, putting a new focus on online grocery in the process.Online grocery has already grown rapidly from its small base. Its market value doubled from 2016 to 2018, suggesting that consumers were starting to get more comfortable ordering essentials and certain foods online — a major barrier to adoption.

Business Insider Intelligence

Now, the pandemic has pushed many US consumers to buy groceries online for the first time to minimize their contact with others. Business Insider Intelligence forecasts that online grocery will continue its surge in Q2 2020, and that we'll see an increase in adoption from all generations, including baby boomers, who have previously been slow to buy groceries online. As the channel increases in popularity, grocers are rushing to take advantage of this potential, resulting in a highly competitive market. Both established grocery players and newcomers to the space are expanding their curbside pickup and delivery offerings — the two basic components of online grocery — in an attempt to grab market share.They're each employing different strategies to find success: Amazon is leaning on its e-commerce and fulfillment capabilities to offer a variety of online grocery services, for example, while Walmart is using its strong brick-and-mortar footprint to its advantage. Still, others, like Kroger and Aldi, are working with third parties such as Instacart to provide their services.In the first Online Grocery Report, Business Insider Intelligence looks at a variety of grocers' curbside pickup and grocery delivery options, analyzing how they compare with competitors' strategies, how profitable they are for the grocer, and what their future may be. While companies like Instacart exist that offer online grocery services for other grocers, we focus specifically on companies that sell their own products. Finally, we examine different strategies companies can use to optimize the profitability of their online grocery offerings. Additionally, in light of the nationwide response to the coronavirus pandemic, Business Insider Intelligence research analyst Daniel Keyes has published an exclusive Analyst Take, which incorporates proprietary survey data, third-party data, and qualitative information to assess how the coronavirus will impact US online grocery penetration.The companies mentioned in this report bundle are: Aldi, Amazon, Costco, Ford, Instacart, Kroger, Ocado, Postmates, Target, Walmart, Whole FoodsHere are some of the key takeaways from the report bundle:Online grocery currently comprises a small portion of grocery overall but is on a rapid rise. Adoption is still fairly low, with about 10% of US consumers saying that they regularly shop online for groceries, according to NPD.However, the value of the US online grocery market has grown from $12 billion in 2016 to $26 billion in 2018 and it has plenty of room to grow, given that the size of the overall grocery market was $632 billion in 2018 according to IBISWorld.Online grocery penetration will rise beyond Q2 2020, but the length of the pandemic will determine how many consumers it reaches.Grocers should identify tactics to fulfill more orders to ensure consumers continue ordering from them throughout the pandemic and after.In full, the report bundle:Sizes the current online grocery market and provides a market forecast through 2023.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Designer handbags from Chanel will now cost more as it hikes prices - Business Insider

French luxury house Chanel is raising prices across the globe on its iconic handbags and some small leather goods.

US personal savings rate increases due to lowered spending amid social distancing - Business Insider

The US personal savings rate increased from 8% in February to 13.1% in March due to lowered spending from social distancing.

Amazon's surge in Q1 revenue is spoiled by steep coronavirus costs - Business Insider

Amazon's Q1 earnings could give more insights into how exactly the coronavirus pandemic is affecting its business, and the broader e-commerce space.

Amazon's earnings report for Q1 2020 - Business Insider

Amazon's Q1 earnings could give more insights into how exactly the coronavirus pandemic is affecting its business, and the broader e-commerce space.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

The Growing Threat of Fake Emails and Phishing Scams

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator