简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Carry Trades Are Back in Focus!

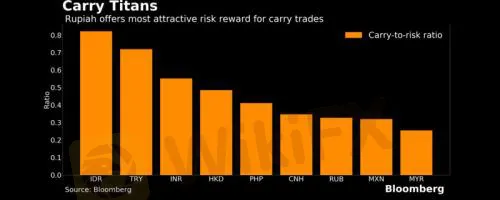

Abstract:As the Fed promised to keep interest rate at a historical low of nearly zero, forex carry trades again draw the market’s attention. Bloomberg’s analysis over 32 currencies shows that Indonesian rupiah offers the highest risk-to-reward rate in carry trades, followed by Turkish lira and Indian rupee.

As the Fed promised to keep interest rate at a historical low of nearly zero, forex carry trades again draw the market‘s attention. Bloomberg’s analysis over 32 currencies shows that Indonesian rupiah offers the highest risk-to-reward rate in carry trades, followed by Turkish lira and Indian rupee.

Source: Bloomberg

Carry trade refers to the practice to make profit by borrowing a low-yielding currency and then investing in another high-yielding currency (such as emerging market currencies). Analysis indicates IDRs carry-to-risk ratio is 0.85, TRY at 0.73 and INR at 0.56. Only about half of the surveyed currencies have interest rate higher than USD.

After the Fed flooded the global financial system with US dollar to avoid credit squeeze, the recent forex volatility has fallen back from a decades high, making carry trades attractive again. The increasingly active carry trade market has thus seen an influx of international investors who want to seize the opportunity to make a fortune.

So here comes the question: Do carry trades bear risks? Just like any type of trading, carry trades involve certain degrees of risks. The prerequisite for making profits through carry trades is low market volatility, so a main risk facing carry traders is forex rate fluctuation. If forex rates fluctuate significantly, carry trade investors may end up losing not only their gains but also the principals. Therefore, investors need to conduct effective risk management in trading, keep a close eye on global forex dynamics and watch out for “black swan events”.

As a leading forex media, WikiFX brings you live global forex updates 24/7 and industry dynamic interpretation to guide investors on their forex trading path. In addition, WikiFX has recorded the information of over 18,000 brokers across the world, offering investors a comprehensive evaluation of brokers compliance and quality. Click here to download the WikiFX App https://bit.ly/3ajawKO

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Scam Couple behind NECCORPO Arrested by Thai Authorities

Top Profitable Forex Trading Strategies for New Traders

Currency Calculator