简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Australia House Prices Face ‘Significant’ Risk as Aid Expires

Abstract:Australia house prices fell the most in 16 months in June, and face “significant” downside risk as mortgage holidays and government wage subsidies expire in coming months.

LISTEN TO ARTICLE

2:14

SHARE THIS ARTICLE

Share

Tweet

Post

Homes stand in the Bella Vista suburb of Sydney, Australia, on June 3.

Photographer: Brendon Thorne/Bloomberg

Photographer: Brendon Thorne/Bloomberg

Australia house prices fell the most in 16 months in June, and face “significant” downside risk as mortgage holidays and government wage subsidies expire in coming months.

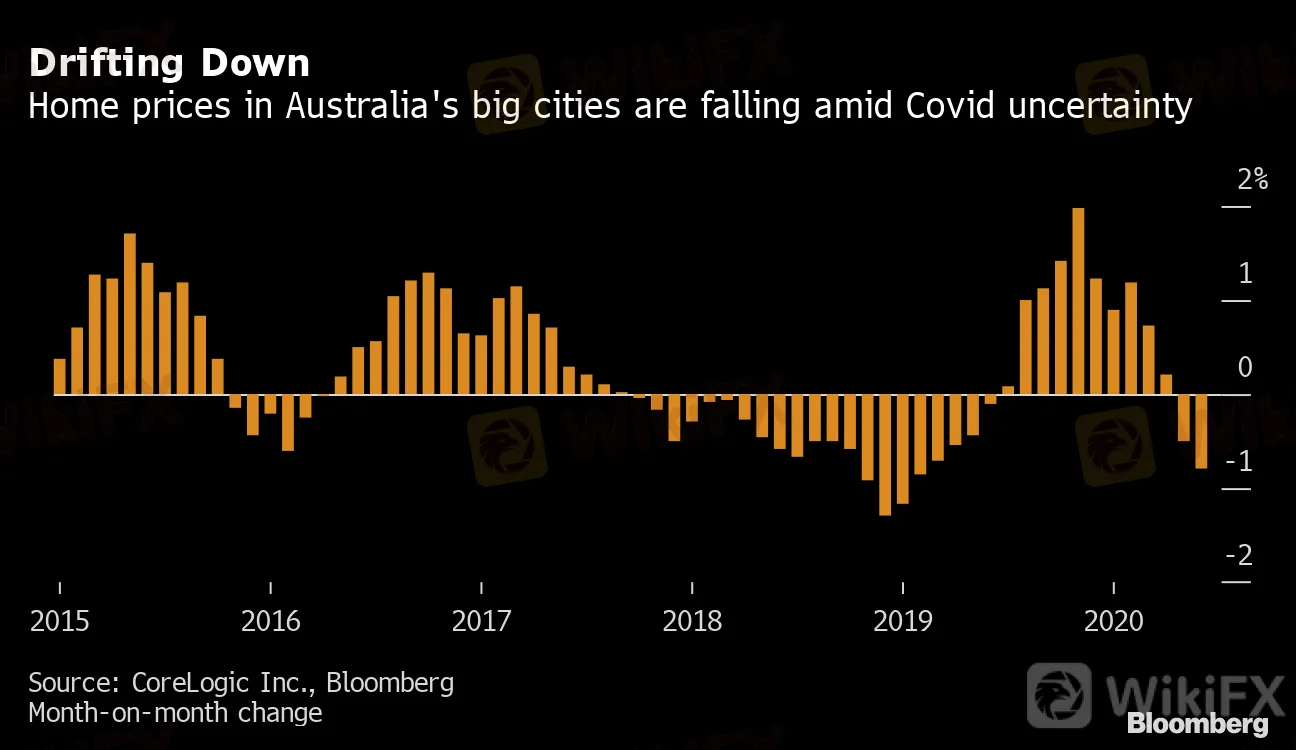

Property values in major cities fell 0.8% last month, the steepest decline since February 2019, according to CoreLogic Inc. data released Wednesday. The slide was led by Perth and Melbourne, which is at the center of a new spike in coronavirus cases that has prompted the government to lock down parts of the city.

“Despite the early signs of improved economic activity and a lift in housing turnover, the downside risk remains significant,” said Tim Lawless, head of research at CoreLogic. “The recent rise of active virus cases in Victoria are a reminder that the potential risk of a second wave remains a stark reality.”

A further test for the housing market will come later this year when current extraordinary levels of government and bank assistance start to wind down. More than 485,000 home borrowers are on payment holidays, while about 3.5 million workers are on government wage subsidies, with both programs helping avoid the need for forced sales that could push down prices.

Drifting Down

Home prices in Australia's big cities are falling amid Covid uncertainty

Source: CoreLogic Inc., Bloomberg

Month-on-month change

The wage subsidies are set to end in September, while banks may also toughen up criteria for borrowers wanting to extend the initial six-month payment deferrals.

“Eventually the economy and borrowers will need to abide by market forces,” Lawless said. “This is when we could see a rise in mortgage arrears and the potential for a lift in urgent or forced sales.”

Read more: Australia Housing Not the One-Way Road to Riches It Once Was

While Australias relative success in containing the virus means the economy is reopening quicker than in many other countries, the after-effects may linger for years. A second-wave of infections that slows or reverses the reopening could also set back the recovery.

What Bloombergs Economists say:

“While the Covid-19 shock may prove to be Australias shortest business cycle downturn, the damage will take a long time to recover. Key downside risks are a second wave of infections getting out of control and a potentially lackluster fiscal support as policy pivots from supporting businesses during lockdown toward fostering a post-pandemic recovery.”

James McIntyre, economist. For the full report, click here

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Should You Choose Rock-West or Avoid it?

Scam Couple behind NECCORPO Arrested by Thai Authorities

Currency Calculator