简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bank Indonesia Steps Up Unconventional Moves With Budget Funding

Abstract:Indonesias central bank ventured further into unconventional policy territory, agreeing to buy billions of dollars of sovereign bonds directly from the government to help finance the fiscal response to the coronavirus pandemic.

Indonesias central bank ventured further into unconventional policy territory, agreeing to buy billions of dollars of sovereign bonds directly from the government to help finance the fiscal response to the coronavirus pandemic.

Bank Indonesia will commit to purchase 574.4 trillion rupiah ($40 billion) of bonds from the government, including 397.56 trillion rupiah in private placements at the benchmark seven-day reverse repurchase rate. The central bank will step in to buy the remainder at auctions if there isnt sufficient demand. It will return all the interest earned on the bonds bought directly through the private placing, and will partly bear the interest cost on the remainder.

Governments around the world are borrowing record amounts to finance their pandemic stimulus, with many turning to their central banks to fund the extra debt. Bank Indonesia has already been buying bonds directly from the government at primary auctions, but its now going one step further by purchasing a pre-set amount at low rates. This kind of debt monetization carries possible inflation and currency risks, especially for emerging markets.

Finance Minister Sri Mulyani Indrawati told reporters Monday that the bond-purchase agreement worked out with the central bank was a one-off move triggered by the pandemic crisis, and would be done in a prudent way. Bank Indonesia Governor Perry Warjiyo said inflation is low and under control but policy makers are mindful of the risks.

“From the monetary and fiscal sides, together we‘re trying to recover Indonesia’s economic policy in a sustainable way,” Indrawati said. “The government is committed to maintaining fiscal discipline, to bringing down the budget deficit gradually to below 3% and to adhering to fiscal discipline in 2023 and beyond.”

| Additional Financing Requirement | 903.46 trillion rupiah |

|---|---|

| Bank Indonesia‘s portion | 574.4 trillion rupiah

|

| Governments portion | 329 trillion rupiah |

The deal reached between the central bank and the government was less radical than some had expected, with earlier proposals suggesting Bank Indonesia would purchase most of the bonds at zero interest -- amounting to the central bank printing free money for the government. Those concerns prompted a drop in the rupiah and credit-default swaps last week.

Read More: Why Bank Indonesia Will Fund $40 Billion of Governments Budget

Indonesias currency and bonds rallied on Tuesday as the proposed private placement of debt with the central bank allayed concerns of a bond oversupply. The rupiah climbed as much as 0.7% to 14,395 to a dollar, while the yield on the benchmark 10-year sovereign bonds fell 6 basis points to 7.175%, according to data compiled by Bloomberg.

The bonds purchased by Bank Indonesia will also be tradeable, meaning it could use them for monetary operations, reducing risks for the central bank.

The “financing mechanism appears to be less ‘creative’ than originally feared, which should help to better anchor market sentiment,” said Wellian Wiranto, an economist at Oversea-Chinese Banking Corp. in Singapore. “The bonds are slated to be tradable and marketable as well -- previously not. This would allow BI to wind down its holdings potentially down the road, rather than being stuck on their balance sheet.”

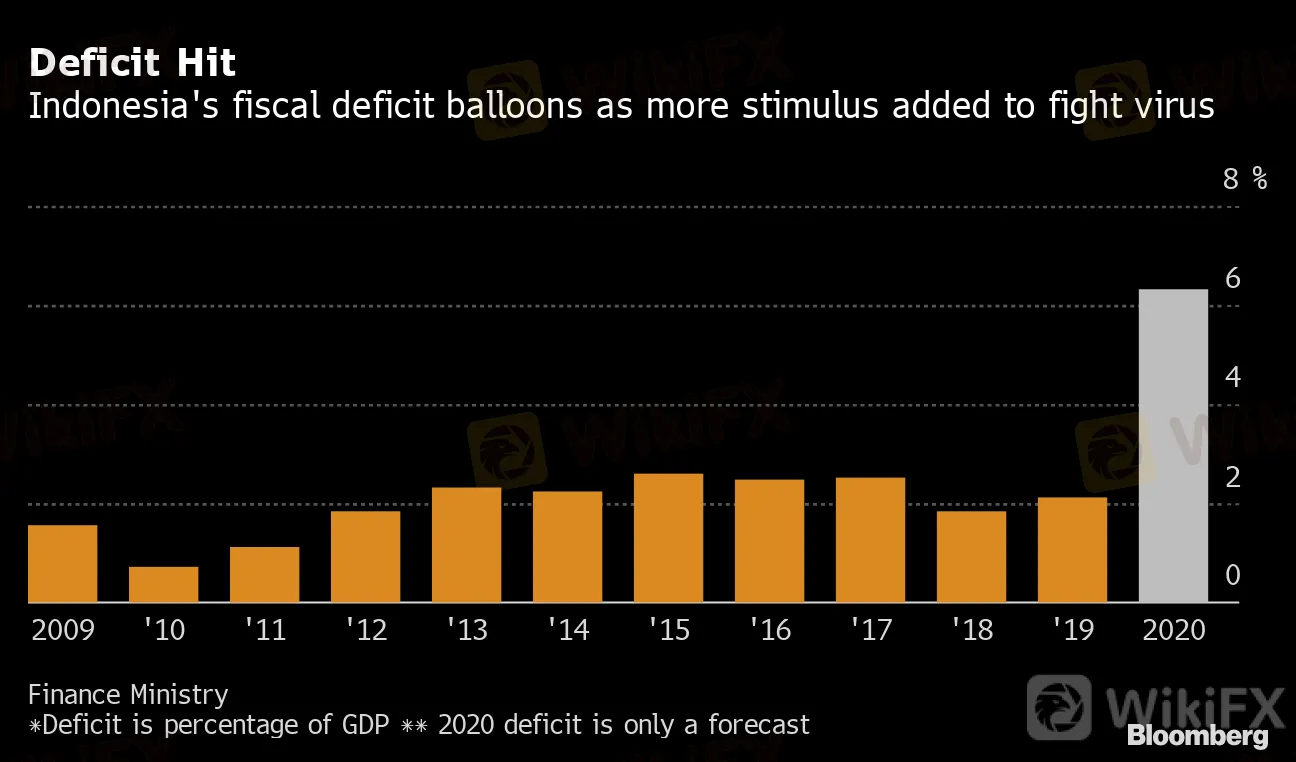

With the economy at risk of shrinking and infections spiking, the government is under severe fiscal pressure. President Joko Widodo is seeking to borrow about $115 billion this year to repay government debts and fund a budget deficit estimated at 6.34% of gross domestic product.

Deficit Hit

Indonesia's fiscal deficit balloons as more stimulus added to fight virus

Finance Ministry

*Deficit is percentage of GDP** 2020 deficit is only a forecast

Under the latest agreement, Indrawati said the government will double the size of its bond auctions, held every two weeks, to 40 trillion rupiah. The central bank will continue to act as a buyer of last resort.

Warjiyo said at Mondays briefing that inflation is under control and the central bank regularly assesses price and growth dynamics.

“We see so far that demand is not yet strong and inflation is low,” he said. “However, if inflation recovers and the economy picks up, Bank Indonesia has the tools ready, we have the policies.”

Citigroup Inc. economist Helmi Arman said the burden-sharing scheme caps the upside risk for bond supply in the near term as the bulk of the securities will be placed privately with Bank Indonesia. Theres less likelihood of the central bank unwinding the securities this year or next even though the notes are tradeable, he said in a report.

Not Unique

Indrawati said the burden-sharing scheme isnt unique to Indonesia, and that Japan and the U.S. have carried out similar programs. Central banks in developing countries like Turkey and the Philippines also are taking a bigger role as a buyer of government debt, she said.

“With the burden sharing, the central bank and the government are demonstrating a solid coordination in giving stimulus to the economy to accelerate the recovery,” said Josua Pardede, an economist at PT Bank Permata in Jakarta. “This should provide positive sentiment, because if the recovery is materialized then it will of course maintain the stabilization in the financial market.”

Other highlights from Mondays briefing:

The government expects economic growth to rebound from the third quarter as it accelerates spending

Warjiyo sees scope for the rupiah to appreciate and bond yields to drop, as the financing agreement provides more certainty to the market

The decision to buy bonds to finance public services is a one-time policy, Warjiyo says

— With assistance by Rieka Rahadiana, and Chester Yung

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator