简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Signs Suggest that Global Stock Market would Stop Rising

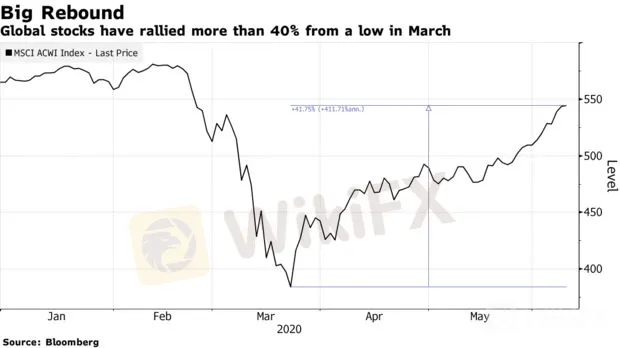

Abstract:Global stock market has recovered a value of US$21 trillion from the low in March, but the bubble in this asset class seems to keep increasing and the upward trend might stop.

WikiFX News (14 June)- Global stock market has recovered a value of US$21 trillion from the low in March, but the bubble in this asset class seems to keep increasing and the upward trend might stop.

At present, the global stock market has recovered to the level before the coronavirus epidemic began to spread rapidly around the world. Paul Sandhu, head of multi-asset quantitative solutions and customer consulting for BNP Paribas in the Asia-Pacific region, said: “This round of rebound is caused by the government's support for the economy.” A large amount of funds from global governments, easing of restrictions and shockingly positive employment data from the United States are attracting more buyers to participate, bringing more momentum for the stock market to rise.

However, the market still keeps a cautious attitude, for the rise in global stock prices last month is purely due to multiplier expansion, while earning expectations have barely changed since May. In addition, the MSCI Global Index has been in the overbought range since the beginning of this month, and the index's relative strength indicator has hit its highest level since January, which is considered as a bearish signal.

The above information is provided by WikiFX, a world-renowned foreign exchange information query provider. For more information, please download the WikiFX App: bit.ly/WIKIFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Chart Of The Day: Twitter Shares May Be Oversold But Stock Still In A Downtrend

Smart money fund managers and investors have become passionate about Twitter (NYSE:TWTR) stock. ARK Invest founder Cathie Wood bought into Twitter's dip after the stock fell to a 52-week low near $41 when co-founder and CEO Jack Dorsey announced in late November that he was stepping down from his leadership role.

The real reason why Elon Musk is selling 10% of Tesla stock

Musk asked his 62.7 million Twitter followers over the weekend whether he should sell 10% of his Tesla holdings.

Stocks at Risk as China-Taiwan Tension Eclipses Xi-Biden Summit

CHINA-US TENSION, TAIWAN, US DOLLAR, S&P 500, FED INTEREST RATE HIKE - TALKING POINTS Xi-Biden summit likely only to achieve surface-level diplomatic breakthroughs Competing global and regional priorities may prevent meaningful cooperation S&P 500 at risk ahead of precarious holiday season, geopolitical uncertainty

Election Years See Weak U.S. Stocks in October

Since the Democratic candidate Biden was reported to be involved in a scandal, he has not yet given a press conference to clarify what happened.

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

The Impact of Interest Rate Decisions on the Forex Market

STARTRADER Spreads Kindness Through Ramadan Campaign

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

How a Housewife Lost RM288,235 in a Facebook Investment Scam

The Daily Habits of a Profitable Trader

Currency Calculator