简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Early Sales Data Hint at Post-Outbreak Retail Recovery in Japan

Abstract:Sales at furniture depot Nitori Holdings Co. and casual fashion retailer Shimamura Co. surged following the lifting of Japans state of emergency, an early indication of the pent-up demand from local shoppers as the threat of the coronavirus subsided.

Sales at furniture depot Nitori Holdings Co. and casual fashion retailer Shimamura Co. surged following the lifting of Japans state of emergency, an early indication of the pent-up demand from local shoppers as the threat of the coronavirus subsided.

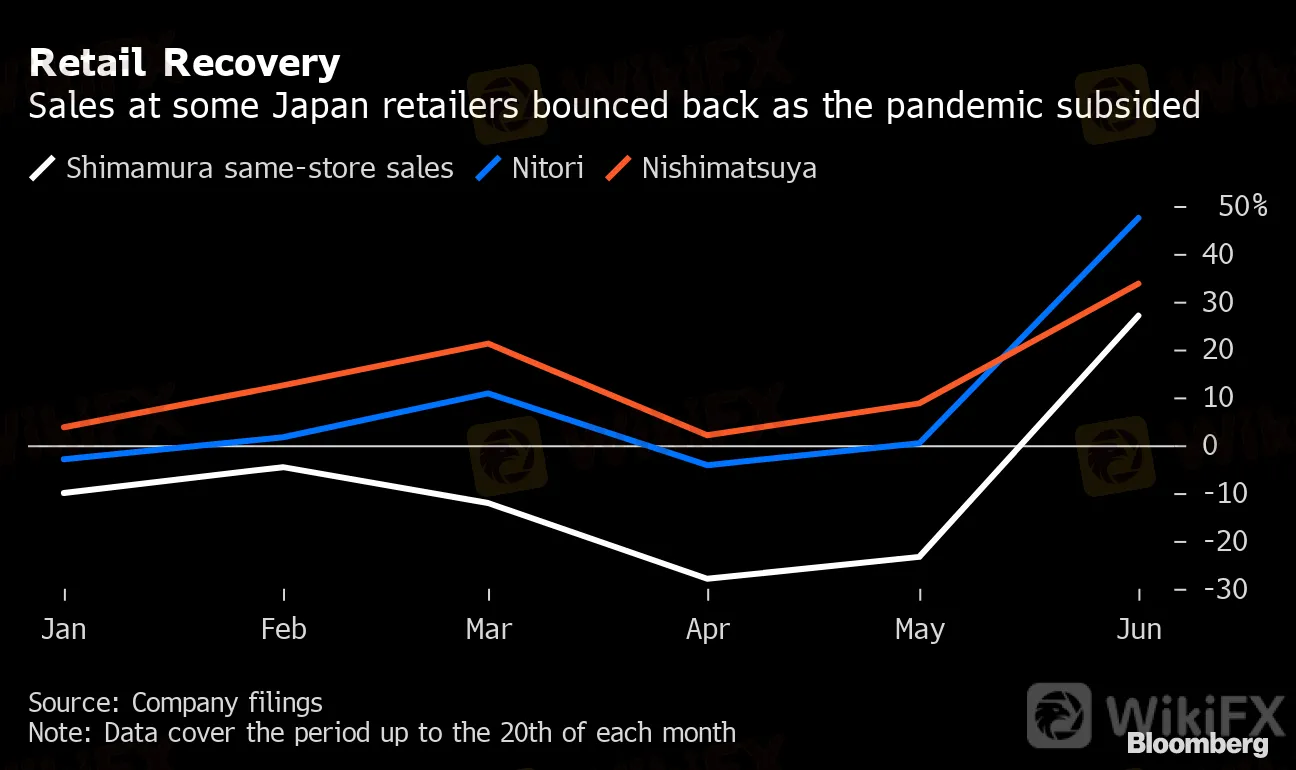

Nitori same-store sales jumped 47% in June from the previous year, the most on record in data going back to 2012. Shimamura saw a 27% increase.

The two companies are early reporters of retail data in Japan with the figures released Tuesday covering the period from May 21 to June 20. Japans coronavirus state of emergency was lifted in stages from May 14, before being fully ended on May 25.

Revenues at department stores, more dependent on tourist spending, fell 27% compared with the year earlier between June 1 and 17, Kyodo reported, citing the Japan Department Stores Association. Should that pace hold, it would still represent a recovery from May, when sales dropped 66% nationwide according to data released Tuesday. Sales plunged 73% in April.

Retail Recovery

Sales at some Japan retailers bounced back as the pandemic subsided

Source: Company filings

Note: Data cover the period up to the 20th of each month

Nitori cited continued demand for home office furniture and storage goods, noting that 4.8 percentage points of the increase could be attributed to the fact that the period had one more Saturday compared with 2019.

The Sapporo-based firm had already seen relatively little impact on its revenue during the state of emergency, with sales jumping in March and falling just 4% in April. Its shares rose about 17% this year versus an 8% loss for the broader Topix. At Shimamura, by contrast, turnover fell every month in 2020, including a 28% drop in April. Its stock fell 9% year to date.

Japanese consumers have taken to remote work in a way that few had predicted, with Nitori in particular standing to benefit from an increased level of spending as workers spruce up their living environments at home. A Jiji survey found that 70% want to continue working from home even after the pandemic is contained, while a Cabinet Office poll showed increased levels of interest from 25% of city dwellers in moving to the country.

Shimamura also said it saw continued “stay-home” demand for relaxing interior clothing and summer goods, with June customer numbers up 16% from the year earlier. On Monday, infant goods retailer Nishimatsuya Chain Co., which had seen gains every month throughout the emergency, reported a 34% jump in sales.

Japan releases overall retail sales data for May on June 29. The print for April showed a 14% drop compared to the previous year, the second-largest decline in a single month since 1989.

(Updates with details of May department store spending, next retail sales data release)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator