简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

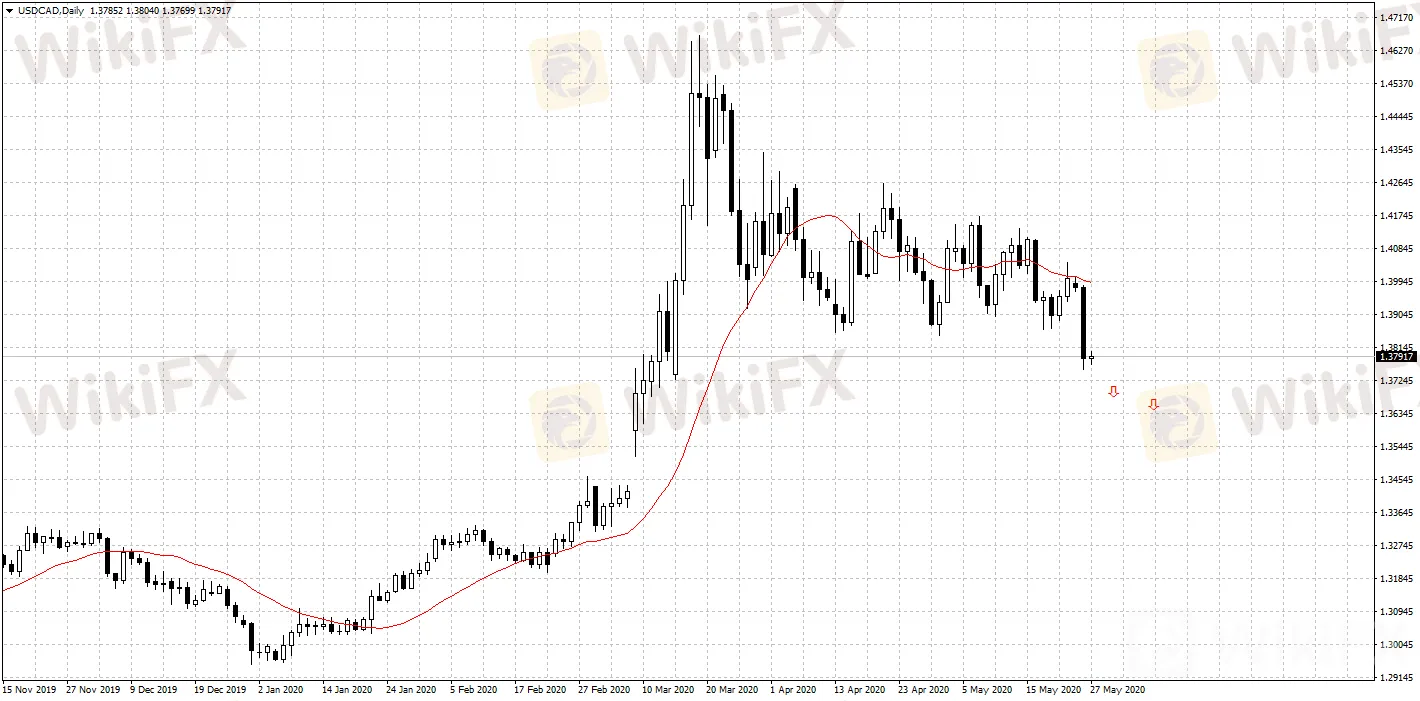

USD/CAD Experienced Largest Single-day Decline Since March

Abstract:Overnight USD/CAD rate dropped 228 pips to 1.3773, a new low since March 16th. This has been the largest intraday decline since March.

May 27th from WikiFX News. Overnight USD/CAD rate dropped 228 pips to 1.3773, a new low since March 16th. This has been the largest intraday decline since March.

Bank of Canada‘s outgoing Governor Stephen Poloz maintains a dovish forward guidance before leaving the post, saying that the central bank is “doing the best to ensure a solid foundation for economic recovery”. Poloz is leaving the post in June, and he had previously warned that massive monetary stimulus will be needed for Canada’s economy.

As the Bank of Canada remains open to introducing more unconventional measures, the Canadian dollar may face even more unfavorable risks.

Canada will release on Friday the GDP for Q1, 2020, which is expected to see the greatest decline since the data was first recorded and published in 1961.

USD/CAD daily pivot points: 1.3814-1.3870

S1:1.3700 R1:1.3928

S2: 1.3614 R2:1.4070

For more market updates and information, please download WikiFX App at: bit.ly/wikifx

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

USD/CAD holds above key support near 1.2715 ahead of data, Yellen

USD/CAD extends the pullback from five-day tops into Tuesday, although the bears appear to take a breather following a steady decline from 1.2760.

USD/CAD: Enduring Upside Foreseeable

With the Canadian dollar hampered by oil prices, USD/CAD may embrace further upside in the foreseeable future amid the unstable rally in the US dollar.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator