简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ECB’s Asset Purchase Program Faces Challenges

Abstract:After euro plummeted nearly 100 pips against US dollar to its lowest in 4 days, German’s Advisory Board for Ministry of Finance warned that there’s significant risk of a new euro crisis.

After euro plummeted nearly 100 pips against US dollar to its lowest in 4 days, German‘s Advisory Board for Ministry of Finance warned that there’s significant risk of a new euro crisis.

German‘s top court warned that part of the European Central Bank(ECB)’s practices may be illegal, and partially rejected ECB‘s quantitative easing plan. German’s Minister of Finance said that in principle, the ruling still allows ECB to make massive purchase of assets, while Germany will make further decisions in June in regards to EUs stimulus plan.

Jan Von Gerich,a market economist from Nordea Bank, noted that the Federal Constitutional Courts ruling offered 3 months for the ECB to further justify the asset purchase program, which means euro-assets and Italian bonds will face greater short-term pressure.

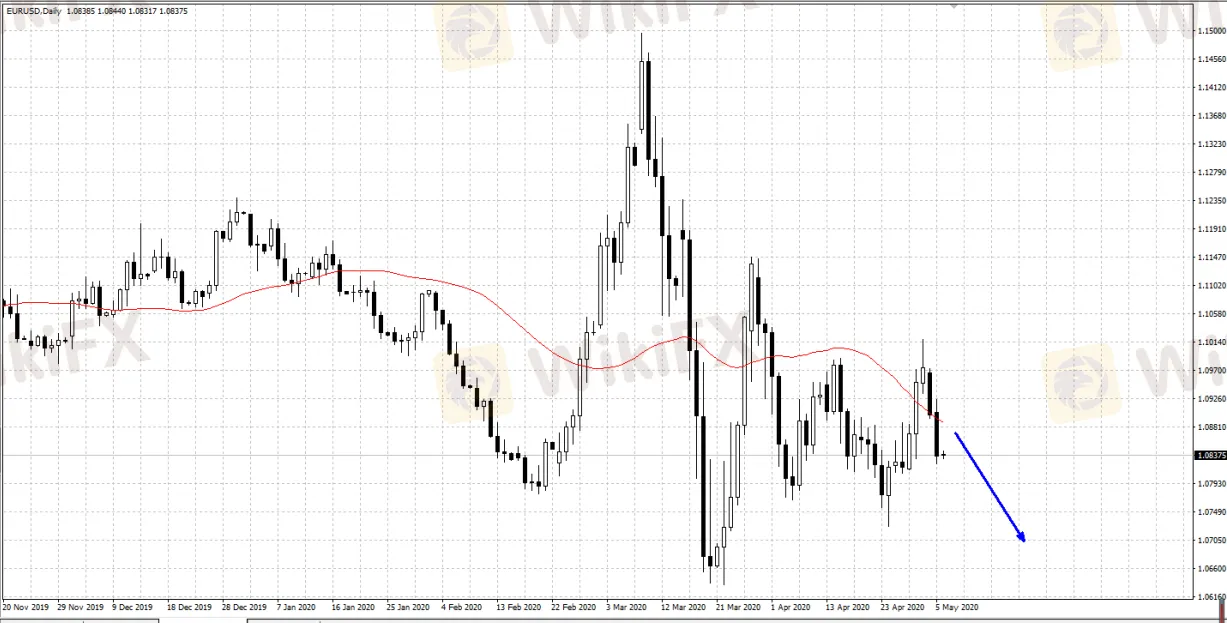

EUR/USD daily pivot points: 1.0850-1.0875

S1 1.0800 R1 1.0900

S2 1.0762 R2 1.0962

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

The ECB's consumer expectations survey shows mixed economic signals with slight improvements in unemployment expectations but unchanged growth forecasts. The euro faces pressure from a strong USD, while the GBP shows resilience, contributing to the strength of GBP/USD and the decline of EUR/GBP.

GEMFOREX - weekly analysis

The week ahead: Traders on the backfoot ahead of a quiet week

Twin Scam Alert: Broker Capitals is a New Domain of Finex Stock

This week, the Italy financial regulator CONSOB issued a warning against an unlicensed broker named Broker Capitals. When we clicked on Broker Capitals' website, its logo, trade name, and design seemed familiar to us.

Berkshire CEO-designate Abel sells stake in energy company he led for $870 million

Berkshire Hathaway Inc said on Saturday that Vice Chairman Greg Abel, who is next in line to succeed billionaire Warren Buffett as chief executive, sold his 1% stake in the company’s Berkshire Hathaway Energy unit for $870 million.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

ED Exposed US Warned Crypto Scam ”Bit Connect”

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

Currency Calculator