简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading Opportunities in EUR/USD and EUR/JPY

Abstract:Trading variety recommended today is: EUR/USD (up: 7 days, overnight change: 0.56%, fluctuation: 0.81%)

WikiFX News (4 June)-Trading variety recommended today is: EUR/USD (up: 7 days, overnight change: 0.56%, fluctuation: 0.81%)

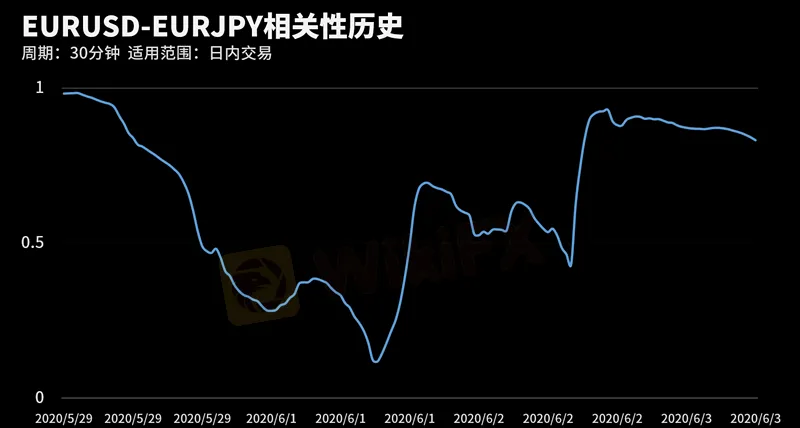

The correlation coefficient of EUR/USD and EUR/JPY reaches 0.97 during this period, and below are some trading tips for investors.

u Hedging: when buying one 1 standard lot of long/short position EUR/USD, hedge with 1 standard lot of EUR/JPY in the opposite direction.

u Portfolio diversification: When investing in EUR/USD, avoid the high-correlation varieties and invest in other forex varieties less relevant to EUR/USD.

u Risk distribution: when buying one 1 standard lot of long/short position EUR/USD, couple with 1 standard lot of EUR/JPY in the same direction.

u Today's special reminder for investors: Eurozone service industry PMI final reading will be released at 16:00, Eurozone's April monthly retail sales at 17:00, and the main refinancing rate of the European Central Bank to June 4 released at 19:45.

From WikiFX, a world-renowned forex trading inquiry service provider. For more information, please download: (download link)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

KVB Market Analysis | 21 August: USD/JPY Stalls Near 145.50 Amid Diverging Economic Indicators

USD/JPY holds near 145.50, recovering from 144.95 lows. The Yen strengthens on strong GDP, boosting rate hike expectations for the Bank of Japan. However, gains may be limited by potential US Fed rate cuts in September.

KVB Market Analysis | 20 August: Gold Prices Remain Near Record High Amid US Rate Cut Expectations

Gold prices remain near record highs, driven by expectations of a US interest rate cut and a weakening US Dollar. Investors are focusing on the upcoming Jackson Hole Symposium, where Fed Chair Jerome Powell's speech will be closely watched for clues on the Fed's stance. Additionally, the release of US manufacturing data (PMIs) is expected to influence gold's direction.

WikiFX Broker

Latest News

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

Currency Calculator